- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Discover Gilead Sciences And 2 More Stocks That May Be Priced Below Intrinsic Estimates

Reviewed by Simply Wall St

As the U.S. market grapples with the impact of newly imposed tariffs and a broad-based sell-off, investors are keenly assessing opportunities that may arise from these turbulent conditions. In such an environment, identifying stocks that appear to be undervalued based on intrinsic estimates can provide potential avenues for investment, as they might offer resilience against broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SouthState (NYSE:SSB) | $99.22 | $193.86 | 48.8% |

| Gilead Sciences (NasdaqGS:GILD) | $115.99 | $228.07 | 49.1% |

| Old National Bancorp (NasdaqGS:ONB) | $23.52 | $45.94 | 48.8% |

| Brunswick (NYSE:BC) | $59.01 | $115.84 | 49.1% |

| Similarweb (NYSE:SMWB) | $9.11 | $18.05 | 49.5% |

| JBT Marel (NYSE:JBTM) | $129.25 | $257.94 | 49.9% |

| Nutanix (NasdaqGS:NTNX) | $77.44 | $153.66 | 49.6% |

| Mobileye Global (NasdaqGS:MBLY) | $14.45 | $28.65 | 49.6% |

| Workiva (NYSE:WK) | $86.16 | $168.67 | 48.9% |

| Sotera Health (NasdaqGS:SHC) | $11.68 | $22.61 | 48.3% |

We'll examine a selection from our screener results.

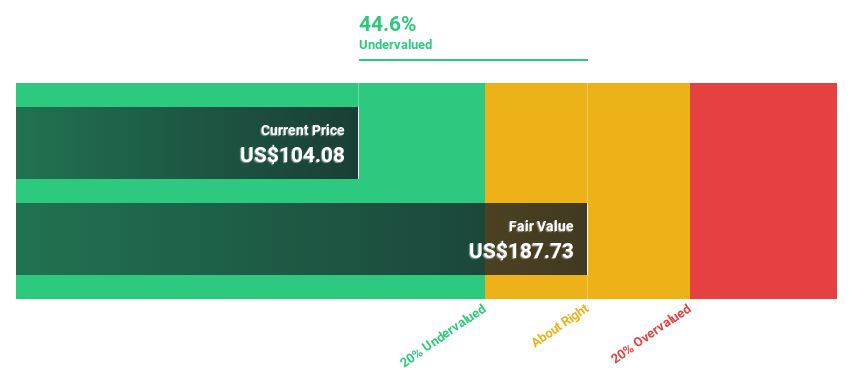

Gilead Sciences (NasdaqGS:GILD)

Overview: Gilead Sciences, Inc. is a biopharmaceutical company that discovers, develops, and commercializes medicines for unmet medical needs globally, with a market cap of approximately $142.36 billion.

Operations: Gilead Sciences operates in the biopharmaceutical sector, focusing on discovering, developing, and commercializing medicines to address unmet medical needs across the United States, Europe, and international markets.

Estimated Discount To Fair Value: 49.1%

Gilead Sciences shows potential as an undervalued stock based on cash flows, trading at US$115.99, significantly below its estimated fair value of US$228.07. Despite high debt levels and a current profit margin dip to 1.7%, earnings are forecasted to grow significantly by 23.6% annually over the next three years, outpacing the broader U.S. market's growth expectations of 14%. Recent regulatory advancements for key products like lenacapavir may bolster future cash flows.

- Upon reviewing our latest growth report, Gilead Sciences' projected financial performance appears quite optimistic.

- Dive into the specifics of Gilead Sciences here with our thorough financial health report.

