- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte’s Strong Revenue Growth and Product Pipeline Could Be a Game Changer for VCYT

Reviewed by Sasha Jovanovic

- In the past quarter, Artisan Partners highlighted Veracyte, Inc., a molecular diagnostics company with three approved cancer tests, for its 14% year-over-year revenue growth driven by strong Decipher and Afirma sales, margin expansion, and positive cash flows.

- An important aspect is Veracyte's progress toward new product launches, including a Minimal Residual Disease platform slated for 2026, which has drawn increased institutional investor attention to the business.

- We'll explore how the spotlight on Veracyte's solid revenue growth and cancer diagnostics innovation shapes the company's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Veracyte Investment Narrative Recap

To be a Veracyte shareholder today, you need to believe in the company's ability to grow beyond its core Decipher and Afirma tests while executing on new cancer diagnostics like the Minimal Residual Disease (MRD) platform. While recent news of strong revenue growth and institutional interest draws attention to these positive trends, it does not materially change the underlying short-term catalyst: the expansion and reimbursement of existing tests remain the key near-term driver, while revenue concentration risk is still the most immediate threat.

The upcoming Q3 2025 earnings announcement on November 4 is the most relevant event, as it will offer fresh insight into revenue momentum and profitability. In this context, continued outperformance of core product lines and updates on MRD platform progress are likely to remain front and center for investors tracking near-term execution against growth targets.

However, with reimbursement risks still looming, it’s crucial investors remain mindful that ...

Read the full narrative on Veracyte (it's free!)

Veracyte's narrative projects $629.2 million in revenue and $121.9 million in earnings by 2028. This requires 9.5% yearly revenue growth and a $95.6 million earnings increase from $26.3 million currently.

Uncover how Veracyte's forecasts yield a $39.75 fair value, a 14% upside to its current price.

Exploring Other Perspectives

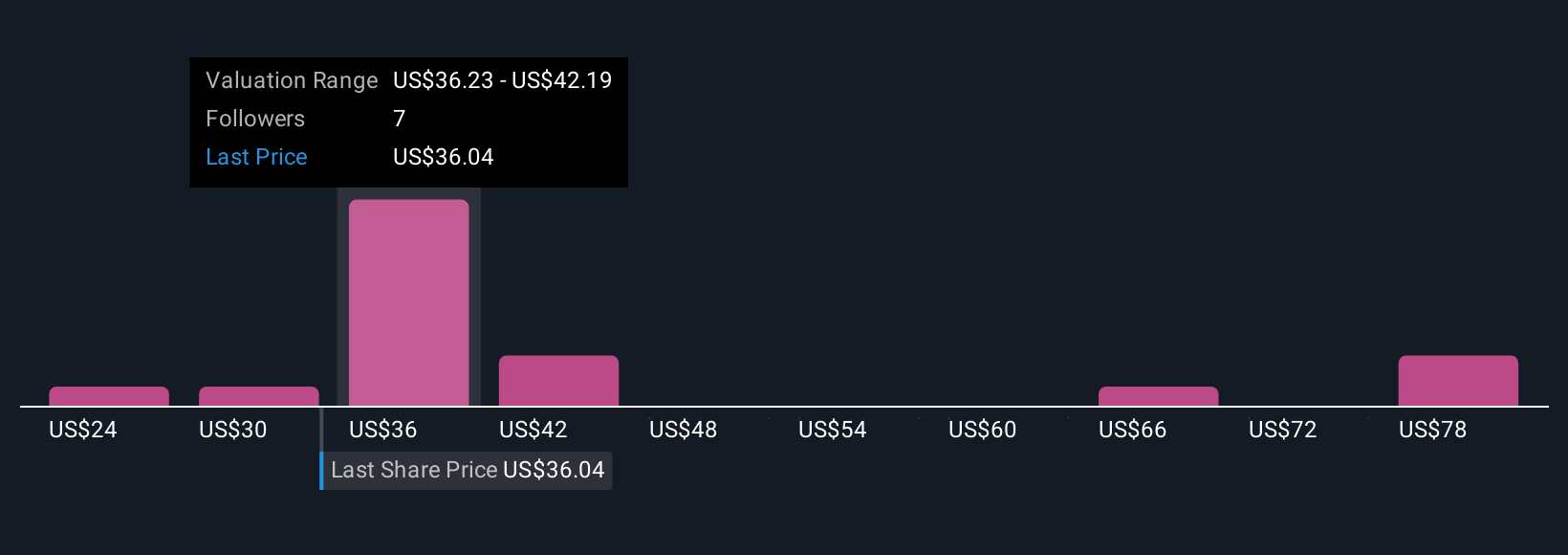

Six Simply Wall St Community members estimate Veracyte’s fair value from US$24.31 to US$83.39, showing wide variety in individual forecasts. These diverse views complement ongoing concerns about revenue concentration and remind you to compare alternative perspectives on performance drivers before making conclusions.

Explore 6 other fair value estimates on Veracyte - why the stock might be worth 30% less than the current price!

Build Your Own Veracyte Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veracyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veracyte's overall financial health at a glance.

No Opportunity In Veracyte?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives