- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma Holdings (XERS): Exploring Valuation as Analysts Grow Bullish on Breakeven Prospects and Earnings Progress

Reviewed by Kshitija Bhandaru

Xeris Biopharma Holdings (XERS) is attracting increased attention as investors react to rising confidence in the company’s path to breakeven, a trend driven by its recent streak of outperforming earnings estimates.

See our latest analysis for Xeris Biopharma Holdings.

Xeris Biopharma Holdings has seen momentum build lately, as investor optimism over breakeven prospects has fueled a climb to new 52-week highs. That buzz is reflected in a 1-year total shareholder return of 1.8%, combining both share price and dividends, as the market weighs faster earnings progress against continued financial risks.

If you’re following Xeris’s steady climb, this could be the ideal moment to widen your lens and discover other compelling opportunities in the biotech and pharmaceutical space. See the full list for free with our See the full list for free..

The question now becomes whether Xeris Biopharma’s impressive momentum and optimism are leaving the stock undervalued, or if all of this growth potential is now fully factored into the current price.

Most Popular Narrative: 9.7% Undervalued

With the narrative suggesting a fair value of $9.00 and the last close at $8.13, Xeris Biopharma Holdings appears to offer notable upside potential if the most-followed outlook proves correct. The setup for this valuation hinges on the expectation of rapid growth and margin improvement over the next several years.

"Rapidly expanding patient demand for Recorlev and Gvoke, driven by their differentiation, the growing prevalence of Cushing's syndrome and diabetes, and increased physician and patient awareness, reflecting broader demographic shifts and chronic disease management needs, are likely to deliver sustained revenue growth. Continued investment in expanding the commercial footprint, enhancing patient support, and deepening engagement with healthcare professionals positions Xeris to capture a larger share of the growing at-home and patient-centric treatment market, supporting both revenue growth and improved SG&A leverage."

Want to know the bold assumptions driving this valuation? The narrative is built on forecasts for surging drug sales and a game-changing shift in future profit margins. Find out what earnings scenario the analysts are betting on and what makes this growth outlook so unconventional. There is one projection here that could make or break the story.

Result: Fair Value of $9.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, particularly Xeris's reliance on a narrow product lineup and rising expenses, which could pressure margins if commercial growth slows.

Find out about the key risks to this Xeris Biopharma Holdings narrative.

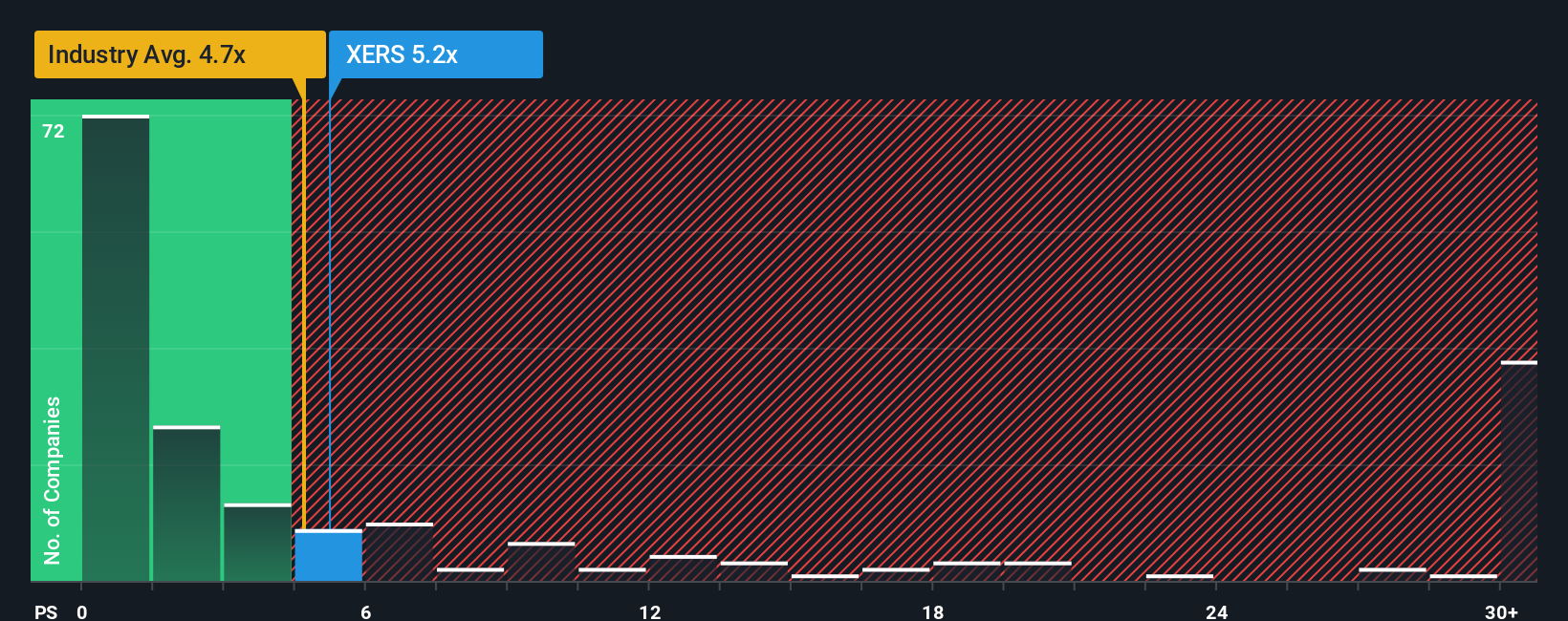

Another View: Market Ratios Paint a Different Picture

Looking at Xeris Biopharma’s price-to-sales ratio of 5.3x, it stands higher than the US Pharmaceuticals industry average of 4.9x and above its peer average of 3.3x. Even so, it remains below the fair ratio of 5.9x, a figure our research suggests the market may move toward. This gap means that while the shares appear more expensive than peers, there could still be value if growth matches expectations. However, does the market agree, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xeris Biopharma Holdings Narrative

If you have a different take on Xeris Biopharma Holdings or want to dig into the numbers yourself, you can easily build your own data-driven outlook and put your perspective to the test in just a few minutes. Do it your way

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock smarter opportunities today using the Simply Wall Street Screener. These pre-screened stocks highlight high-potential sectors and could give you a crucial advantage in finding your next great investment.

- Spot companies redefining artificial intelligence by checking out these 25 AI penny stocks before they capture the market’s spotlight.

- Capture attractive yields and steady income streams with these 19 dividend stocks with yields > 3%, which offers returns above the market average.

- Seize the momentum in innovative blockchain and cryptocurrency companies by exploring these 78 cryptocurrency and blockchain stocks, where new digital frontiers await your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Good value with reasonable growth potential.

Market Insights

Community Narratives