- United States

- /

- Biotech

- /

- NasdaqGS:XBIT

XBiotech (NASDAQ:XBIT) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, XBiotech Inc. (NASDAQ:XBIT) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for XBiotech

What Is XBiotech's Debt?

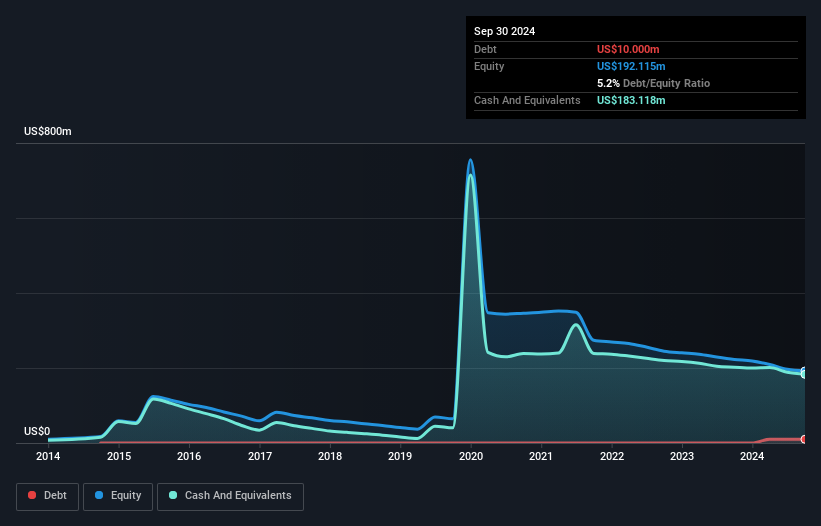

The image below, which you can click on for greater detail, shows that at September 2024 XBiotech had debt of US$10.0m, up from none in one year. But it also has US$183.1m in cash to offset that, meaning it has US$173.1m net cash.

How Healthy Is XBiotech's Balance Sheet?

We can see from the most recent balance sheet that XBiotech had liabilities of US$16.0m falling due within a year, and liabilities of US$1.74m due beyond that. On the other hand, it had cash of US$183.1m and US$871.0k worth of receivables due within a year. So it actually has US$166.3m more liquid assets than total liabilities.

This surplus liquidity suggests that XBiotech's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that XBiotech has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is XBiotech's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Since XBiotech doesn't have significant operating revenue, shareholders may be hoping it comes up with a great new product, before it runs out of money.

So How Risky Is XBiotech?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year XBiotech had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$29m of cash and made a loss of US$33m. While this does make the company a bit risky, it's important to remember it has net cash of US$173.1m. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with XBiotech (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XBIT

XBiotech

A biopharmaceutical company, discovers, develops, and commercializes true human monoclonal antibodies for treating various diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success