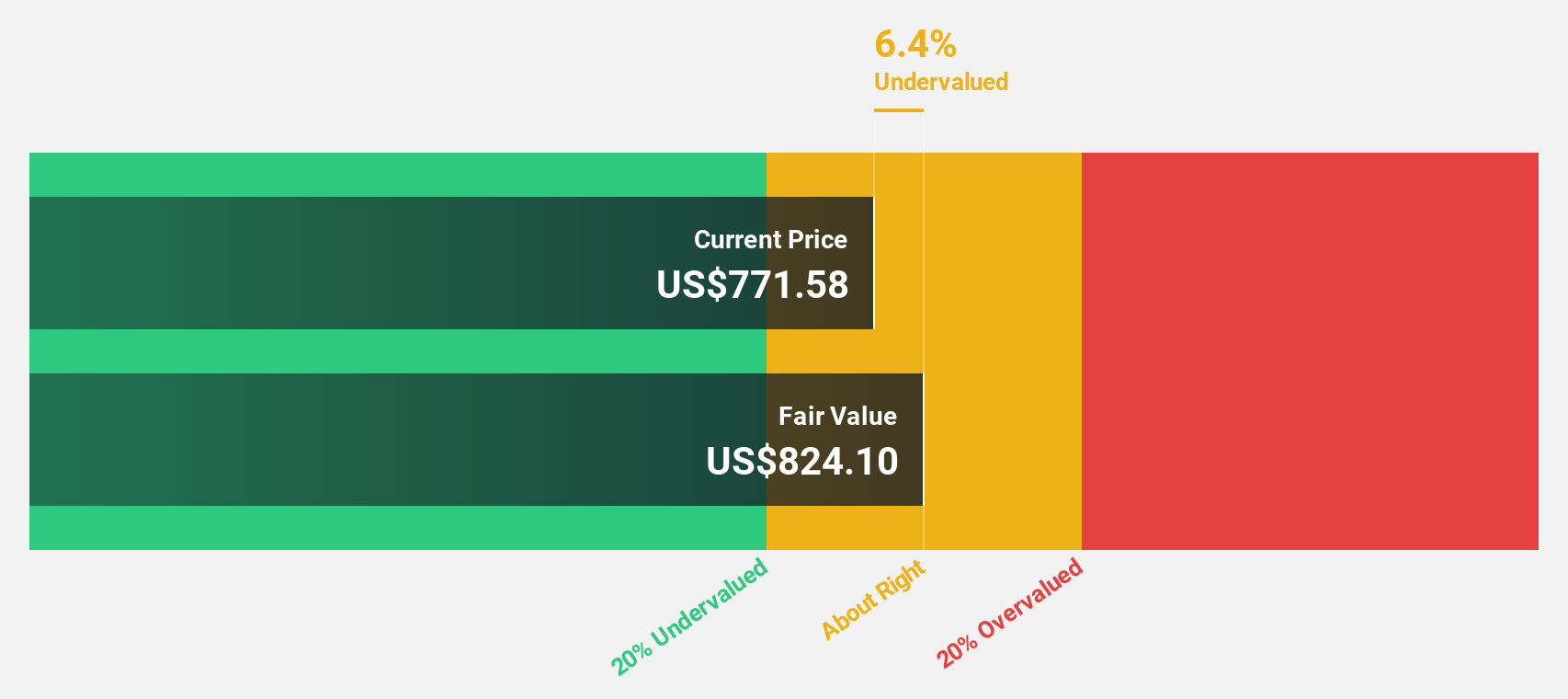

Intuit (NasdaqGS:INTU)

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States with a market cap of approximately $171.61 billion.

Operations: The company's revenue segments include Pro-Tax at $594 million, Consumer at $4.45 billion, Credit Karma at $1.96 billion, and Global Business Solutions at $10.16 billion.

Estimated Discount To Fair Value: 28.7%

Intuit is trading at US$601.09, notably below its estimated fair value of US$842.94, indicating potential undervaluation based on cash flows. Earnings are projected to grow annually by 16.5%, surpassing the broader U.S. market's expectations of 14%. However, significant insider selling in recent months could be a concern for investors. Recent product enhancements and strategic partnerships, such as with Amazon and Mailchimp, may support future revenue growth and strengthen cash flow dynamics.

- Our comprehensive growth report raises the possibility that Intuit is poised for substantial financial growth.

- Get an in-depth perspective on Intuit's balance sheet by reading our health report here.

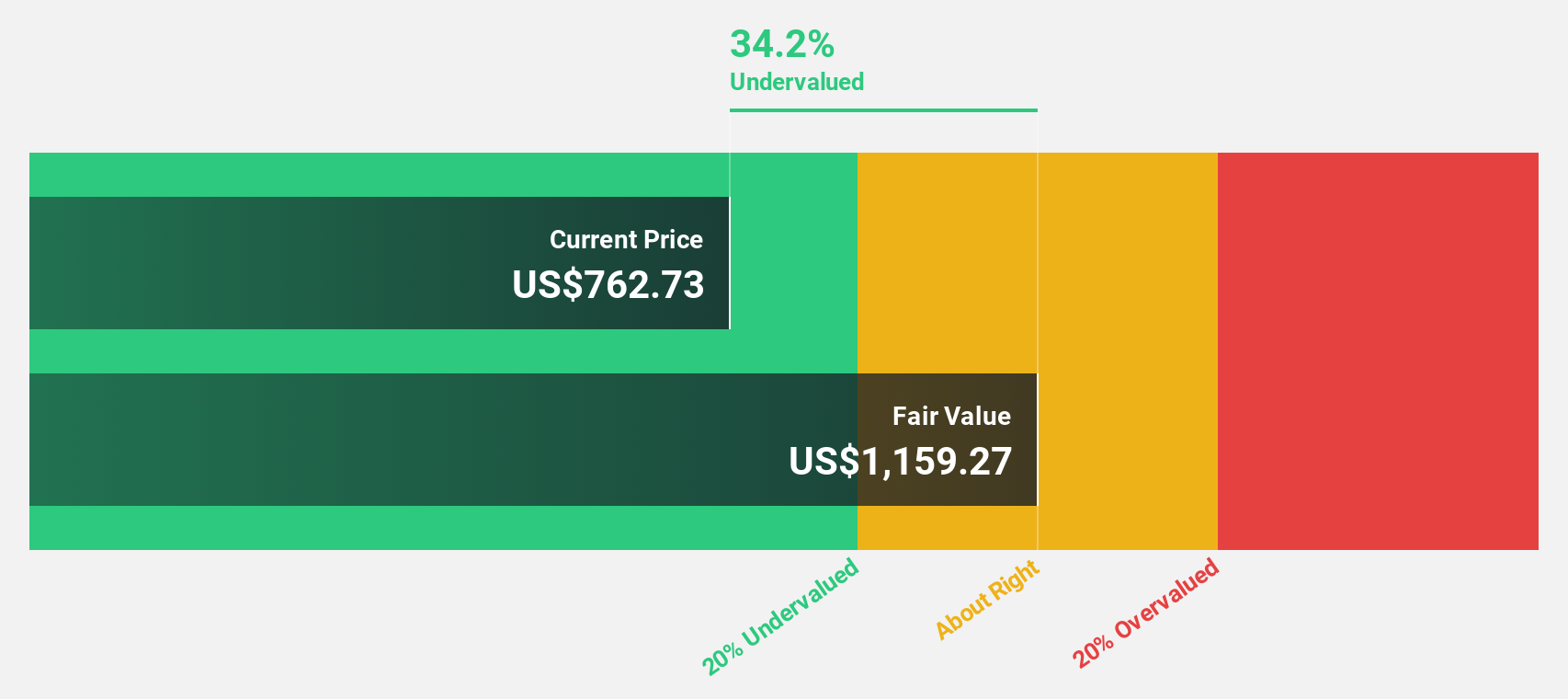

Eli Lilly (NYSE:LLY)

Overview: Eli Lilly and Company is a global pharmaceutical firm that discovers, develops, and markets human pharmaceuticals across various regions including the United States, Europe, China, and Japan, with a market cap of approximately $826.88 billion.

Operations: Eli Lilly generates its revenue primarily through the discovery, development, manufacturing, marketing, and sales of pharmaceutical products, amounting to $45.04 billion.

Estimated Discount To Fair Value: 24.1%

Eli Lilly is trading at US$929.72, below its estimated fair value of US$1,224.12, suggesting undervaluation based on cash flows. Despite carrying high debt levels, the company's earnings are forecast to grow significantly at 21.6% annually, outpacing the U.S. market's growth rate of 14%. Recent expansions in domestic manufacturing and positive product developments like Jaypirca for CLL may enhance revenue streams and bolster cash flow potential in the long term.

- According our earnings growth report, there's an indication that Eli Lilly might be ready to expand.

- Navigate through the intricacies of Eli Lilly with our comprehensive financial health report here.

Make It Happen

- Gain an insight into the universe of 195 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives