- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma Holdings Loses US$52m Market Value But Insiders See Windfall Of US$29k

Insiders who bought Xeris Biopharma Holdings, Inc. (NASDAQ:XERS) in the last 12 months may probably not pay attention to the stock's recent 14% drop. Reason being, despite the recent loss, insiders original purchase value of US$188.8k is now worth US$218.0k.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for Xeris Biopharma Holdings

Xeris Biopharma Holdings Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Chief Financial Officer Steven Pieper bought US$55k worth of shares at a price of US$1.95 per share. That implies that an insider found the current price of US$2.13 per share to be enticing. That means they have been optimistic about the company in the past, though they may have changed their mind. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. In this case we're pleased to report that the insider purchases were made at close to current prices.

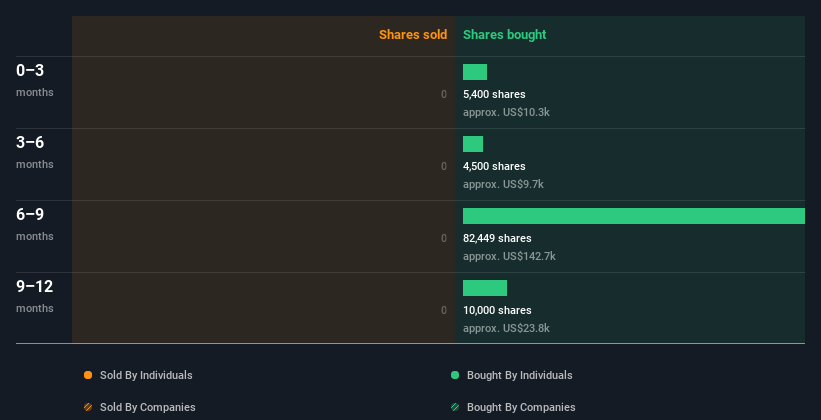

In the last twelve months Xeris Biopharma Holdings insiders were buying shares, but not selling. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Xeris Biopharma Holdings is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insiders At Xeris Biopharma Holdings Have Bought Stock Recently

We saw some Xeris Biopharma Holdings insider buying shares in the last three months. Lead Independent Director John Schmid purchased US$10k worth of shares in that period. It's great to see that insiders are only buying, not selling. But the amount invested in the last three months isn't enough for us too put much weight on it, as a single factor.

Does Xeris Biopharma Holdings Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 4.1% of Xeris Biopharma Holdings shares, worth about US$14m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Xeris Biopharma Holdings Insiders?

Our data shows a little insider buying, but no selling, in the last three months. Overall the buying isn't worth writing home about. However, our analysis of transactions over the last year is heartening. Insiders do have a stake in Xeris Biopharma Holdings and their transactions don't cause us concern. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. For instance, we've identified 2 warning signs for Xeris Biopharma Holdings (1 can't be ignored) you should be aware of.

Of course Xeris Biopharma Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026