- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Announces Positive Phase 2 Results For siRNA Therapy Amid 6% Quarterly Price Dip

Reviewed by Simply Wall St

Eli Lilly (NYSE:LLY) has recently announced several developments, including positive Phase 2 results for their siRNA therapy lepodisiran and the expansion of their digital healthcare platform, LillyDirect, to support Alzheimer's patients. Despite these advancements, Eli Lilly's stock fell 6% in the last quarter. This movement came amid a broader market downturn, with substantial declines in major indices such as the Dow and S&P 500 due to escalating tariff issues and growing economic concerns. These market-wide pressures likely overshadowed the company's positive clinical and strategic updates, impacting Eli Lilly's share performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

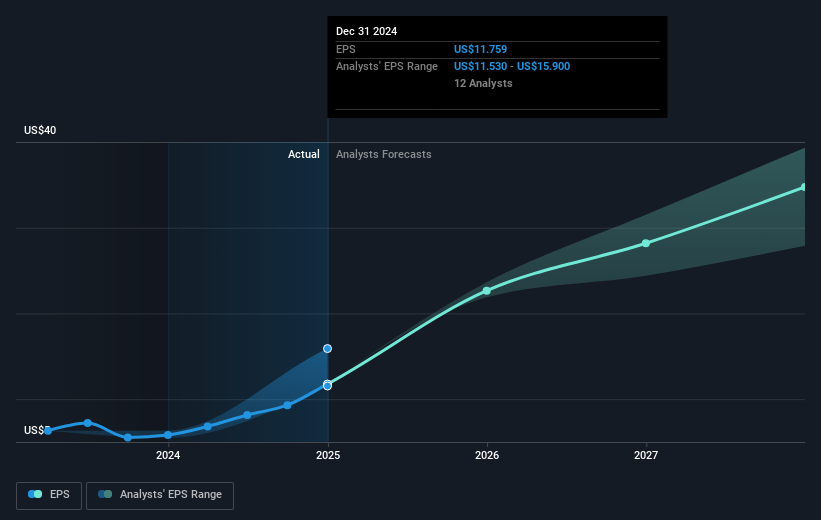

The last five years have seen Eli Lilly's total shareholder returns reach a very large 438.61%, showcasing substantial growth when compared to the broader market and industry trends. This significant increase can be attributed to a number of key factors that bolstered investor confidence and stock performance. One driving force was their open-ended $15 billion share repurchase program announced in early 2025, which signaled financial health and commitment to returning capital to shareholders. Their $23 billion investment in expanding manufacturing capacity since 2020 also positioned the company well for future product demands.

Additionally, technological collaborations have enhanced Eli Lilly's strategic outlook. Notably, their partnership with OpenAI to innovate in antimicrobials underscores a forward-thinking approach. Successful clinical trials and international approvals, such as for the drug Omvoh for Crohn's disease and Ebglyss for atopic dermatitis, further resulted in positive sentiment. These concerted efforts support Eli Lilly's robust performance, surpassing the US Pharmaceuticals industry, which saw a substantial 10.4% decline in the past year alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eli Lilly, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives