- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Investors Appear Satisfied With Xeris Biopharma Holdings, Inc.'s (NASDAQ:XERS) Prospects As Shares Rocket 34%

Despite an already strong run, Xeris Biopharma Holdings, Inc. (NASDAQ:XERS) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 116% following the latest surge, making investors sit up and take notice.

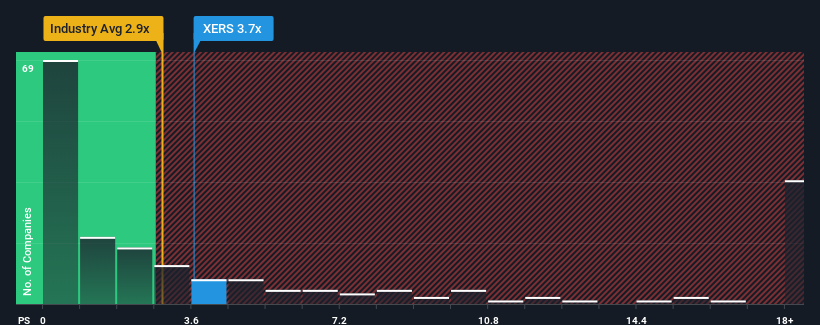

Since its price has surged higher, when almost half of the companies in the United States' Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 2.9x, you may consider Xeris Biopharma Holdings as a stock probably not worth researching with its 3.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Xeris Biopharma Holdings

How Has Xeris Biopharma Holdings Performed Recently?

Xeris Biopharma Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Xeris Biopharma Holdings will help you uncover what's on the horizon.How Is Xeris Biopharma Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Xeris Biopharma Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 22% per year over the next three years. With the industry only predicted to deliver 17% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Xeris Biopharma Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Xeris Biopharma Holdings' P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Xeris Biopharma Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Pharmaceuticals industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Xeris Biopharma Holdings that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives