- United States

- /

- Biotech

- /

- NasdaqGM:XNCR

Assessing Xencor (XNCR) Valuation After New U.S. Patent Extends Ultomiris Royalty Stream

Reviewed by Simply Wall St

Xencor (XNCR) just secured a new U.S. patent that effectively adds about three extra years to its Ultomiris royalty stream, a material boost that could help smooth funding for its antibody pipeline.

See our latest analysis for Xencor.

The new patent lands after a volatile stretch for Xencor, with the share price now at $17.06 and a powerful 90 day share price return of 98.37 percent contrasting with a weak 1 year total shareholder return of negative 31.10 percent. This suggests momentum is rebuilding even as long term holders remain underwater.

If this kind of royalty backed pipeline story interests you, it is also worth scanning healthcare stocks for other healthcare names that might be setting up for the next leg higher.

With shares still more than 60 percent below the Street’s target despite a sharply improving tape, is Xencor quietly undervalued ahead of a royalty fueled inflection, or is the market already discounting years of pipeline upside?

Most Popular Narrative: 39.1% Undervalued

With the narrative fair value sitting well above Xencor’s last close at $17.06, the story hinges on how the pipeline translates into future cash flows.

The robust and flexible XmAb platform allows for modular drug development and the creation of differentiated assets, expected to reduce development costs and timelines, directly benefiting future operating margins and net profitability. Clinical trial strategy emphasizes efficient dose ranging and selection, ongoing biomarker efforts, and combination-therapy optionality, positioning the company to respond rapidly to evolving standards of care and maximize the commercial potential of its pipeline, with positive implications for recurring revenue and ultimate earnings leverage.

Curious how a still unprofitable biotech can command a premium style future earnings multiple, while banking on double digit revenue growth and margin transformation? The narrative’s math is bold, and the timing assumptions even bolder. Want to see exactly which future profit profile is needed to back this fair value call? Dive in to unpack the full valuation blueprint behind Xencor’s projected upside.

Result: Fair Value of $28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering execution risk in late stage trials and intensifying TL1A competition could quickly erode confidence in today’s optimistic valuation path.

Find out about the key risks to this Xencor narrative.

Another View: Market Ratios Flash Caution

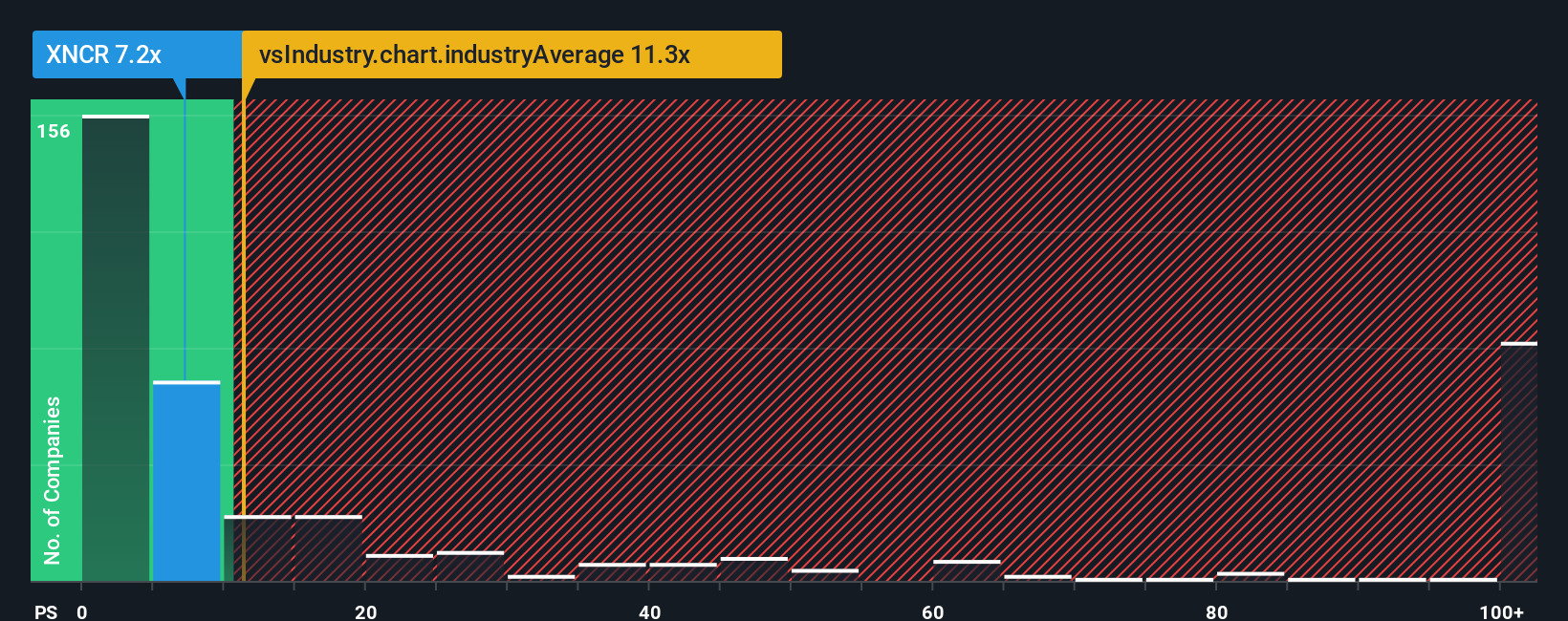

That upside narrative clashes with what the price to sales ratio is signaling. Xencor trades at 8.1 times sales, cheaper than the US biotech average of 11.8 times and peers at 9.1 times, but far above its 1.2 times fair ratio estimate, which implies meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xencor Narrative

If you see the story differently or would rather crunch the numbers yourself, you can build a fresh narrative in just minutes. Do it your way.

A great starting point for your Xencor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street’s Screener, so you do not miss the next breakout story.

- Target steadier income streams by reviewing these 12 dividend stocks with yields > 3%. This screener focuses on companies positioned to keep paying investors even when markets turn choppy.

- Capitalize on long term disruption by assessing these 25 AI penny stocks. This screener highlights where real business adoption of AI could translate into powerful earnings momentum.

- Seize potential mispricings with these 904 undervalued stocks based on cash flows. This tool is designed to highlight businesses whose cash flows may not yet be reflected in their share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:XNCR

Xencor

A clinical-stage biopharmaceutical company, focuses on the discovery and development of engineered monoclonal antibodies for the treatment of asthma and allergic diseases, autoimmune diseases, and cancer.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026