- United States

- /

- Pharma

- /

- NYSE:JNJ

What Johnson & Johnson (JNJ)'s Upbeat 2025 Outlook and Dividend Hike Means For Shareholders

Reviewed by Sasha Jovanovic

- Johnson & Johnson reported higher-than-expected third-quarter results and raised its 2025 earnings guidance, now projecting annual product revenue between US$93.5 billion and US$93.9 billion, exceeding analyst forecasts.

- The affirmation of a quarterly dividend and ongoing clinical advancements reinforces confidence in the company's outlook for sustained performance across its healthcare segments.

- We'll explore how Johnson & Johnson's updated revenue outlook and dividend declaration may influence its long-term investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Johnson & Johnson Investment Narrative Recap

To own shares in Johnson & Johnson, you need to believe in the company's ability to balance its legacy products with new innovations, even as it faces the challenge of biosimilar competition. The raised sales outlook and continued dividend payout reflect management's confidence, but the most important short-term catalyst remains execution on new product launches, while the erosion of revenue from loss of exclusivity for STELARA remains the biggest risk. The latest results do not materially alter this balance.

Of the recent announcements, the company's strong pipeline updates, like the positive Phase 2b data for icotrokinra in ulcerative colitis, are most relevant, as ongoing success in innovative medicines is central to offsetting pressures from biosimilar entrants and maintaining growth. These clinical advancements, alongside robust third-quarter financials, underscore how new therapies may help support future earnings and resilience if market share in key drugs declines.

By contrast, investors should be aware that the risk of STELARA biosimilars entering the market could...

Read the full narrative on Johnson & Johnson (it's free!)

Johnson & Johnson's outlook anticipates $104.1 billion in revenue and $22.9 billion in earnings by 2028. This scenario depends on an annual revenue growth rate of 4.7% and a modest earnings increase of $0.2 billion from the current $22.7 billion in earnings.

Uncover how Johnson & Johnson's forecasts yield a $185.13 fair value, a 3% downside to its current price.

Exploring Other Perspectives

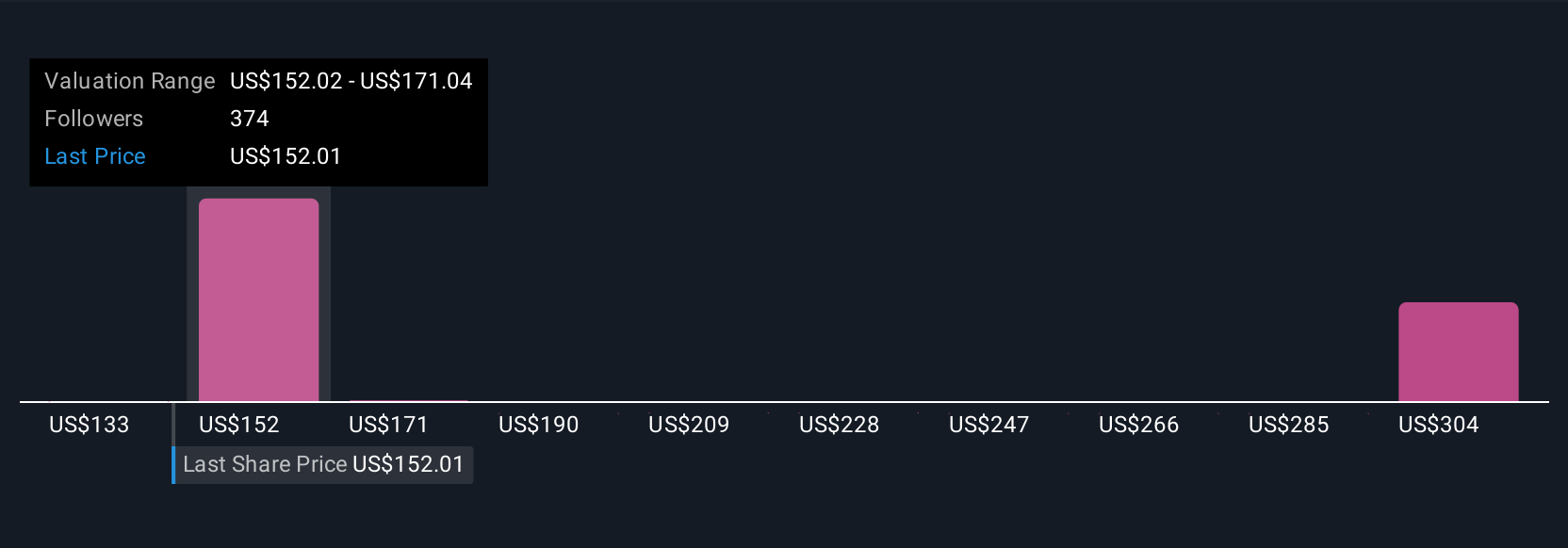

Community fair value estimates for Johnson & Johnson range from US$133 to US$442.56, based on 31 perspectives from the Simply Wall St Community. With biosimilar competition posing a possible risk to core revenues, market participants should be prepared for a variety of outlooks on the company's long-term performance.

Explore 31 other fair value estimates on Johnson & Johnson - why the stock might be worth over 2x more than the current price!

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives