- United States

- /

- Pharma

- /

- NYSE:ELAN

Elanco Animal Health (ELAN): Valuation in Focus Following FDA-Backed Zenrelia Label Upgrade

Reviewed by Kshitija Bhandaru

If you are watching Elanco Animal Health (NYSE:ELAN) after the latest headlines, you are not alone. The company’s FDA-backed update to its Zenrelia label, which removes warnings about fatal vaccine-induced disease, has given investors a fresh reason to reconsider the stock. With this regulatory lift, Zenrelia now enjoys a stronger safety profile in the U.S., bringing it closer to its standing in international markets and removing a key source of prescriber concern.

This label update builds on a period of momentum for Elanco. Over the past three months, the stock has surged upward, boosted by confidence in new product launches and improved market sentiment. This improvement has been reinforced by several analysts raising their outlooks. Developments such as the Zenrelia approval, strong recent earnings, and Elanco’s entry into the S&P MidCap 400 are shifting perceptions about its long-term growth and execution, especially as products like Zenrelia and Credelio Quattro ramp up.

Now the question is front and center: with shares up this year and sentiment improved, is the recent rally justified by fundamentals, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 5.7% Overvalued

According to the most widely followed narrative, Elanco Animal Health is currently seen as slightly overvalued against its estimated fair value, as analysts weigh growth catalysts and ongoing uncertainties. This consensus view is based on a mix of stable revenue expectations, improved business execution, and innovation-driven upside, balanced against future margin and profitability risks.

"Elanco anticipates an acceleration in organic constant currency revenue growth of 4% to 6%, driven by innovation and market expansion. This will positively impact revenue growth. The successful launch of six potential blockbuster products and exceeding innovation revenue targets for 2024 positions Elanco for strong innovation contributions in 2025, expected to increase innovation revenue, positively influencing earnings."

Want to know the growth blueprint behind this high valuation? The key element of this narrative is future-defining product rollouts and an earnings trajectory that challenges sector norms. Interested in what bold financial forecasts drive the analyst fair value? Read the full consensus view to see the surprising quantitative assumptions that underpin this stock's premium price tag.

Result: Fair Value of $18.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing foreign exchange volatility and rising operating expenses remain potential hurdles. These factors could quickly challenge this optimistic outlook for Elanco’s growth trajectory.

Find out about the key risks to this Elanco Animal Health narrative.Another View: Discounted Cash Flow Model Paints a Different Picture

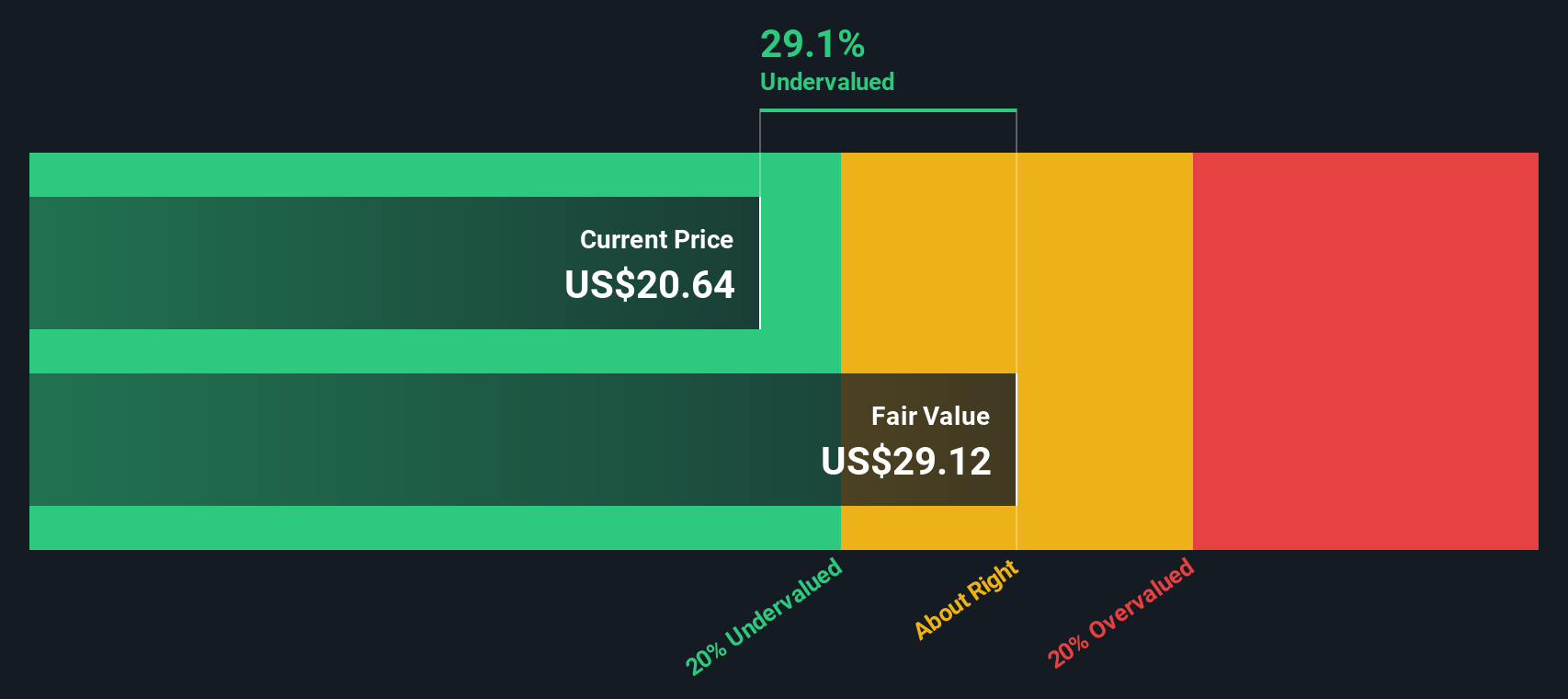

While analysts see Elanco Animal Health as slightly overvalued using traditional benchmarks, our SWS DCF model presents a different perspective. This valuation approach suggests the shares may actually be undervalued at current prices. Which story will the market ultimately side with?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elanco Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elanco Animal Health Narrative

If you have a different perspective or want to dive deeper into the numbers, building your own story takes less than three minutes. Start now: Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Don’t sit back while others move ahead. Use the Simply Wall St Screener to target stocks built for tomorrow’s returns with these unique ideas:

- Capitalize on market inefficiencies by seizing undervalued stocks based on cash flows that look set to deliver value few investors are watching.

- Ride the AI-powered healthcare revolution and tap into breakthroughs transforming medical innovation with healthcare AI stocks.

- Capture ongoing income in any market environment by selecting companies offering dividend stocks with yields > 3% that reward shareholders with attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives