- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY): Revisiting Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Eli Lilly (LLY) stock has seen some movement lately, prompting investors to revisit its current valuation. Looking at recent returns, the shares have climbed 10% over the past month, even as the broader sector faced mixed results.

See our latest analysis for Eli Lilly.

Momentum has picked up for Eli Lilly’s share price, which has notched an impressive 10% gain over the past month and now sits at $833.49. Despite strong short-term moves, the one-year total shareholder return is still down nearly 10%, serving as a reminder of how turbulent the stock’s journey has been in relation to its big-picture growth and valuation story. Over three and five years, however, total returns of nearly 158% and 503% respectively point to robust long-term performance and enduring investor confidence.

If pharma’s recent volatility has you curious, take the opportunity to discover even more potential with our See the full list for free..

With Eli Lilly’s rapid gains and strong fundamentals, the question now is whether the current price leaves room for further upside or if investors have already accounted for all future growth potential.

Most Popular Narrative: 6.5% Undervalued

With Eli Lilly’s last close at $833.49 and the most-followed narrative assigning fair value at $891.62, current pricing lags well behind future potential by more than 6%. Bold expansion plans and growth catalysts are central to this valuation perspective.

“Advancements in research and development, particularly in neurodegenerative diseases (e.g., Alzheimer's with Kisunla and donanemab), and a deep clinical pipeline with multiple late-stage readouts, position Eli Lilly to capture future multi-billion dollar market opportunities and support long-term revenue and margin expansion.”

Want to know the bold financial forecast powering that price target? The answer lies in profit margins and revenue growth rarely seen outside tech or luxury leaders. The narrative’s projections depend on a future financial profile fit for industry trailblazers. Discover which ambitious numbers drive this fair value and if the bull case really holds up under scrutiny.

Result: Fair Value of $891.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, pressure from U.S. and European drug pricing reforms, as well as setbacks with blockbuster obesity treatments, could quickly reshape the bullish outlook on Eli Lilly.

Find out about the key risks to this Eli Lilly narrative.

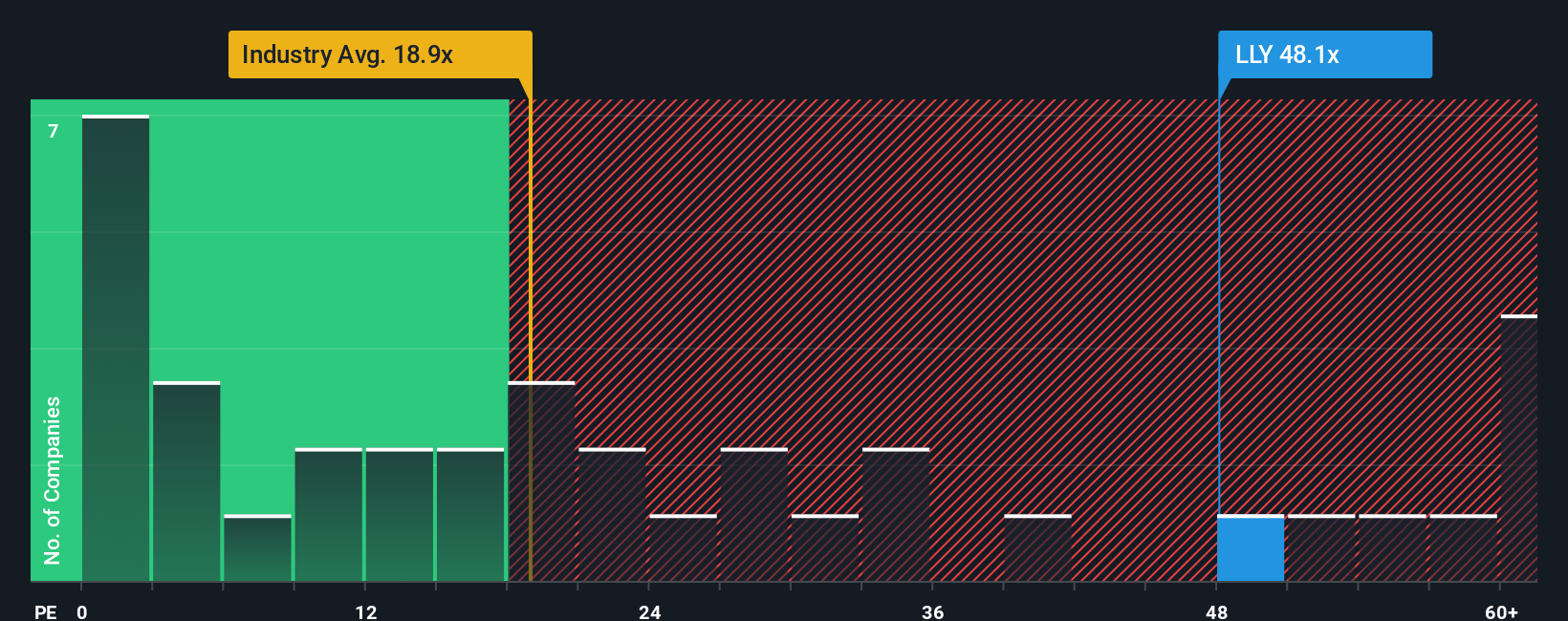

Another View: Price-to-Earnings Raises Flags

While the consensus targets suggest Eli Lilly is undervalued, the current price-to-earnings ratio of 54.2x is much higher than both peers (16.1x) and the industry average (18.8x). It also exceeds the fair ratio of 40x, signaling investors may be paying a premium for future growth that may not materialize. Could this optimism expose shareholders to downside risk if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you want to challenge these perspectives or reach your own conclusions, you can dive into the figures and shape your unique thesis in just minutes. Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the next opportunity with our handpicked screeners. If you're serious about smarter investing, don't let these unique stock ideas pass you by.

- Uncover income potential by focusing on companies offering these 19 dividend stocks with yields > 3% with yields above 3% and resilient business models.

- Tap into next-generation growth by exploring these 24 AI penny stocks that are positioned to benefit from increasing demand for artificial intelligence solutions.

- Accelerate your search for untapped value with these 901 undervalued stocks based on cash flows using rigorous cash flow analysis and fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives