- United States

- /

- Pharma

- /

- OTCPK:ELTP

February 2025 Penny Stocks To Keep An Eye On

Reviewed by Simply Wall St

As February 2025 unfolds, the U.S. stock market has shown signs of resilience with the S&P 500 and Nasdaq Composite inching higher after a four-day losing streak, despite ongoing concerns about the economic outlook. In this context, penny stocks—often representing smaller or newer companies—continue to capture investor interest due to their affordability and potential for growth. While traditionally viewed with caution, these stocks can offer unique opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| TETRA Technologies (NYSE:TTI) | $3.93 | $540.42M | ★★★★☆☆ |

| Safe Bulkers (NYSE:SB) | $3.89 | $410.67M | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.8206 | $6.54M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.41 | $41.82M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.43 | $47.52M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.16 | $154.05M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.35 | $23.41M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8354 | $74.1M | ★★★★★☆ |

Click here to see the full list of 732 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Vanda Pharmaceuticals (NasdaqGM:VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing therapies for high unmet medical needs globally, with a market cap of approximately $260.09 million.

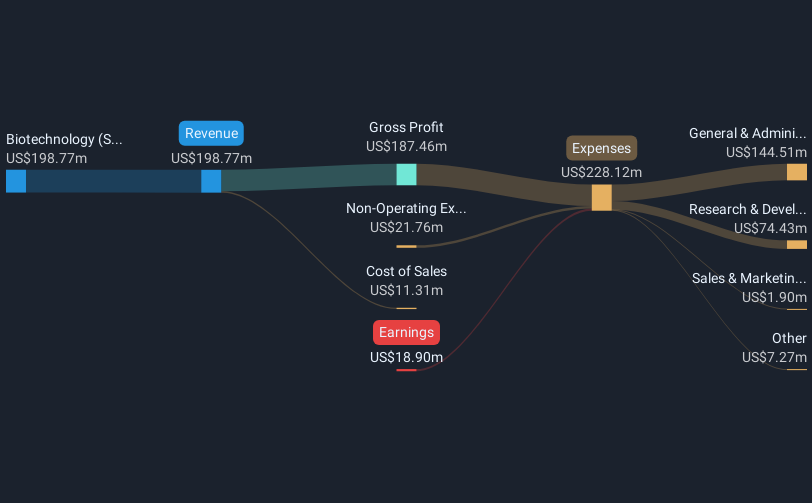

Operations: The company generates revenue primarily from its biotechnology startup segment, totaling $198.77 million.

Market Cap: $260.09M

Vanda Pharmaceuticals, with a market cap of US$260.09 million, is trading significantly below its estimated fair value and maintains a debt-free balance sheet with short-term assets exceeding liabilities. Despite being unprofitable and experiencing increased losses over five years, it has not diluted shareholders recently. The company reported Q4 2024 revenue of US$53.19 million but faced challenges such as FDA rejection of its tradipitant NDA for gastroparesis treatment, which Vanda disputes legally. Notably, Vanda's innovative ASO therapeutic for Charcot-Marie-Tooth disease highlights potential advancements in precision medicine for rare diseases.

- Click here to discover the nuances of Vanda Pharmaceuticals with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Vanda Pharmaceuticals' future.

ATRenew (NYSE:RERE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $623.33 million.

Operations: The company's revenue is derived from its retail electronics segment, generating CN¥15.35 billion.

Market Cap: $623.33M

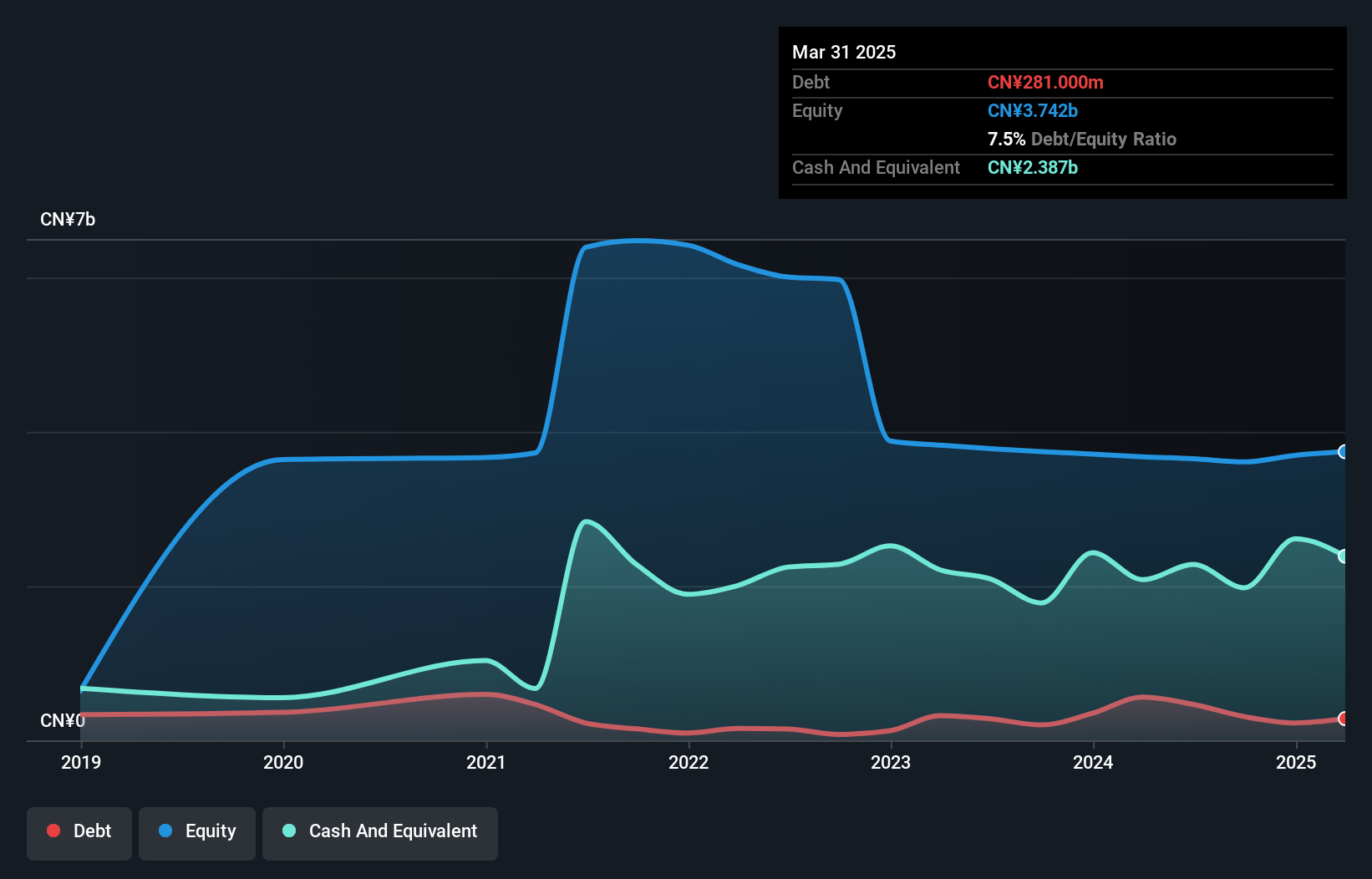

ATRenew, with a market cap of US$623.33 million, is unprofitable but has reduced losses by 21.8% annually over the past five years. Its management and board are experienced, boasting tenures of 5.7 and 3.7 years respectively. The company’s short-term assets of CN¥4 billion exceed both its short-term liabilities (CN¥1.2 billion) and long-term liabilities (CN¥122.5 million), indicating strong liquidity management despite insufficient data on cash runway sustainability under varying conditions. Debt reduction from 12.3% to 8.5% in five years further strengthens its financial position, while earnings growth is forecasted at a substantial rate of 226%.

- Unlock comprehensive insights into our analysis of ATRenew stock in this financial health report.

- Evaluate ATRenew's prospects by accessing our earnings growth report.

Elite Pharmaceuticals (OTCPK:ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release and generic pharmaceuticals with a market cap of $512.77 million.

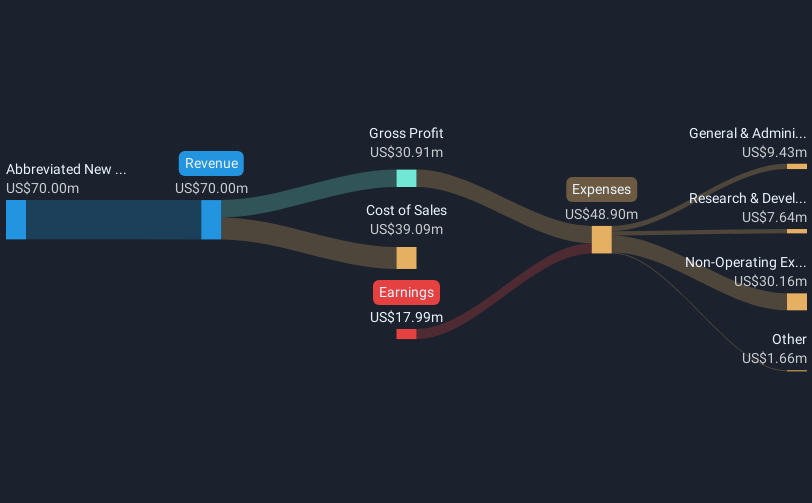

Operations: The company's revenue is primarily generated from Abbreviated New Drug Applications (ANDA), amounting to $70 million.

Market Cap: $512.77M

Elite Pharmaceuticals, with a market cap of US$512.77 million, is navigating financial challenges despite having short-term assets of US$48 million exceeding both short-term (US$14.7 million) and long-term liabilities (US$39.6 million). The company remains unprofitable but has managed to reduce its losses by 14.5% annually over five years and maintains a cash runway exceeding three years due to positive free cash flow growth. Recent earnings showed revenue of US$52.05 million for the nine months ending December 31, 2024, though net losses reached US$21.31 million compared to a previous net income of US$16.78 million year-over-year.

- Click here and access our complete financial health analysis report to understand the dynamics of Elite Pharmaceuticals.

- Review our historical performance report to gain insights into Elite Pharmaceuticals' track record.

Summing It All Up

- Access the full spectrum of 732 US Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ELTP

Elite Pharmaceuticals

A specialty pharmaceutical company, engages in the development, manufacture, and sale of oral, controlled-release products, and generic pharmaceuticals.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives