- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Veracyte (VCYT): Assessing Valuation After BALANCE Trial Data and Analyst Upgrades Boost Investor Confidence

Reviewed by Kshitija Bhandaru

Veracyte (VCYT) shares have been moving after new data from the BALANCE trial was showcased at ASTRO 2025. This presentation highlights the impact of their PAM50 molecular signature in guiding hormone therapy for prostate cancer patients.

See our latest analysis for Veracyte.

It’s been an eventful stretch for Veracyte, as excitement from the BALANCE trial results and a recent analyst upgrade have helped fuel a 12.9% share price return over the past month. Despite some ups and downs earlier in the year, the latest momentum reflects both renewed optimism around clinical adoption and sustained confidence from investors. This has contributed to a 2.3% total shareholder return over the past year and an impressive 123% cumulative total return over three years.

If the pace of innovation in diagnostics appeals to you, now’s the perfect time to see which other healthcare stocks are making big moves with our See the full list for free.

But with a recent surge in the share price and excitement around clinical data, the question is whether Veracyte is now trading at a bargain or if the market has already accounted for its next chapter of growth.

Most Popular Narrative: 12.5% Undervalued

Veracyte finished the day at $34.80, but the most followed narrative puts its fair value higher based on strong projected growth and profitability improvements. This sets up a debate around whether the current price truly reflects the company’s long-term market position.

Pipeline momentum, with five major product launches and a pivotal clinical study (OPTIMA) completing in the next 18 months, positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets (e.g., MRD in bladder cancer, Prosigna for breast cancer), and significantly expand addressable markets. This supports long-term topline acceleration.

Want to explore the real catalysts powering this bullish outlook? One key assumption could be a leap in profit margins, but what else drives the narrative? Find out which projections, if achieved, could put Veracyte on a growth runway few expect. Dive in to uncover the surprising growth targets and see why this valuation stands out.

Result: Fair Value of $39.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on just a few core products and uncertainty around payer coverage could derail Veracyte’s projected growth story if challenges emerge.

Find out about the key risks to this Veracyte narrative.

Another View: Sizing Up With Ratios

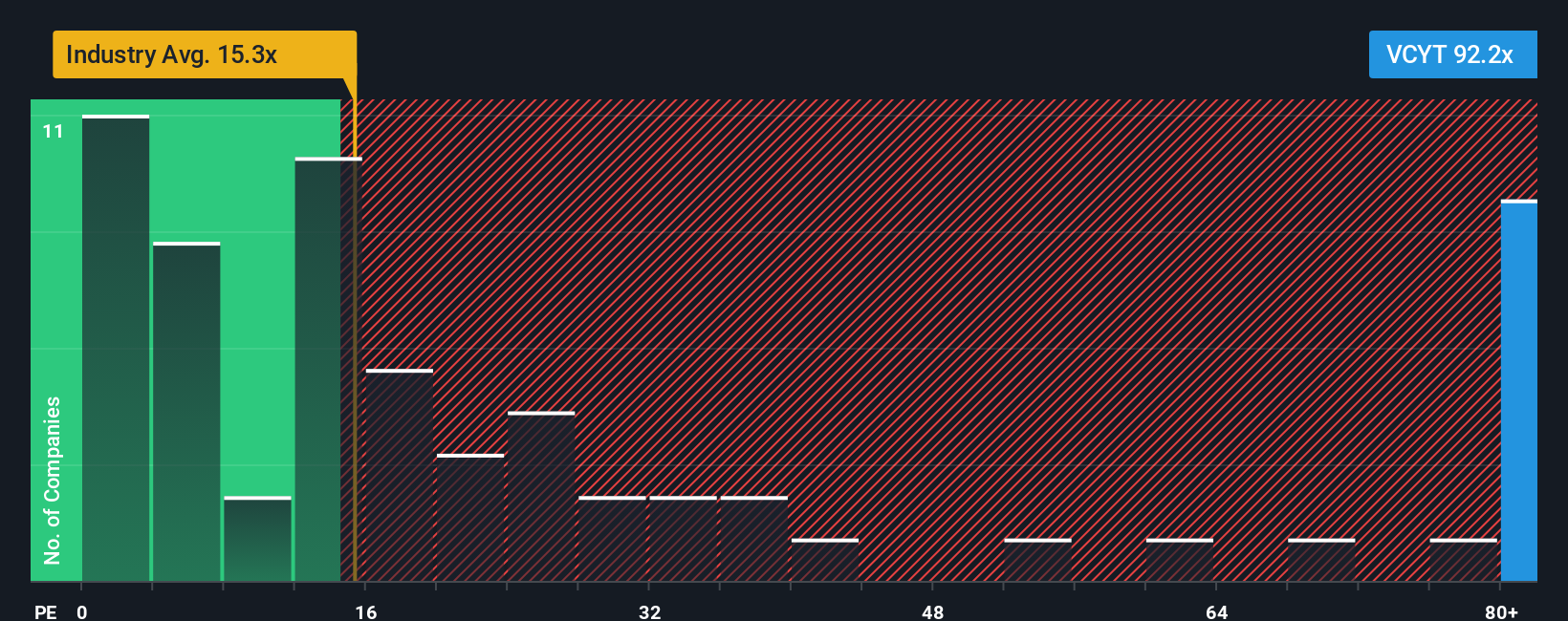

Looking through the lens of price-to-earnings, Veracyte trades at 104 times earnings, well above both the biotech industry average of 17x and its peers at 11.4x. Even the fair ratio for Veracyte sits at 25.3x, highlighting how much optimism is already priced in. Could this premium signal more potential risk than reward, or has the market simply recognized something others have not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veracyte Narrative

If you have your own perspective or want to dig deeper into the numbers, it’s easy to create and analyze your own Veracyte narrative in just a few minutes with Do it your way.

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their search to one company or strategy. Supercharge your watchlist today by checking out these powerful opportunities making headlines right now.

- Capture growth from a new generation of intelligent automation by targeting these 24 AI penny stocks, which are leading the race in artificial intelligence innovation and enterprise adoption.

- Boost your portfolio’s income potential by building positions in these 19 dividend stocks with yields > 3%, which offer steady returns and reliable yields above 3%.

- Capitalize on mispriced assets by analyzing these 898 undervalued stocks based on cash flows, where the market may have overlooked genuine value based on strong cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives