- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics, Inc. (NASDAQ:TXG) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

10x Genomics, Inc. (NASDAQ:TXG) shares have had a horrible month, losing 28% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 75% share price decline.

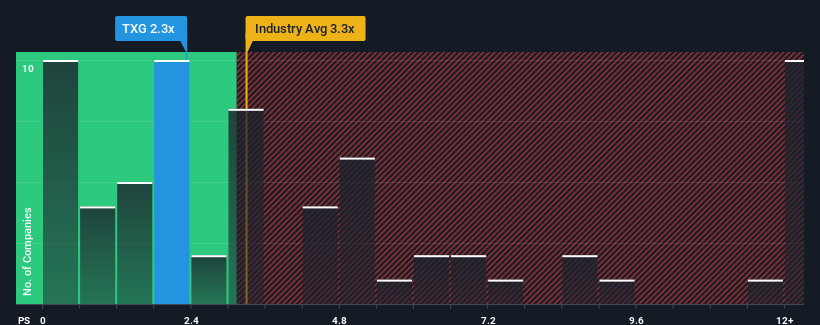

After such a large drop in price, 10x Genomics may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.3x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.3x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for 10x Genomics

What Does 10x Genomics' P/S Mean For Shareholders?

10x Genomics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on 10x Genomics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For 10x Genomics?

In order to justify its P/S ratio, 10x Genomics would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 6.2% per year over the next three years. With the industry predicted to deliver 6.9% growth each year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that 10x Genomics' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does 10x Genomics' P/S Mean For Investors?

10x Genomics' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for 10x Genomics remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It is also worth noting that we have found 1 warning sign for 10x Genomics that you need to take into consideration.

If these risks are making you reconsider your opinion on 10x Genomics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives