- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Will Veracyte (VCYT) Leverage PAM50 Data to Strengthen Its Position in Precision Oncology?

Reviewed by Sasha Jovanovic

- At the 2025 ASTRO annual meeting in San Francisco, Veracyte presented new prospective, randomized clinical trial data showing that its PAM50 molecular signature can help identify which patients with recurrent prostate cancer benefit most from adding hormone therapy with apalutamide to salvage radiation therapy, utilizing the Decipher GRID research platform.

- These findings highlight the potential for molecular diagnostics to tailor prostate cancer treatment, supporting the clinical value and distinctiveness of Veracyte’s genomic tools in advancing personalized patient care.

- We'll explore how this new clinical evidence for PAM50 and the Decipher GRID platform could influence Veracyte's investment narrative and future growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Veracyte Investment Narrative Recap

For investors considering Veracyte, the core belief centers on the sustained adoption of the company’s Decipher and Afirma genomic tests, with growth driven by clinical evidence, payer coverage, and expanding guideline inclusions. While the latest BALANCE trial data on the PAM50 molecular signature strengthens Veracyte’s clinical credentials, it does not materially change the near-term catalyst: broadening Decipher’s clinical adoption and reimbursement. The largest short-term risk remains revenue concentration in these core products, especially given evolving payer and competitive dynamics.

Among recent announcements, the unveiling of new data at the 2025 ASTRO meeting is particularly relevant. By further validating the Decipher GRID platform and PAM50’s predictive value, this update underscores Veracyte’s differentiation in prostate cancer diagnostics, a critical factor as the company seeks broader acceptance with payers and physicians, and to mitigate the risks from increasing competition and potential reimbursement changes.

However, investors should be aware that, in contrast to the momentum highlighted, heavy reliance on a handful of core products continues to carry...

Read the full narrative on Veracyte (it's free!)

Veracyte's narrative projects $629.2 million revenue and $121.9 million earnings by 2028. This requires 9.5% yearly revenue growth and a $95.6 million earnings increase from $26.3 million today.

Uncover how Veracyte's forecasts yield a $39.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

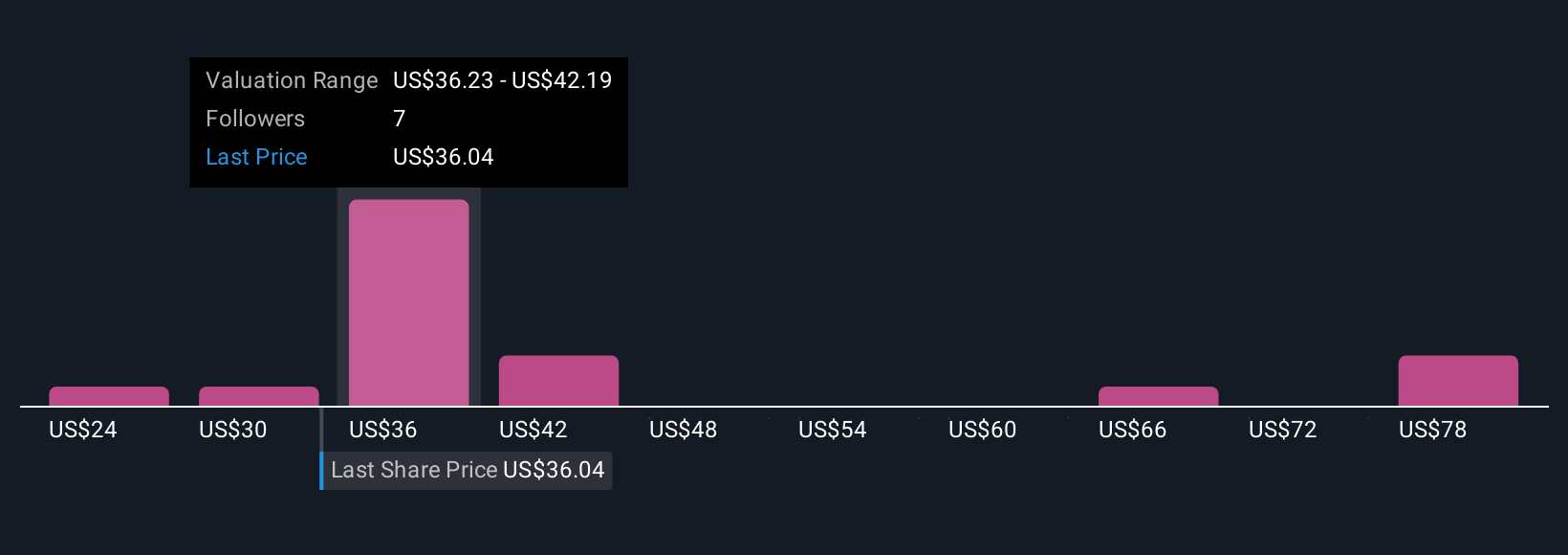

Six individual fair value analyses from the Simply Wall St Community range widely, from US$24.31 up to US$83.92. As you consider these perspectives, keep in mind that reimbursement challenges remain a key focus impacting the company's growth story.

Explore 6 other fair value estimates on Veracyte - why the stock might be worth 32% less than the current price!

Build Your Own Veracyte Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veracyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veracyte's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives