- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

United Therapeutics (UTHR) Is Up 30.9% After Positive Phase 3 Tyvaso Data in IPF Patients

Reviewed by Simply Wall St

- On September 2, 2025, United Therapeutics announced that its TETON-2 Phase 3 study showed that nebulized Tyvaso significantly improved lung function in patients with idiopathic pulmonary fibrosis (IPF) compared to placebo over 52 weeks.

- This outcome is especially important because positive effects were observed even among patients already receiving standard anti-fibrotic therapies, a milestone not reached in previous phase 3 IPF trials.

- Now, we'll explore how positive TETON-2 results for Tyvaso in IPF could influence United Therapeutics' long-term growth prospects and risk profile.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

United Therapeutics Investment Narrative Recap

To be a shareholder in United Therapeutics, you need to believe in the company’s ability to extend its pulmonary franchise beyond pulmonary arterial hypertension and deliver innovation-driven growth. The TETON-2 Phase 3 success for Tyvaso in idiopathic pulmonary fibrosis (IPF) just addressed the most important short-term catalyst by unlocking a new indication, but competitive risks, especially from emerging therapies and generics, remain a central challenge for the business.

Among recent announcements, the July 2025 launch of a US$1 billion share repurchase program stands out, as it reinforces management’s confidence in continued cash generation and offers support for earnings per share as United Therapeutics pursues new clinical and commercial milestones like TETON-2. Yet, market optimism must always be balanced by awareness of material threats from shifting treatment paradigms and ongoing legal disputes.

However, investors should know that even as new clinical wins emerge, the growing risk of competition from innovative alternatives and generics...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics' narrative projects $3.7 billion in revenue and $1.5 billion in earnings by 2028. This requires 6.0% yearly revenue growth and a $300 million increase in earnings from the current $1.2 billion.

Uncover how United Therapeutics' forecasts yield a $399.90 fair value, in line with its current price.

Exploring Other Perspectives

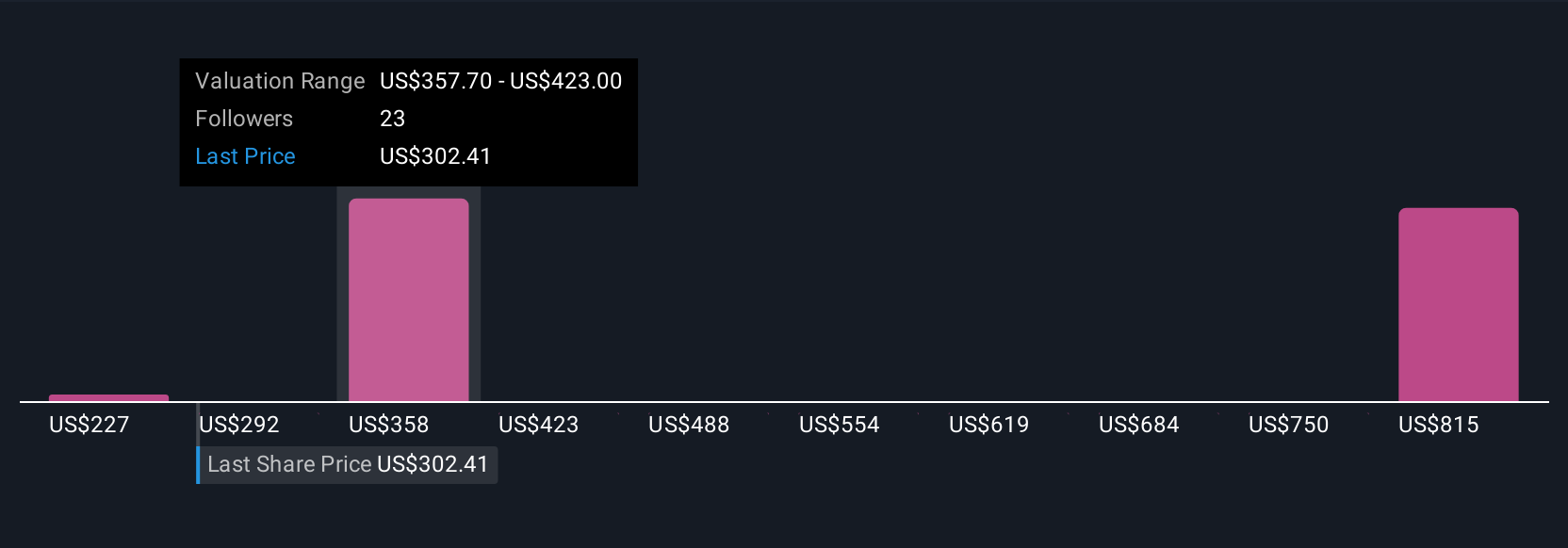

Simply Wall St Community members provided 5 fair value estimates for United Therapeutics, ranging from US$227 to US$1,072 per share. As you consider these widely differing perspectives, remember that recent positive TETON-2 data may boost near-term optimism but competition and changes in treatment standards continue to shape the company’s future path.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

No Opportunity In United Therapeutics?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives