- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Assessing Xeris Biopharma Holdings (XERS) Valuation Following Upgrades and Fresh Earnings Revisions

Reviewed by Simply Wall St

Most Popular Narrative: 16.8% Undervalued

The current valuation narrative points to Xeris Biopharma Holdings trading below its estimated fair value. This outlook suggests market expectations could align more closely with new guidance and profitability forecasts.

Continued investment in expanding the commercial footprint, enhancing patient support, and deepening engagement with healthcare professionals positions Xeris to capture a larger share of the growing at-home and patient-centric treatment market. This supports both revenue growth and improved SG&A leverage.

Want to discover the hidden drivers behind this bold valuation call? What are analysts counting on to justify a much higher target? The narrative hinges on a set of assumptions and projections that could surprise even the most seasoned biotech investors. Prepare for some eye-opening metrics fueling this fair value estimate.

Result: Fair Value of $9.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a few key products and rising expenses could quickly dampen optimism if market or pipeline expectations are not met.

Find out about the key risks to this Xeris Biopharma Holdings narrative.Another View: A Market-Based Comparison

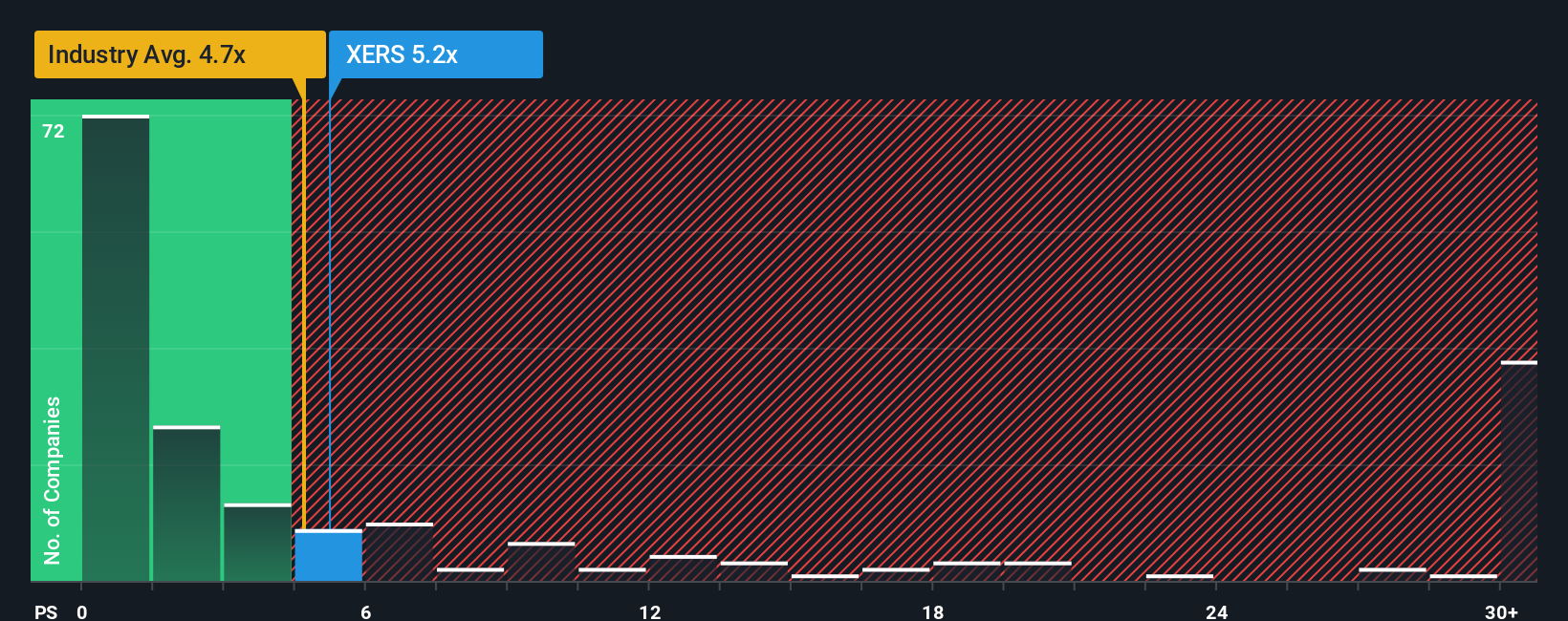

Taking a different angle, a look at Xeris Biopharma Holdings's value compared to the industry average raises eyebrows, as the stock actually appears more expensive using this approach. Could the strong growth narrative be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Xeris Biopharma Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Xeris Biopharma Holdings Narrative

If these perspectives do not match your own, or if you prefer to analyze information independently, you’re welcome to build your own in just a few minutes – Do it your way.

A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Use Simply Wall Street's tools to pinpoint stocks with unique advantages and hidden potential that others might overlook.

- Tap into early growth by tracking penny stocks with strong financials. Financially strong up-and-comers could become tomorrow’s market leaders.

- Secure steady income streams with dividend stocks with yields > 3%, featuring companies offering attractive yields and reliable dividend histories.

- Capitalize on the rapidly evolving healthcare sector thanks to healthcare AI stocks. This tool highlights innovative businesses merging medical expertise with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Good value with reasonable growth potential.

Market Insights

Community Narratives