- United States

- /

- Software

- /

- NasdaqGS:INTU

US High Growth Tech Stocks to Watch in May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 2.7%, yet it has risen by 9.1% over the past year, with earnings forecasted to grow by 14% annually. In light of these conditions, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that can thrive despite short-term fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.62% | 66.56% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Gorilla Technology Group (NasdaqCM:GRRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gorilla Technology Group Inc. offers security, network, business intelligence, and IoT technology solutions in Taiwan and the United Kingdom with a market capitalization of approximately $334 million.

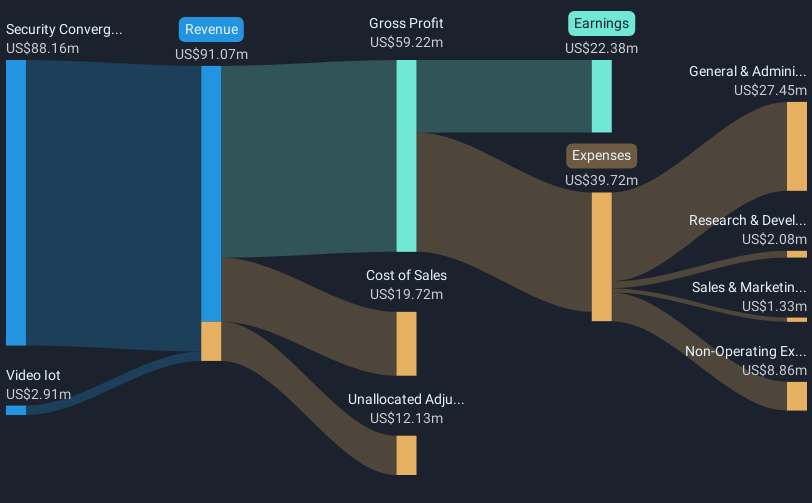

Operations: Gorilla Technology Group Inc. generates revenue primarily from its Security Convergence segment, contributing $101.70 million, alongside a smaller contribution of $2.78 million from Video IoT solutions.

Gorilla Technology Group, amidst a challenging financial landscape marked by a net loss of $64.79 million in 2024 from a previous net income of $13.5 million, remains poised for potential growth with projected revenue increases at an annual rate of 27.5%. This anticipated growth outpaces the broader US market's average of 8.6%, signaling robust sector-specific momentum despite recent earnings volatility. The firm's substantial investment in R&D, aligning with industry trends towards enhanced digital solutions, underscores its commitment to innovation—crucial for staying competitive in the rapidly evolving tech landscape.

- Click here to discover the nuances of Gorilla Technology Group with our detailed analytical health report.

Learn about Gorilla Technology Group's historical performance.

Verastem (NasdaqCM:VSTM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Verastem, Inc. is a development-stage biopharmaceutical company dedicated to the development and commercialization of cancer treatment drugs in the United States, with a market capitalization of $456.63 million.

Operations: Verastem, Inc. is engaged in the development and commercialization of cancer treatment drugs in the United States. The company operates as a development-stage biopharmaceutical entity with its primary focus on innovative oncology therapies.

Verastem's trajectory in the high-growth tech sector is underscored by its aggressive R&D investments and rapid revenue growth, forecasted at 51.4% annually, significantly outpacing the broader market's 8.6%. Despite current unprofitability, the firm is expected to pivot to profitability within three years, with earnings potentially increasing by 61.54% per year. Recent strategic alliances and FDA approvals highlight its innovative approach in oncology, positioning it for potential breakthroughs in treatment landscapes. These developments suggest a robust framework for future growth amidst operational challenges like substantial shareholder dilution observed over the past year.

- Get an in-depth perspective on Verastem's performance by reading our health report here.

Gain insights into Verastem's historical performance by reviewing our past performance report.

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. is a company that offers financial management, compliance, and marketing products and services in the United States with a market capitalization of approximately $200.88 billion.

Operations: Intuit generates revenue through its diverse segments, including Pro-Tax ($618 million), Consumer ($4.85 billion), Credit Karma ($2.10 billion), and Global Business Solutions ($10.62 billion). The company focuses on financial management and related services in the U.S., leveraging these segments to drive its business operations.

Intuit's recent performance highlights its adaptability and growth in the tech sector, with a 15% increase in annual revenue projections to $18.76 billion and a notable 35% rise in operating income expectations. The company's commitment to innovation is evident from its R&D spending, which strategically aligns with its earnings growth forecast of approximately 15.7% per year, outpacing the broader US market average of 14.4%. Furthermore, Intuit has enhanced its customer engagement through initiatives like Tap to Pay on iPhone for QuickBooks users, simplifying transactions and boosting financial management efficiency for small businesses—a move that not only caters to current consumer payment preferences but also positions Intuit favorably within the evolving fintech landscape.

- Delve into the full analysis health report here for a deeper understanding of Intuit.

Review our historical performance report to gain insights into Intuit's's past performance.

Make It Happen

- Discover the full array of 234 US High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives