- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Announces Executive Changes To Drive Global Growth And Pipeline Advancement

Reviewed by Simply Wall St

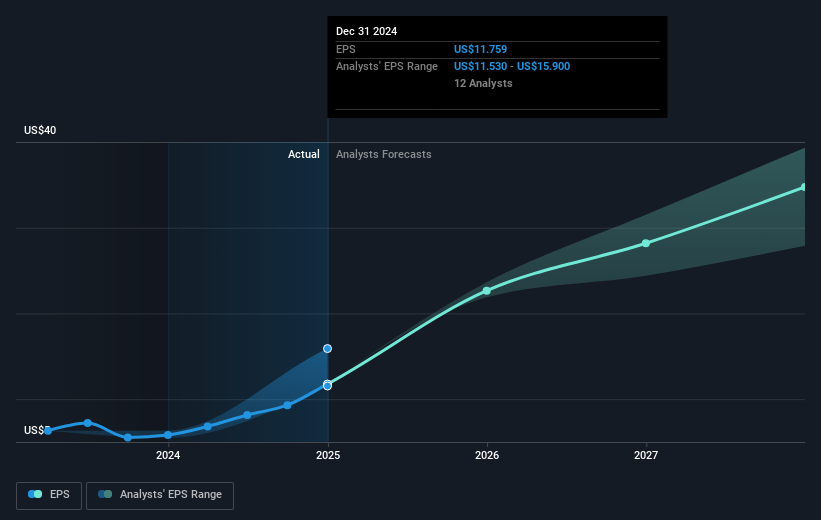

Eli Lilly (NYSE:LLY) recently announced leadership transitions, including new roles for Ilya Yuffa, Patrik Jonsson, and Kenneth Custer, marking a strategic shift aiming to expand its global market presence and enhance product reach. Over the past month, the company's stock appreciated by 7%, potentially reflecting investor confidence in its direction amid these changes. Strong quarterly financial results, with significant increases in sales and earnings, would have bolstered investor sentiment. While broader market trends showed an upward trajectory with the Dow Jones and S&P 500 also rising, Eli Lilly’s comprehensive developments likely added weight to its favorable performance.

Eli Lilly's recent leadership transitions could bolster its strategic focus on global market expansion, potentially impacting its revenue and earnings forecasts. The company aims to enhance its product reach, particularly in oncology and immunology, areas of anticipated growth based on the release of Phase III trial data. These developments are positioned against the backdrop of significant investments in manufacturing and R&D, which could optimize production efficiency and improve supply chain resilience, key factors for revenue growth despite potential short-term costs.

Looking at its longer-term performance, Eli Lilly's stock appreciated by 422.93% over the past five years, reflecting substantial growth compared to the US Pharmaceuticals industry. Over the past year, while the industry experienced a shrinkage of 7.3%, Eli Lilly managed to outperform this trend with notable performance metrics.However, this must be viewed in the context of a broader market comparison over the same period where the US market saw a return of 7.7%, meaning Eli Lilly's performance was not as strong in that specific timeframe.

The recent 7% share price increase, amid expectations of revenue reaching US$85.1 billion and earnings climbing to US$31.7 billion by 2028, indicates investor positivity. Analysts' consensus price target of US$981.63 suggests a 21% potential increase from the current share price of US$775.12, though it's essential for investors to analyze these figures alongside potential risks such as pricing pressures and regulatory challenges. Prudence is advised when considering the alignment of actual future outcomes with these optimistic forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives