- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG): Is the Market Overlooking the Company's True Value?

Reviewed by Kshitija Bhandaru

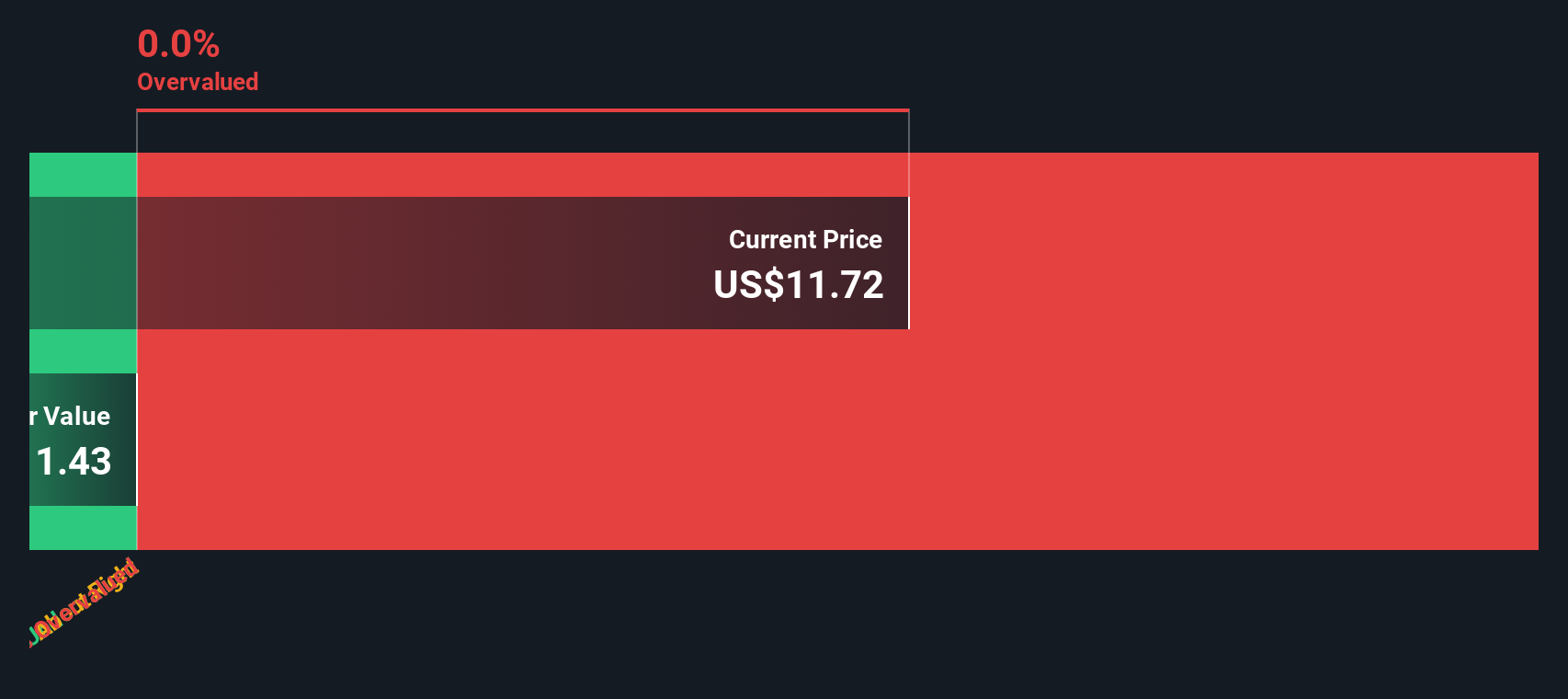

Most Popular Narrative: 17.2% Undervalued

According to the most widely followed narrative, 10x Genomics appears significantly undervalued, with fair value estimated at a solid premium over the current share price. Analyst consensus points to long-term upside based on future growth and margin improvement.

“Recent and upcoming product launches, including Flex v2 (targeting higher throughput, lower costs, and AI integration), Visium HD extensions, and Xenium RNA plus protein, are expanding the range of applications and reinforcing 10x's leadership in advanced genomics tools. These launches are expected to drive both top-line growth and sustain premium pricing over time.”

What’s fueling this provocative valuation gap? The narrative leans on surprisingly ambitious improvements in future profitability and revenues, backed by assumptions you won’t want to miss. Want to understand the core growth drivers and the specific numbers behind this fair value? This narrative’s blueprint could spark major discussion among investors looking for the next breakthrough play.

Result: Fair Value of $15.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic uncertainty and continued pressure on academic funding could challenge the company’s growth prospects and undermine this undervalued narrative.

Find out about the key risks to this 10x Genomics narrative.Another View: What Does Our DCF Model Say?

The SWS DCF model uses a different approach but reaches a similar conclusion, reinforcing the idea that 10x Genomics may be undervalued relative to its future cash flows. Could DCF assumptions reveal hidden upside, or are both methods missing risks just ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out 10x Genomics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own 10x Genomics Narrative

If you see things differently or want to draw your own conclusions from the data, it takes just a few minutes to put together your own perspective. Do it your way.

A great starting point for your 10x Genomics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your horizon beyond 10x Genomics and uncover smart investment angles you might have missed. Here are three ways to get ahead of the crowd right now:

- Tap unique opportunities among small-cap companies with big potential, and secure your spot at the forefront using penny stocks with strong financials.

- Capitalize on the booming demand for real cash returns by accessing stocks offering attractive yields through dividend stocks with yields > 3%.

- Find undervalued gems poised for a comeback, and get one step ahead of the market with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives