- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY) Gains Breakthrough Therapy Designation For Advanced Lung Cancer Treatment

Reviewed by Simply Wall St

Eli Lilly (LLY) recently received a significant boost in the arena of drug development, with the FDA granting Breakthrough Therapy designation to olomorasib in combination with KEYTRUDA for treating specific lung cancers. Despite this promising advancement, the company's stock price remained flat over the past week, likely reflecting broader market trends where general movements were minimal. The market's anticipation of future Fed rate cuts following weak labor data played a significant role in overshadowing individual company news, including Eli Lilly's successful drug-related announcements. Overall, the broader market dynamics seemed to temper any potential excitement around Eli Lilly's positive developments.

Eli Lilly's recent FDA Breakthrough Therapy designation for olomorasib, in partnership with KEYTRUDA, could significantly bolster the company's research focus and strengthen its position in the oncology sector. While this announcement did not immediately influence the stock price, it underscores the strategic importance of innovation in driving long-term growth. Over the past five years, Eli Lilly's total shareholder return, including share price appreciation and dividends, has surged by over 400%. This impressive performance contextualizes the recent flat share price movement amidst broader market conditions.

Over the last year, however, Eli Lilly's stock has underperformed both the US market, which grew by 18.1%, and the US Pharmaceuticals industry, which saw a decline of 12.8%. This discrepancy emphasizes the market's focus on broader economic trends rather than company-specific developments such as the FDA designation.

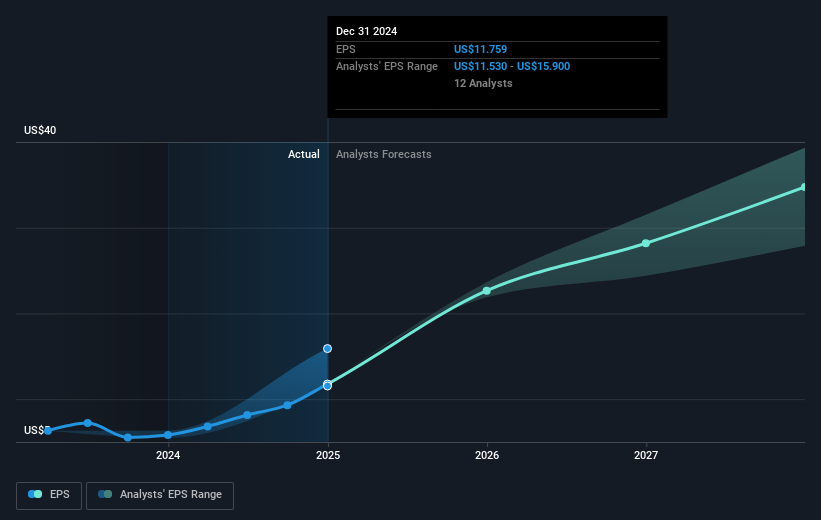

Future revenue and earnings forecasts could receive a positive boost from this drug designation, potentially enhancing Eli Lilly's long-term growth trajectory. The consensus price target of US$888.52 indicates a potential upside from the current share price of US$737.83, reflecting optimism regarding the company's future earnings expansion and market position. As analysts estimate significant earnings growth, their projections will be critical in assessing Eli Lilly's ability to capitalize on current and future opportunities in the pharmaceutical industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives