- United States

- /

- Biotech

- /

- NasdaqCM:TLSA

Discover October 2024's Promising US Penny Stocks

Reviewed by Simply Wall St

As the U.S. markets experience mixed results with the S&P 500 and Dow Jones snapping their six-week winning streaks, investors are keenly observing economic data and earnings reports for further insights. In this context, penny stocks—often representing smaller or newer companies—remain a compelling area of interest due to their potential for growth and affordability. Despite being considered a niche investment category, these stocks can offer significant opportunities when they possess strong financial health, making them worthy of consideration in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78982 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.12 | $512.97M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $148.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.59 | $52.47M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.06M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.68 | $2.78M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tiziana Life Sciences (NasdaqCM:TLSA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tiziana Life Sciences Ltd is a biotechnology company that focuses on discovering and developing molecules for treating human diseases in oncology and immunology in the United States, with a market cap of $101.47 million.

Operations: Tiziana Life Sciences Ltd does not report any revenue segments.

Market Cap: $101.47M

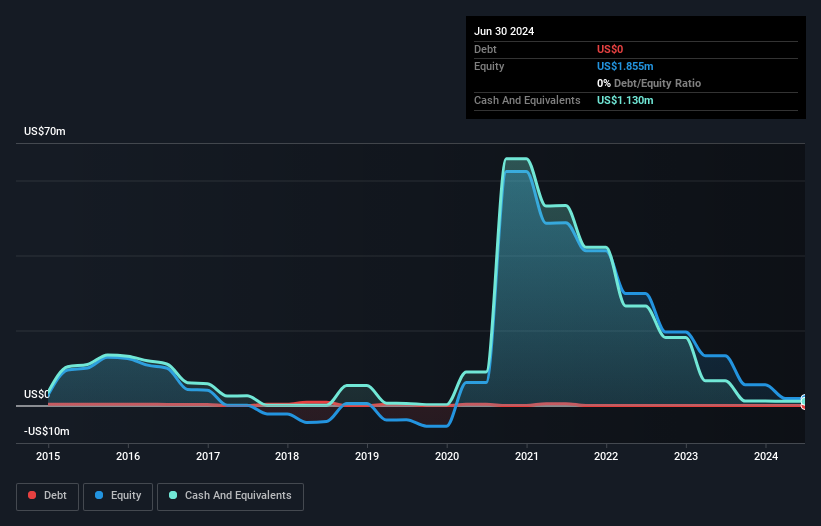

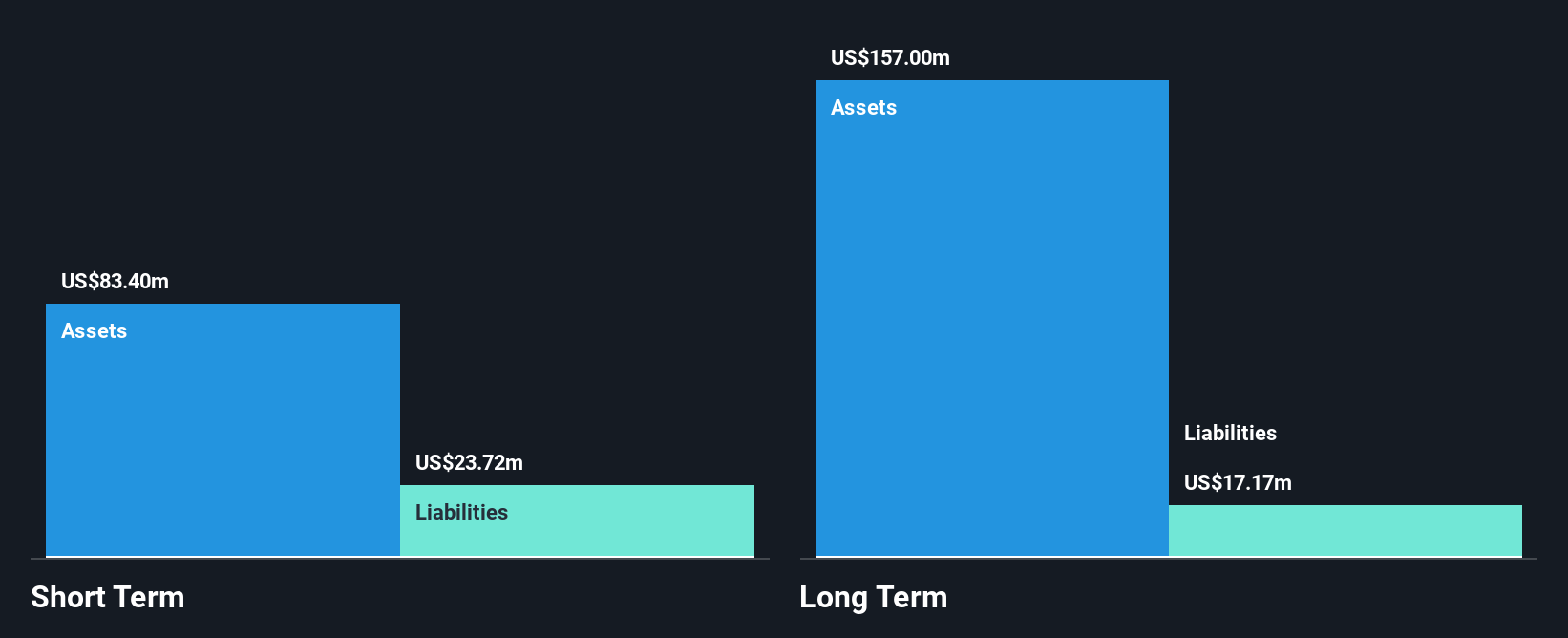

Tiziana Life Sciences, with a market cap of US$101.47 million, operates as a pre-revenue biotech entity focused on oncology and immunology. Despite its unprofitability and volatile share price, the company has maintained shareholder value without significant dilution over the past year. Recent leadership changes include appointing Ivor Elrifi as CEO to strengthen strategic direction. Tiziana has regained Nasdaq compliance for its listing requirements but faces short-term financial challenges with assets not fully covering liabilities and only a brief cash runway available. The company recently withdrew a US$50 million equity offering but remains debt-free, potentially mitigating some financial risks.

- Jump into the full analysis health report here for a deeper understanding of Tiziana Life Sciences.

- Review our historical performance report to gain insights into Tiziana Life Sciences' track record.

BM Technologies (NYSEAM:BMTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BM Technologies, Inc. is a financial technology company that facilitates deposits and banking services between customers and partner banks in the United States, with a market cap of approximately $57.30 million.

Operations: The company's revenue is primarily derived from providing services to financial companies, amounting to $57.96 million.

Market Cap: $57.3M

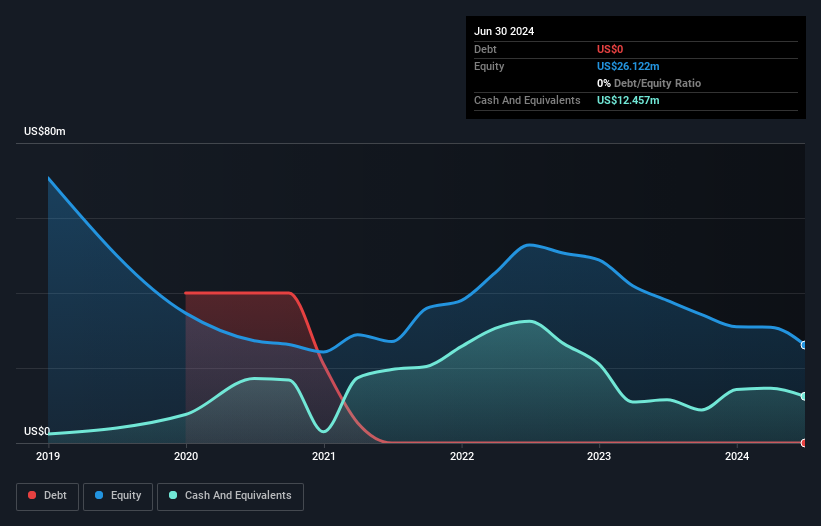

BM Technologies, Inc., with a market cap of US$57.30 million, is navigating the penny stock landscape with notable developments. Despite being unprofitable and experiencing increased losses over the past five years, BMTX maintains a sufficient cash runway exceeding three years and remains debt-free. Recent strategic moves include launching BMTX Identity Verification™ to address enrollment fraud in higher education and introducing a rewards engine for its BankMobile Vibe Checking Account aimed at enhancing customer loyalty. Additionally, First Carolina Bank's agreement to acquire BM Technologies for US$70 million signals significant changes ahead as regulatory approvals are awaited.

- Dive into the specifics of BM Technologies here with our thorough balance sheet health report.

- Understand BM Technologies' earnings outlook by examining our growth report.

Innovid (NYSE:CTV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Innovid Corp. operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $288.42 million.

Operations: The company generates revenue from its Advertising and Creative Services segment, totaling $149.54 million.

Market Cap: $288.42M

Innovid Corp., with a market cap of US$288.42 million, is navigating the penny stock landscape by leveraging its ad serving and creative services platform. Despite being unprofitable, Innovid has reduced its losses and maintains a cash runway exceeding three years due to positive free cash flow. Recent collaborations with Nielsen aim to enhance cross-media ad measurement, potentially increasing efficiency and coverage for clients. The launch of Harmony Frequency further strengthens its position in digital advertising by optimizing frequency management across media portfolios. However, shareholders experienced dilution over the past year as shares outstanding grew by 5.1%.

- Get an in-depth perspective on Innovid's performance by reading our balance sheet health report here.

- Explore Innovid's analyst forecasts in our growth report.

Seize The Opportunity

- Gain an insight into the universe of 760 US Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiziana Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TLSA

Tiziana Life Sciences

A biotechnology company, focuses on the discovery and development of molecules to treat human diseases in oncology and immunology in the United States.

Excellent balance sheet moderate.