- United States

- /

- Biotech

- /

- NasdaqCM:SURF

The Surface Oncology (NASDAQ:SURF) Share Price Is Down 81% So Some Shareholders Are Rather Upset

It's not a secret that every investor will make bad investments, from time to time. But serious investors should think long and hard about avoiding extreme losses. So spare a thought for the long term shareholders of Surface Oncology, Inc. (NASDAQ:SURF); the share price is down a whopping 81% in the last twelve months. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Because Surface Oncology hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 44% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Surface Oncology

Given that Surface Oncology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Surface Oncology saw its revenue fall by 51%. That looks like a train-wreck result to investors far and wide. If you need more proof of that, check the share price. (Hint: it tanked 81%). This kind of performance makes us wary, and usually gives us reason to forget about a stock. A healthy aversion to bagholding (holding potentially worthless stocks) sees many shareholders avoid buying shares like this, rightly or wrongly.

If you are thinking of buying or selling Surface Oncology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

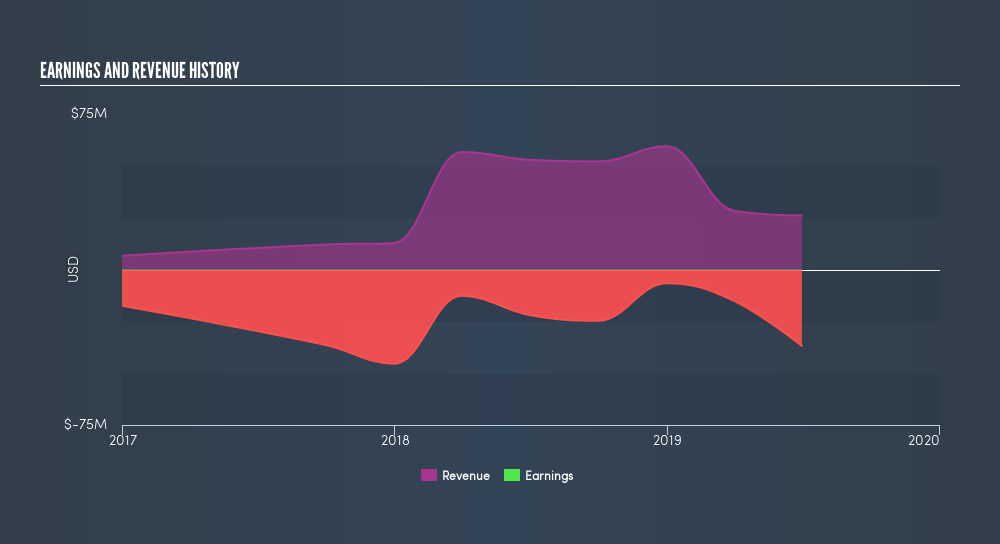

While Surface Oncology shareholders are down 81% for the year, the market itself is up 0.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 44% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Surface Oncology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:SURF

Surface Oncology

Surface Oncology, Inc., a clinical-stage immuno-oncology company, engages in the development of cancer therapies in the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives