- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (NASDAQ:WVE) delivers shareholders enviable 72% CAGR over 3 years, surging 8.5% in the last week alone

It hasn't been the best quarter for Wave Life Sciences Ltd. (NASDAQ:WVE) shareholders, since the share price has fallen 16% in that time. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 412%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. Only time will tell if there is still too much optimism currently reflected in the share price.

Since it's been a strong week for Wave Life Sciences shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Wave Life Sciences

Because Wave Life Sciences made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Wave Life Sciences saw its revenue grow at 43% per year. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 72% per year in that time. It's always tempting to take profits after a share price gain like that, but high-growth companies like Wave Life Sciences can sometimes sustain strong growth for many years. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

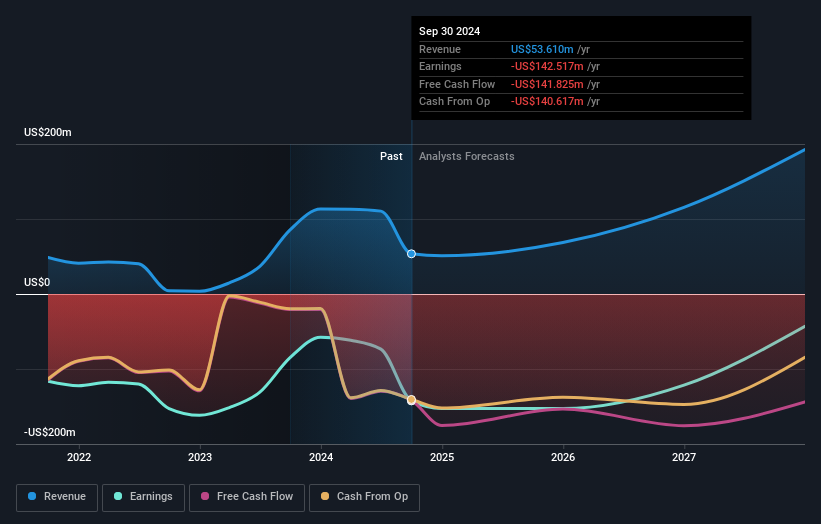

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Wave Life Sciences is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Wave Life Sciences will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that Wave Life Sciences has rewarded shareholders with a total shareholder return of 179% in the last twelve months. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Wave Life Sciences that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives