- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

Should Patent Ruling in Delaware Prompt a Rethink for 10x Genomics (TXG) Investors?

Reviewed by Sasha Jovanovic

- In recent news, the District Court for the District of Delaware ruled that claims in the 11,634,752 patent, previously held by Scale Biosciences and now part of 10x Genomics, were invalid due to lack of written description and enablement. This legal decision may have implications for 10x Genomics’ intellectual property portfolio and competitive landscape in the single cell and spatial analysis market.

- This outcome signals a potential shift for 10x Genomics, as questions around patent protection could influence future innovation and partnerships.

- We'll consider how the loss of patent protection could alter 10x Genomics' competitive positioning and long-term business outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

10x Genomics Investment Narrative Recap

To be a shareholder in 10x Genomics, you need to believe in the company's ability to deliver innovation in single cell and spatial analysis, driving adoption of its platforms despite sector headwinds. The recent invalidation of the Scale Biosciences patent does not appear to materially impact the most immediate catalyst, broadening applications and platform launches, or the clearest short-term risk: ongoing funding constraints in core research markets and resulting pricing pressure.

10x Genomics' announcement of upcoming third-quarter 2025 results is especially relevant, as investors will be watching for any signs that legal or funding challenges are affecting growth and profitability. While product launches and collaborations remain strong catalysts, the update offers a timely checkpoint for evaluating financial stability given current risks.

However, the patent decision highlights a risk to intellectual property strength that investors should understand...

Read the full narrative on 10x Genomics (it's free!)

10x Genomics' outlook anticipates $688.4 million in revenue and $97.8 million in earnings by 2028. This scenario relies on an annual revenue growth rate of 2.2% and a $182.4 million increase in earnings from the current level of -$84.6 million.

Uncover how 10x Genomics' forecasts yield a $15.08 fair value, a 29% upside to its current price.

Exploring Other Perspectives

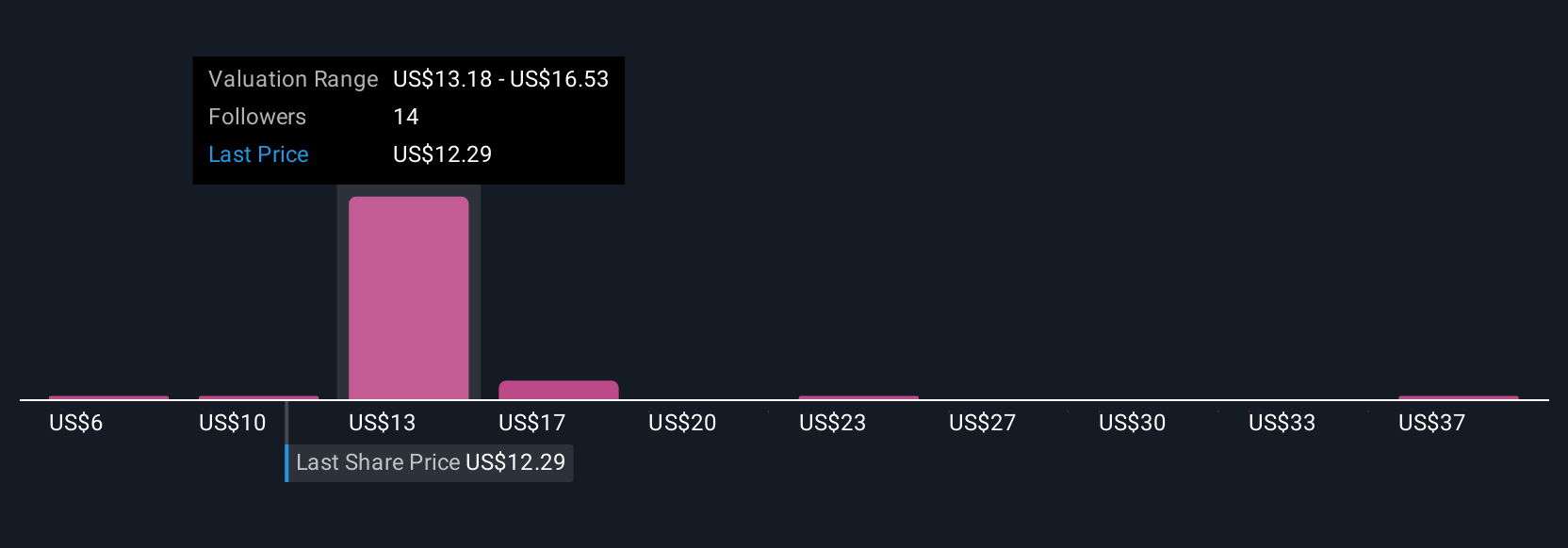

Simply Wall St Community members forecast fair values ranging from US$6.47 to US$40 across 7 distinct analyses. Shifts in patent protection could further influence the wide spectrum of opinions on 10x Genomics’ future performance, so consider multiple viewpoints.

Explore 7 other fair value estimates on 10x Genomics - why the stock might be worth over 3x more than the current price!

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

No Opportunity In 10x Genomics?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives