- United States

- /

- Life Sciences

- /

- NYSE:IQV

Will Analyst Optimism Around IQVIA (IQV) Signal Lasting Strength in Healthcare Data Leadership?

Reviewed by Sasha Jovanovic

- IQVIA Holdings recently drew market attention ahead of its scheduled Q3 earnings report, with analysts expecting profitability to increase 2.7% year-over-year to US$2.68 per share and reaffirming strong confidence in the company's prospects in healthcare data and clinical research.

- An interesting feature is IQVIA's record of surpassing bottom-line estimates in three of the past four quarters, supporting continued analyst optimism.

- We'll explore how analyst confidence ahead of the earnings release potentially influences IQVIA's long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

IQVIA Holdings Investment Narrative Recap

For those considering IQVIA Holdings, the key thesis centers on whether its analytics, data, and clinical research platforms can capture growing industry demand while navigating heightened pricing pressures and margin risks. The recent news of anticipated Q3 profitability growth and continued analyst confidence supports the near-term catalyst of strong healthcare data demand, but does not meaningfully reduce the concern around ongoing CRO market price competition, which remains the most significant risk to margins ahead of this earnings release.

Among recent announcements, the September 2025 launch of IQVIA’s AI-powered Clinical Trial Financial Suite stands out, as it directly addresses operational efficiency, one of the main levers for protecting margins in a more competitive contract environment. This development is a timely addition as the company continues to balance cost containment with backlog growth in its core businesses.

By contrast, investors should also be aware that persistent CRO pricing competition means...

Read the full narrative on IQVIA Holdings (it's free!)

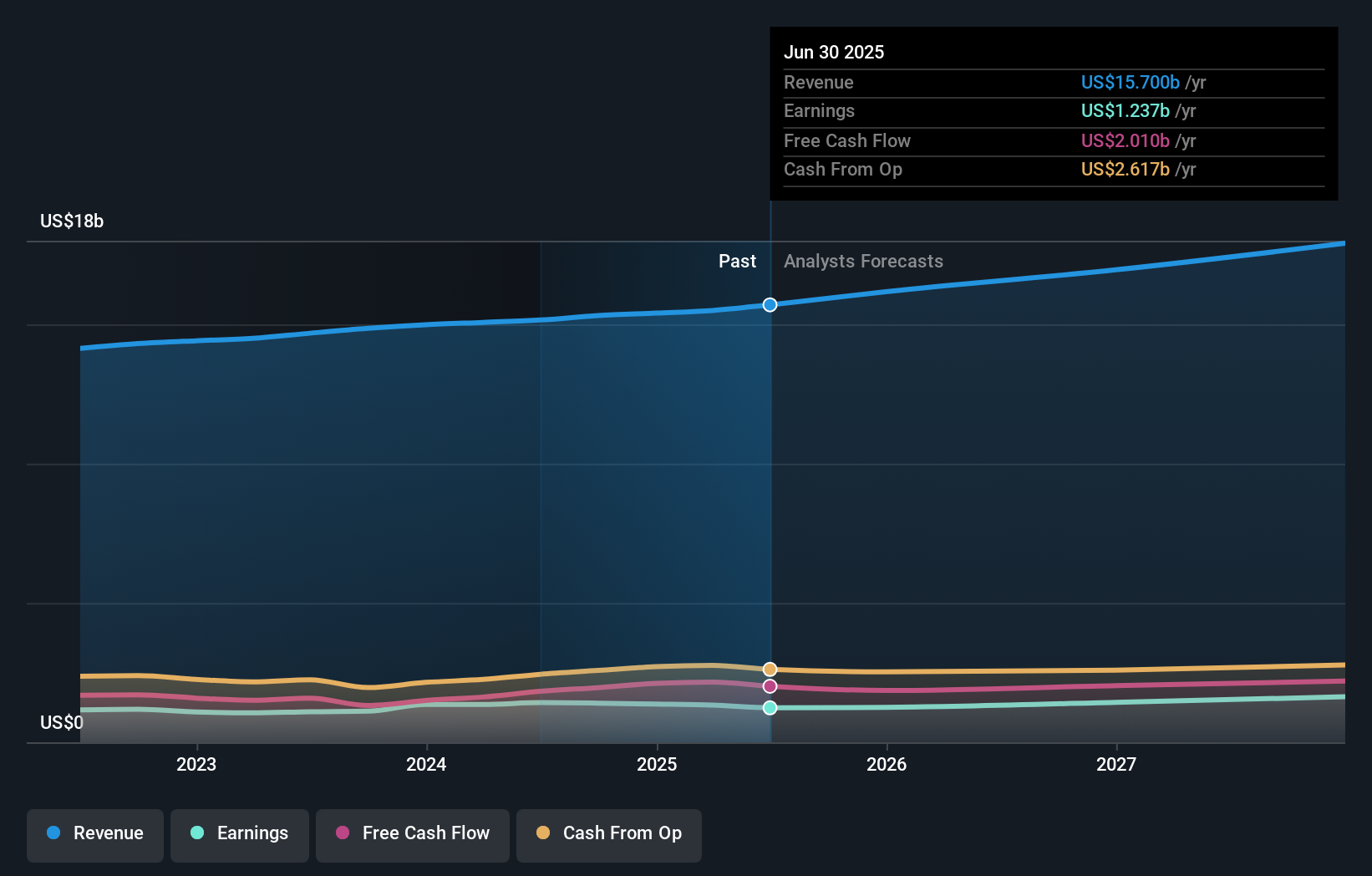

IQVIA Holdings' narrative projects $18.4 billion in revenue and $1.8 billion in earnings by 2028. This requires 5.4% yearly revenue growth and a $0.6 billion increase in earnings from the current $1.2 billion.

Uncover how IQVIA Holdings' forecasts yield a $218.26 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community assessed fair value for IQVIA, ranging widely from US$218.26 to US$309.81 per share. While such differences reflect substantial variation in expectations, many are watching closely to see if margin pressure from CRO market pricing will weigh on forward earnings and broader growth.

Explore 4 other fair value estimates on IQVIA Holdings - why the stock might be worth just $218.26!

Build Your Own IQVIA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IQVIA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IQVIA Holdings' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives