- United States

- /

- Biotech

- /

- NYSE:ABBV

What the Gilgamesh Deal Means for AbbVie’s 2025 Valuation

Reviewed by Bailey Pemberton

Trying to decide whether to buy, hold, or sell AbbVie stock? You are in good company. AbbVie has become a magnet for attention, thanks to its remarkable ability to generate returns while keeping investors on their toes. Just look at how it has performed lately. In the past year alone, the stock is up 17.3%, and over the longer term, it has soared 213.3% in five years. Even with a slight dip of -0.8% this past week, AbbVie has posted a strong 22.9% return year-to-date and notched a 6.0% gain in the last month.

Market optimism has been fueled in part by big news, including AbbVie's potential acquisition of Gilgamesh Pharmaceuticals. This move, estimated at around $1B, could add Bretisilocin, a promising neuro asset, to AbbVie's already robust pipeline. That sort of pipeline expansion often boosts growth prospects and can shift how investors see risks and future rewards for the company.

So, AbbVie's price has definitely made moves. Is it still a bargain, or are investors now paying a premium for all this promise? According to the numbers, AbbVie scores a 2 out of 6 on our valuation checklist. That means it is undervalued in only 2 of the 6 categories we track. But before we jump to conclusions, let’s break down what goes into those valuation checks and why understanding the bigger picture will help you see if AbbVie is right for your portfolio. Also, stick around because there is an even stronger way to cut through all the noise around valuation that we will share at the end.

AbbVie scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and then discounting them back to the value they would have today. It is a common approach for valuing companies like AbbVie that generate significant, steady cash flows over time.

AbbVie’s current Free Cash Flow stands at $18.37 Billion. According to analyst projections and ongoing estimates, this figure is expected to grow substantially, reaching about $40.77 Billion in 2035. Short-term growth is primarily informed by analyst forecasts for the next five years. After that period, further growth is extrapolated based on recent trends. These upward projections signal confidence in AbbVie’s continued ability to generate strong cash flows into the next decade.

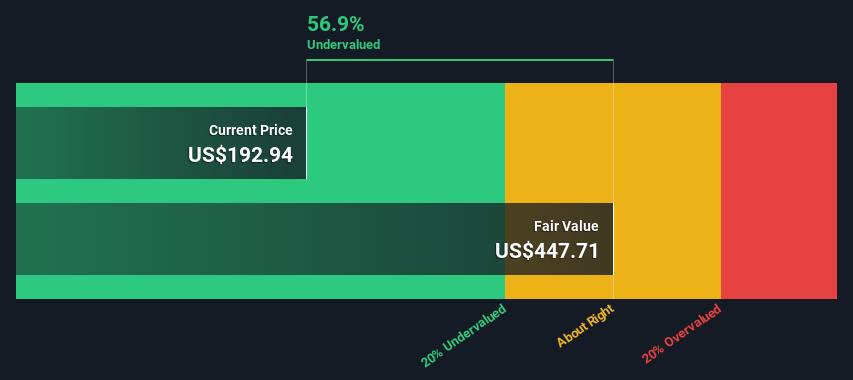

Based on this model, the estimated intrinsic value for AbbVie stock comes out to $439.02 per share. This calculation shows that the stock is currently trading at a 49.7% discount to its estimated value, making it appear significantly undervalued by this measure.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for AbbVie.

Approach 2: AbbVie Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like AbbVie because it directly connects a company’s share price to its earnings. This makes it easier to gauge how much investors are willing to pay for every dollar of profit, which is especially meaningful for companies with steady, reliable income streams.

A “normal” or reasonable PE ratio for a company is influenced by factors such as growth expectations and perceived risk. Fast-growing companies or those with less risk tend to warrant higher PE ratios, while slower growth or elevated risks usually result in lower ratios. Simply put, it reflects how the market values the company’s future prospects versus its current profits.

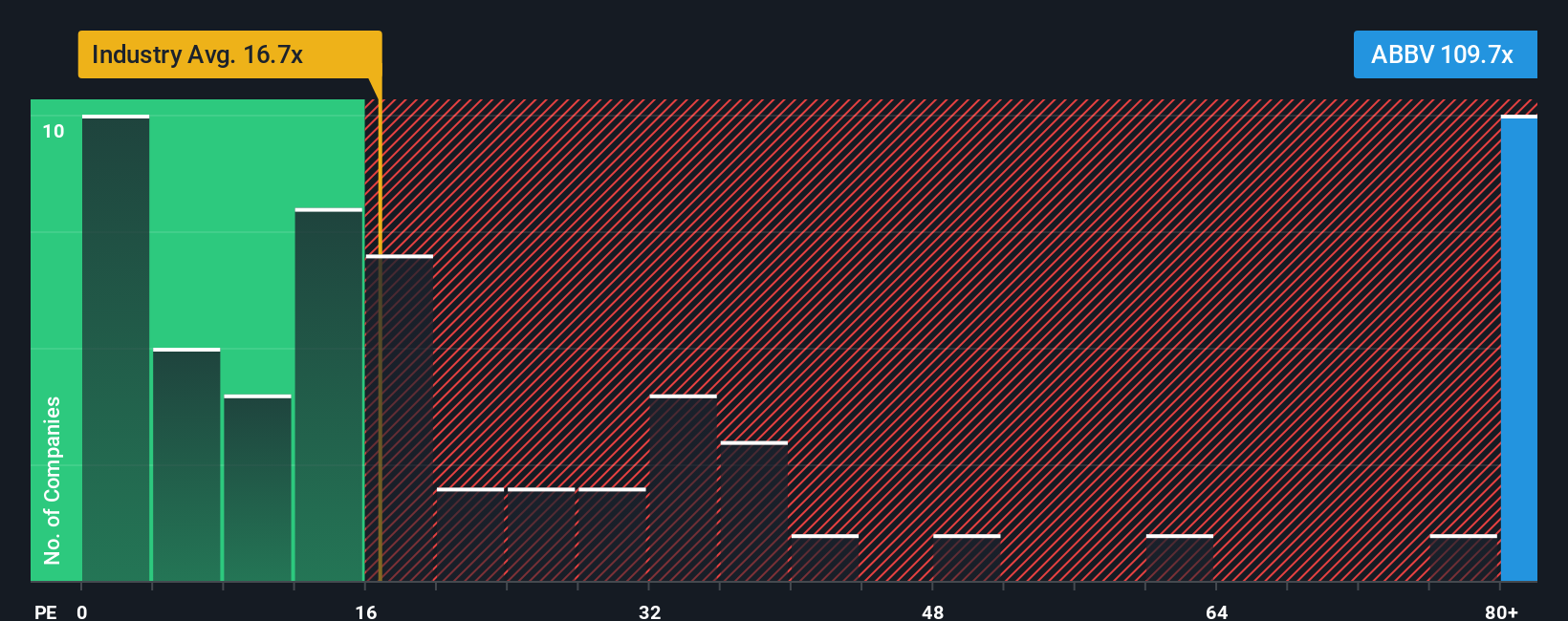

Right now, AbbVie is trading at a PE ratio of 104.7x. This figure stands out compared to both the biotech industry average of 16.3x and the average for its peers at 21.1x. To give a more tailored perspective, Simply Wall St’s proprietary “Fair Ratio” estimate for AbbVie is 40.2x. This Fair Ratio is calculated using an in-depth assessment of the company’s earnings growth, risk profile, market cap, profit margins, and sector dynamics, making it a more nuanced benchmark than relying solely on industry or peer averages.

Comparing AbbVie’s current PE to its Fair Ratio suggests that the stock is trading well above what would be expected given all these factors. While the industry average and peer comparison offer a quick check, the Fair Ratio provides a more personalized analysis. Since AbbVie’s actual PE is significantly higher than its Fair Ratio, this points to the stock being overvalued on this measure.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your AbbVie Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, combining your expectations for its future revenue, profit margins, and fair value with the unique reasons behind them.

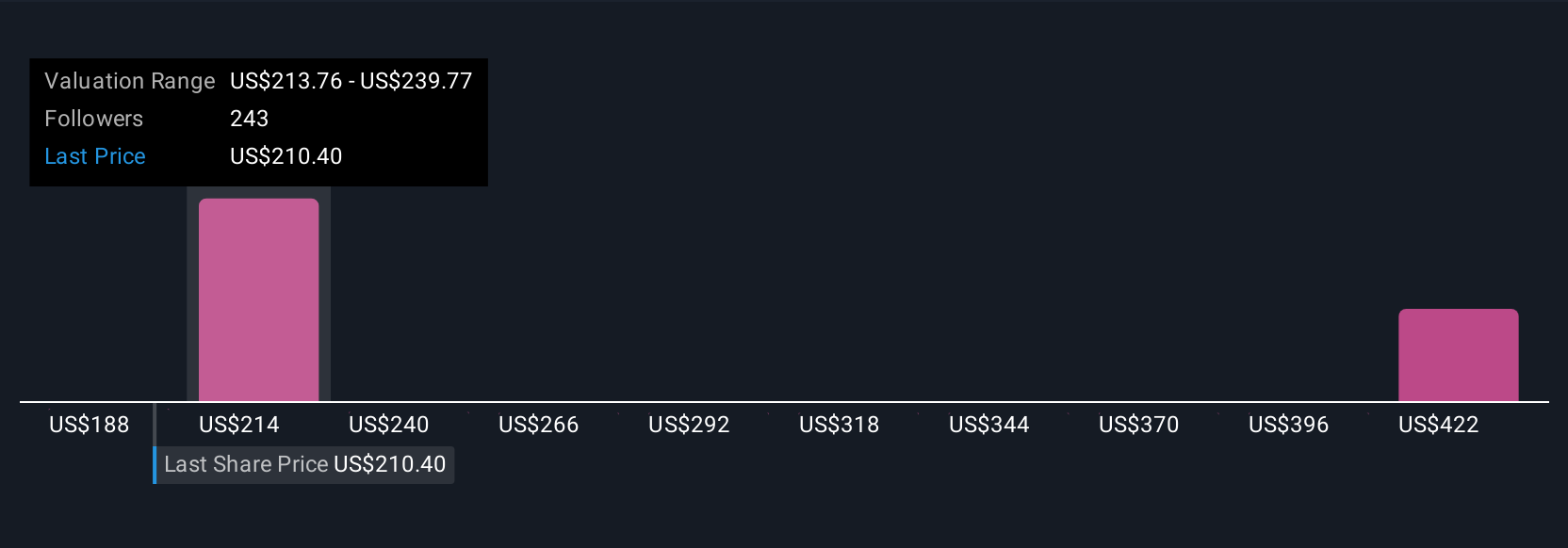

Narratives simplify the investment process by connecting a company’s journey (what you believe will happen and why) to financial forecasts, then translating that story into a practical fair value. Rather than just looking at the latest multiples or price targets, Narratives give you a place to set out your rationale, attach numbers to your beliefs, and see how your estimates compare to others.

The best part is, Narratives are extremely easy to use on Simply Wall St’s Community page, where millions of investors keep their perspectives up to date. Each Narrative lets you instantly compare your calculated Fair Value to AbbVie’s current price, helping you decide exactly when you think it is time to buy or sell based on changing data.

And because Narratives update dynamically as news, earnings, and market moves happen, they stay relevant and actionable. For example, one investor might take a bullish view, seeing AbbVie’s innovation and pipeline growth and set a high fair value target like $255, while another might worry about patent risks and project a much lower value around $170. These estimates are created on the same platform, but reflect each investor's individual views.

Do you think there's more to the story for AbbVie? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)