- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Advances Alopecia Study Results Amid 4% Share Price Rise

Reviewed by Simply Wall St

Eli Lilly (NYSE:LLY) has recently unveiled significant advancements across its product line, including promising results from the BRAVE-AA-PEDS study on adolescents with severe alopecia areata and the positive response from their EBGLYSS study on atopic dermatitis. Such breakthroughs possibly contributed to the company's share price rising by 3.77% over the last quarter. Additionally, Eli Lilly announced expansion efforts, such as plans to build four new manufacturing sites in the U.S., expecting to generate over 3,000 jobs, which likely bolstered investor confidence. In contrast to some sectors affected by market volatility and political economic uncertainties, as evidenced by the broader market's 4.6% decline recently, Lilly's robust product pipeline and strategic expansions appeared unaffected. Therefore, the company's performance might reflect its resilience to current market trends, despite recent moves like tariff changes influencing overall market dynamics, with stocks such as automakers and airlines showing declines.

Navigate through the intricacies of Eli Lilly with our comprehensive report here.

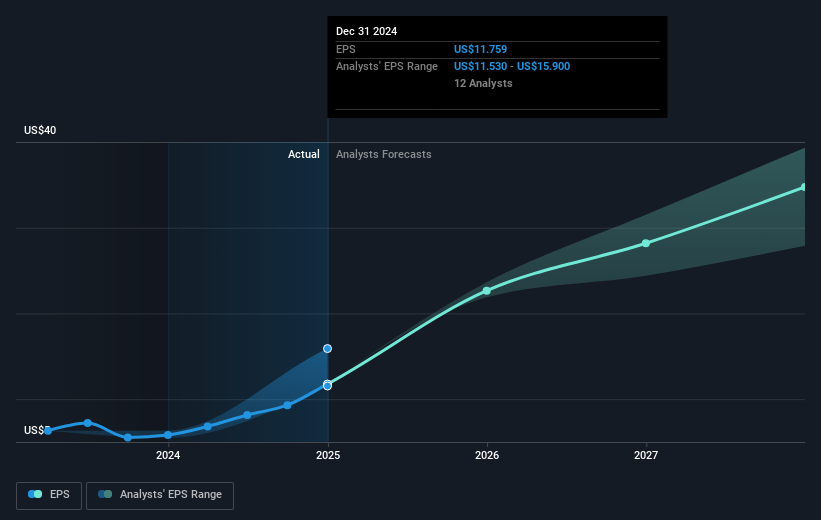

The last five years have seen Eli Lilly's total shareholder return reach a very large 581.91%. Key developments contributing to this impressive performance include the announcement of several innovative products and regulatory milestones. For instance, multiple FDA approvals, like those for Zepbound and Omvoh, significantly expanded the company's treatment portfolio. Another factor has been the robust financial results, with sales and net income seeing formidable growth just recently, as evidenced by Q4 2025 earnings report, which highlighted sales increasing to US$13.5 billion from US$9.4 billion, alongside a notable rise in net income.

Eli Lilly's ability to outperform not only the US market but also the pharmaceuticals industry over the past year underscores its competitive strength, with the stock returning far more than both benchmarks. The company's expansion plans, including multi-billion dollar investments in new manufacturing facilities, have likely played a vital role in driving confidence and supporting the stock's trajectory. These efforts have ensured Eli Lilly's resilience amidst broader market challenges.

- Learn how Eli Lilly's intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in Eli Lilly's business with our detailed risk assessment.

- Have a stake in Eli Lilly? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives