- United States

- /

- Life Sciences

- /

- NYSE:CRL

Could Charles River (CRL) Redefine Its Competitive Edge with New Non-Animal Toxicology Platform?

Reviewed by Sasha Jovanovic

- Charles River Laboratories International and Toxys recently announced a collaboration granting Charles River’s clients access to ReproTracker®, an in vitro stem cell-based assay for early detection of developmental toxicity in drugs and chemicals.

- This partnership highlights Charles River’s ongoing commitment to expanding non-animal testing capabilities, responding to industry demand for safer and more ethical preclinical research solutions.

- We'll explore how integrating ReproTracker as a non-animal toxicology platform could shape Charles River’s investment narrative and growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

Charles River Laboratories International Investment Narrative Recap

At its core, Charles River Laboratories International is a bet on sustained demand for outsourced preclinical research, especially as R&D pipelines in biopharma stabilize and advanced therapies expand market needs. The newest alliance with Toxys for ReproTracker adds to Charles River’s progress in non-animal testing, supporting longer-term competitiveness, but does not immediately address the major near-term challenge of study cancellations and backlog conversion rates that currently limit revenue growth potential.

Of the recent announcements, Charles River’s reaffirmed full-year 2025 earnings guidance stands out, signaling management’s confidence despite recent headwinds reflected in lower earnings and persistent operational pressures. While the ReproTracker partnership underscores an innovative direction, investor focus in the coming quarters will likely remain on how quickly backlog conversion and new bookings improve to support organic growth.

However, investors should be mindful that if demand softness lingers or cancellations increase, especially amid ongoing transformation in testing methods, then the risk to...

Read the full narrative on Charles River Laboratories International (it's free!)

Charles River Laboratories International's narrative projects $4.4 billion in revenue and $483.2 million in earnings by 2028. This requires 2.8% yearly revenue growth and a $552.4 million increase in earnings from the current level of -$69.2 million.

Uncover how Charles River Laboratories International's forecasts yield a $179.73 fair value, a 8% upside to its current price.

Exploring Other Perspectives

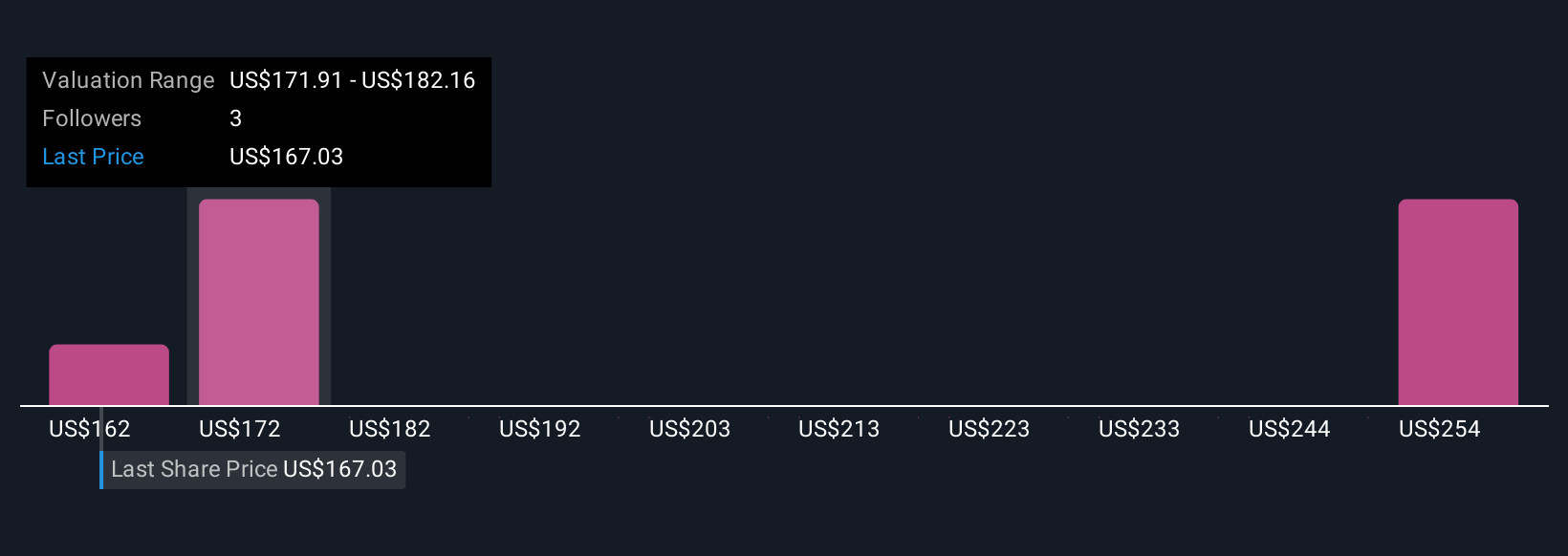

Three Simply Wall St Community members estimate Charles River’s fair value between US$161.65 and US$263.70 per share. While opinions vary, many are watching if softer demand and cancellation trends cap the company’s ability to close this perceived discount.

Explore 3 other fair value estimates on Charles River Laboratories International - why the stock might be worth just $161.65!

Build Your Own Charles River Laboratories International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles River Laboratories International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles River Laboratories International's overall financial health at a glance.

No Opportunity In Charles River Laboratories International?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives