- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

Top US Growth Companies With Insider Ownership In January 2025

Reviewed by Simply Wall St

As 2025 begins, U.S. stock markets are showing signs of recovery following a challenging end to 2024, with major indices like the Dow Jones Industrial Average and S&P 500 poised for gains. In this context, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the business best and may offer resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 79.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Travelzoo (NasdaqGS:TZOO) | 38% | 34.7% |

| Capital Bancorp (NasdaqGS:CBNK) | 31.1% | 30.1% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 19.7% | 60.1% |

Let's explore several standout options from the results in the screener.

AirSculpt Technologies (NasdaqGM:AIRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AirSculpt Technologies, Inc. operates as a holding company for EBS Intermediate Parent LLC, offering body contouring procedure services in the United States, with a market cap of $300.41 million.

Operations: The company generates revenue of $188.78 million from its direct medical procedure services segment.

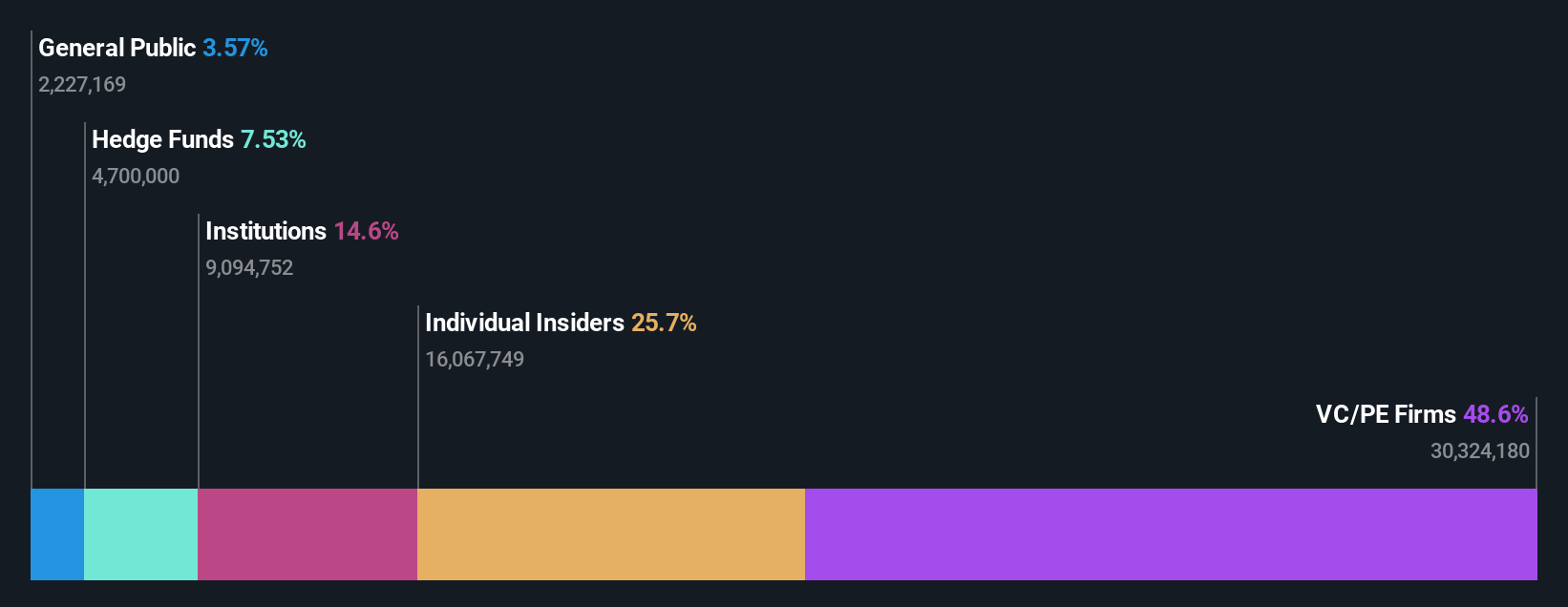

Insider Ownership: 27%

AirSculpt Technologies, with high insider ownership, is forecast to achieve profitability in the next three years, outpacing average market growth. Despite recent volatility and significant insider selling, its revenue is expected to grow at 9.3% per year. The company trades significantly below estimated fair value and has recently expanded its clinic network. Leadership changes include Yogi Jashnani as CEO effective January 2025, bringing expertise in driving revenue and profit growth across multiple industries.

- Unlock comprehensive insights into our analysis of AirSculpt Technologies stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of AirSculpt Technologies shares in the market.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing treatments for severe allergic reactions, with a market cap of approximately $1.03 billion.

Operations: The company's revenue segment consists solely of Pharmaceuticals, generating $2.57 million.

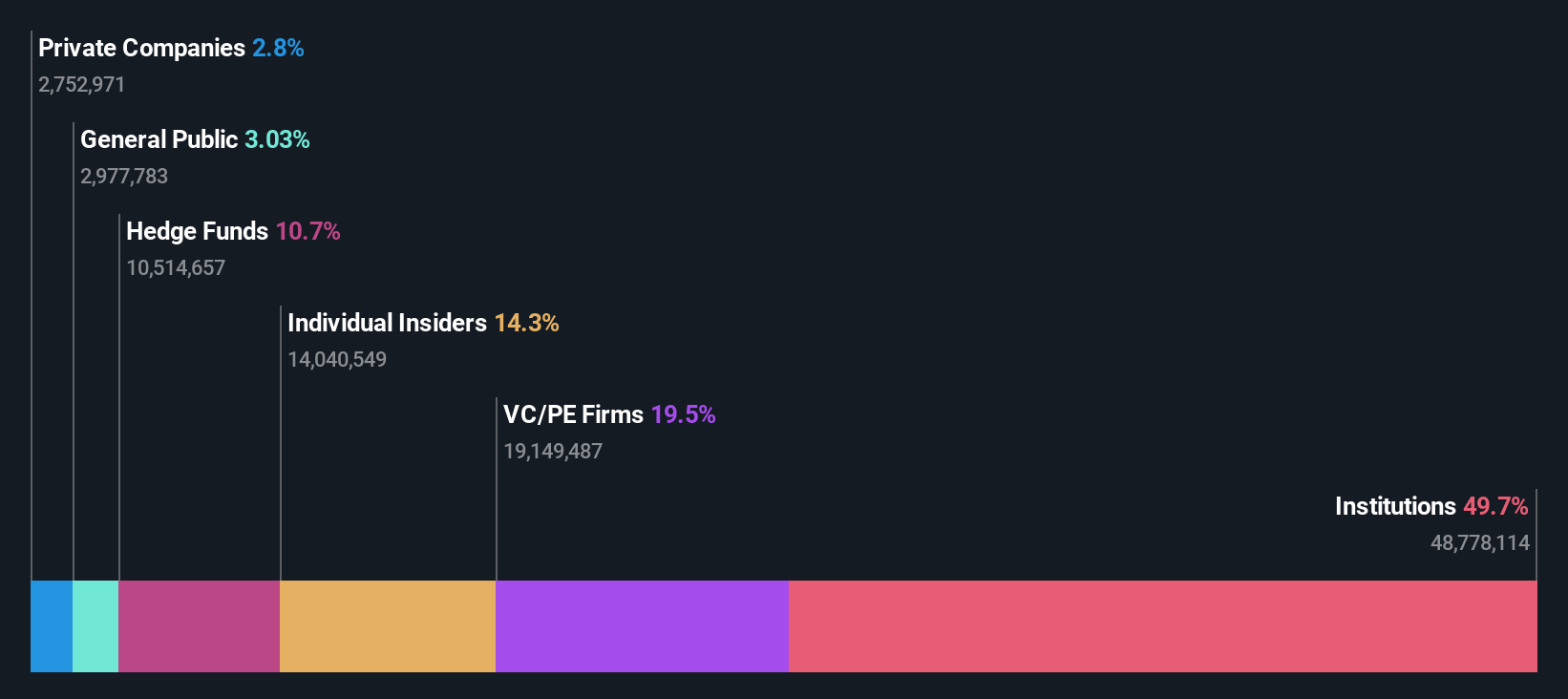

Insider Ownership: 19.7%

ARS Pharmaceuticals, with substantial insider ownership, is on track for rapid revenue growth at 44.8% annually, surpassing market averages. Despite a net loss of US$19.13 million in Q3 2024 and limited current revenue, the company anticipates profitability within three years. Recent approval of neffy®, a needle-free epinephrine spray, by Express Scripts enhances U.S. market access while global licensing agreements promise future expansion and potential milestone payments up to US$320 million plus royalties.

- Click to explore a detailed breakdown of our findings in ARS Pharmaceuticals' earnings growth report.

- In light of our recent valuation report, it seems possible that ARS Pharmaceuticals is trading behind its estimated value.

Enfusion (NYSE:ENFN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enfusion, Inc. offers software-as-a-service solutions for the investment management industry across multiple regions including the United States, Europe, the Middle East, Africa, and Asia Pacific with a market cap of approximately $1.32 billion.

Operations: The company's revenue primarily comes from its online financial information providers segment, generating $195.16 million.

Insider Ownership: 10.6%

Enfusion, with significant insider ownership, is poised for robust earnings growth at 74.8% annually, outpacing the broader market. Despite a decline in net income to US$2.7 million over nine months in 2024, revenue rose to US$148.67 million from the previous year. Recent inclusion in the S&P Software & Services Select Industry Index and strategic leadership hires underscore its commitment to scaling operations and enhancing client services within investment technology sectors.

- Click here and access our complete growth analysis report to understand the dynamics of Enfusion.

- Our valuation report unveils the possibility Enfusion's shares may be trading at a discount.

Key Takeaways

- Investigate our full lineup of 202 Fast Growing US Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives