- United States

- /

- Biotech

- /

- NasdaqCM:SLS

High Growth Tech Stocks to Watch in US December 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a week marked by anticipation of the Federal Reserve's interest rate decision, major indices such as the S&P 500 have recently pulled back from record highs, reflecting investor caution amidst economic uncertainty. In this context, identifying high-growth tech stocks requires a focus on companies with robust innovation strategies and adaptability to changing market dynamics, which can potentially thrive even in volatile environments.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.01% | 24.80% | ★★★★★☆ |

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 27.16% | 29.98% | ★★★★★★ |

| Workday | 11.18% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Viridian Therapeutics | 56.24% | 54.18% | ★★★★★☆ |

| Zscaler | 15.85% | 46.09% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.76% | 116.48% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

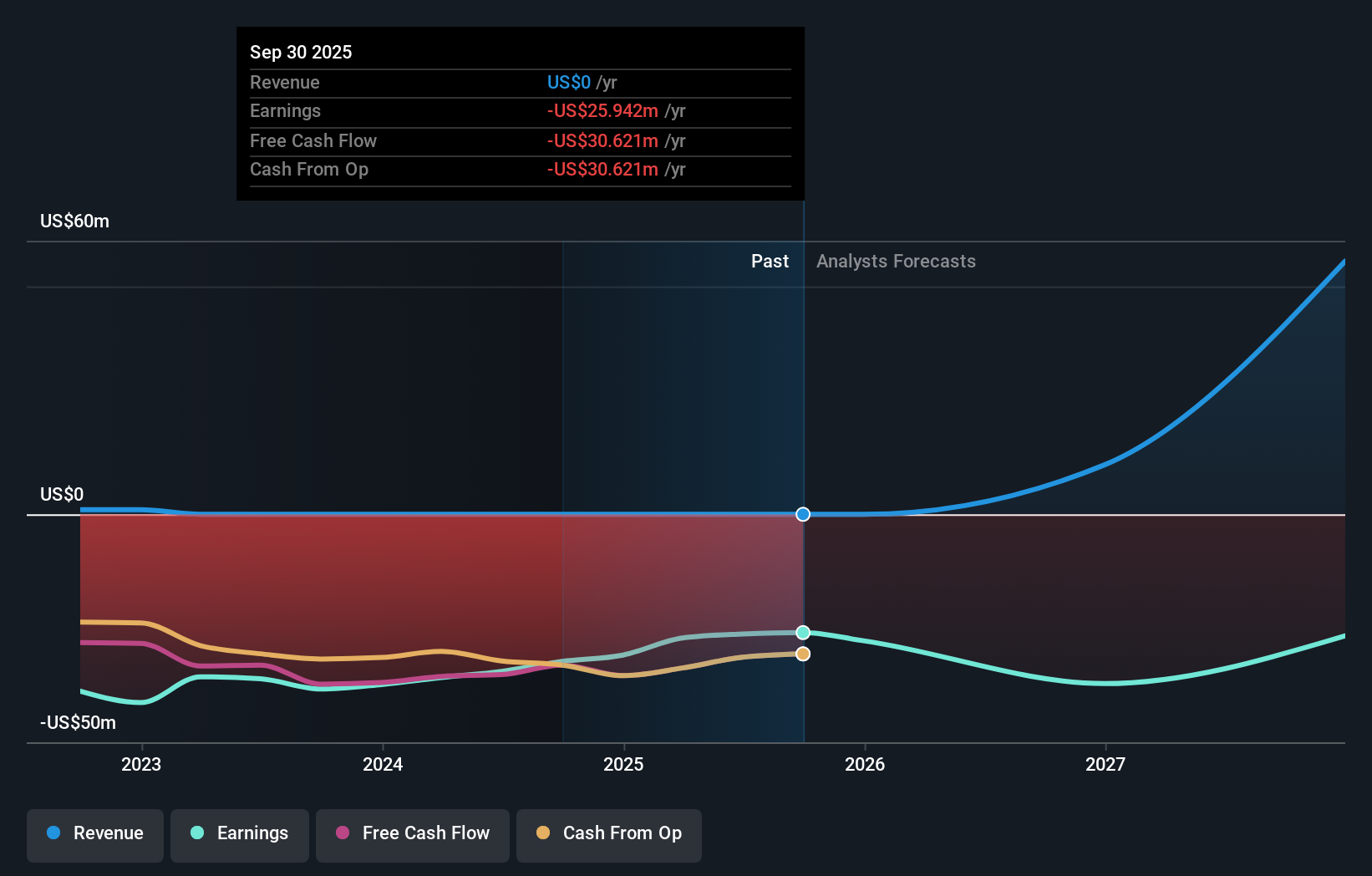

SELLAS Life Sciences Group (SLS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SELLAS Life Sciences Group, Inc. is a late-stage clinical biopharmaceutical company dedicated to developing novel cancer therapeutics in the United States, with a market cap of $259.24 million.

Operations: SELLAS Life Sciences Group is focused on developing innovative cancer treatments in the U.S. As a late-stage clinical biopharmaceutical company, its business model revolves around advancing novel therapeutics through clinical trials.

SELLAS Life Sciences Group's recent strides in biotechnology, particularly through its innovative CDK9 inhibitor SLS009, underscore its potential within high-growth sectors. The company's focused R&D efforts are evident from its presentations at major medical conferences and ongoing clinical trials aimed at combating acute myeloid leukemia. Despite a net loss reduction from $24.14 million to $19.21 million over nine months, SELLAS is navigating a path toward profitability with expected revenue growth of 67.2% annually and earnings forecast to rise by 51.72% per year, signaling robust future prospects in a challenging but critical field of medicine.

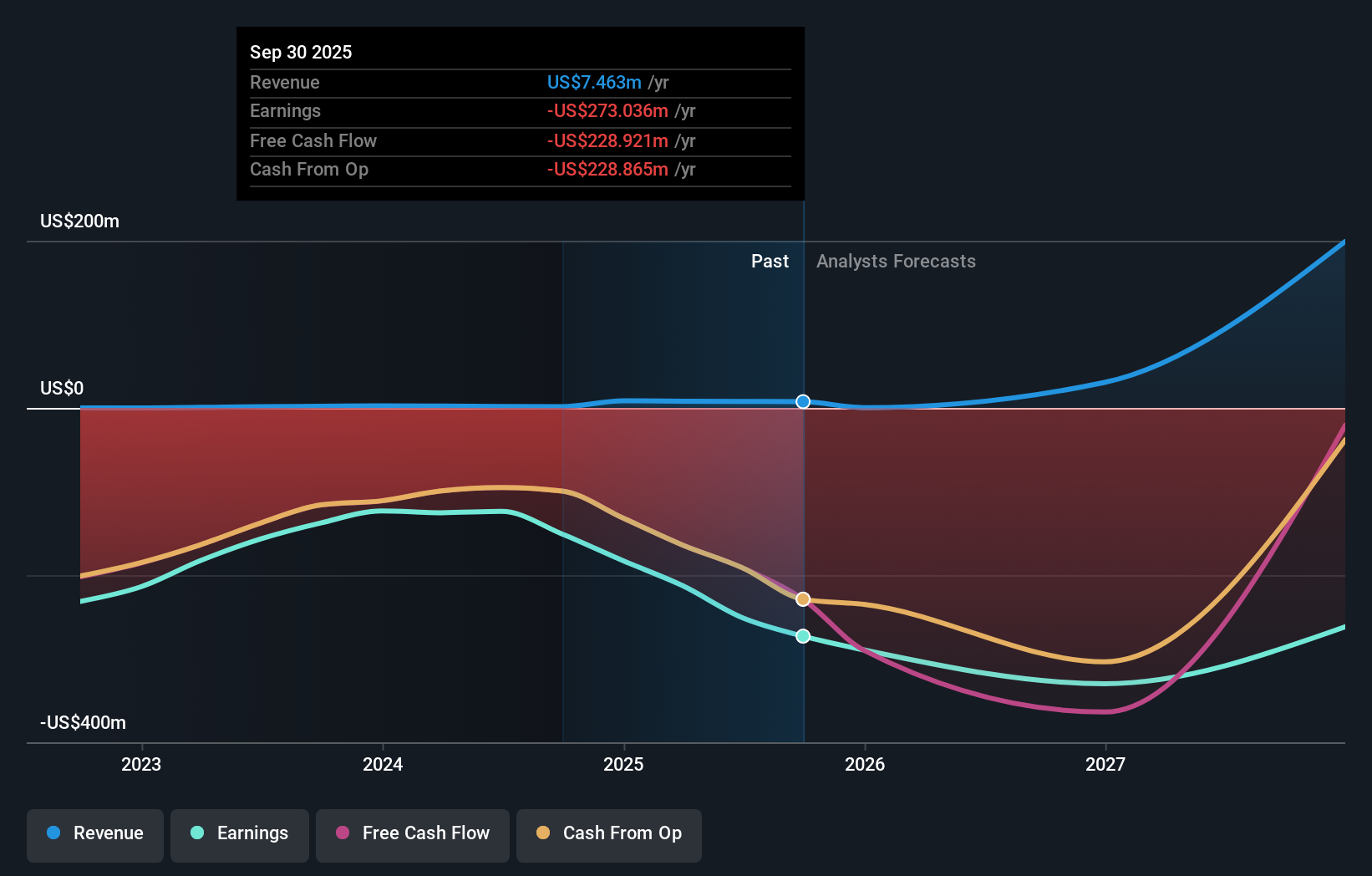

Praxis Precision Medicines (PRAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Praxis Precision Medicines, Inc. is a clinical-stage biopharmaceutical company focused on developing therapies for central nervous system disorders characterized by neuronal excitation-inhibition imbalance, with a market cap of $6.78 billion.

Operations: Praxis focuses on developing therapies for central nervous system disorders with a market cap of $6.78 billion. As a clinical-stage biopharmaceutical entity, it does not currently generate revenue from product sales.

Praxis Precision Medicines is making significant strides in the biotech industry, particularly with its recent advancements in treatments for developmental and epileptic encephalopathies. The company recently announced positive results from the EMBOLD study for relutrigine, leading to an early stop due to efficacy, showcasing Praxis's robust R&D capabilities. Despite a volatile share price and substantial shareholder dilution over the past year, Praxis's revenue is expected to grow at 75.1% annually, with earnings projected to increase by 62.79% per year. These developments underscore Praxis’s potential impact on severe neurological conditions and its trajectory towards profitability within a high-growth sector.

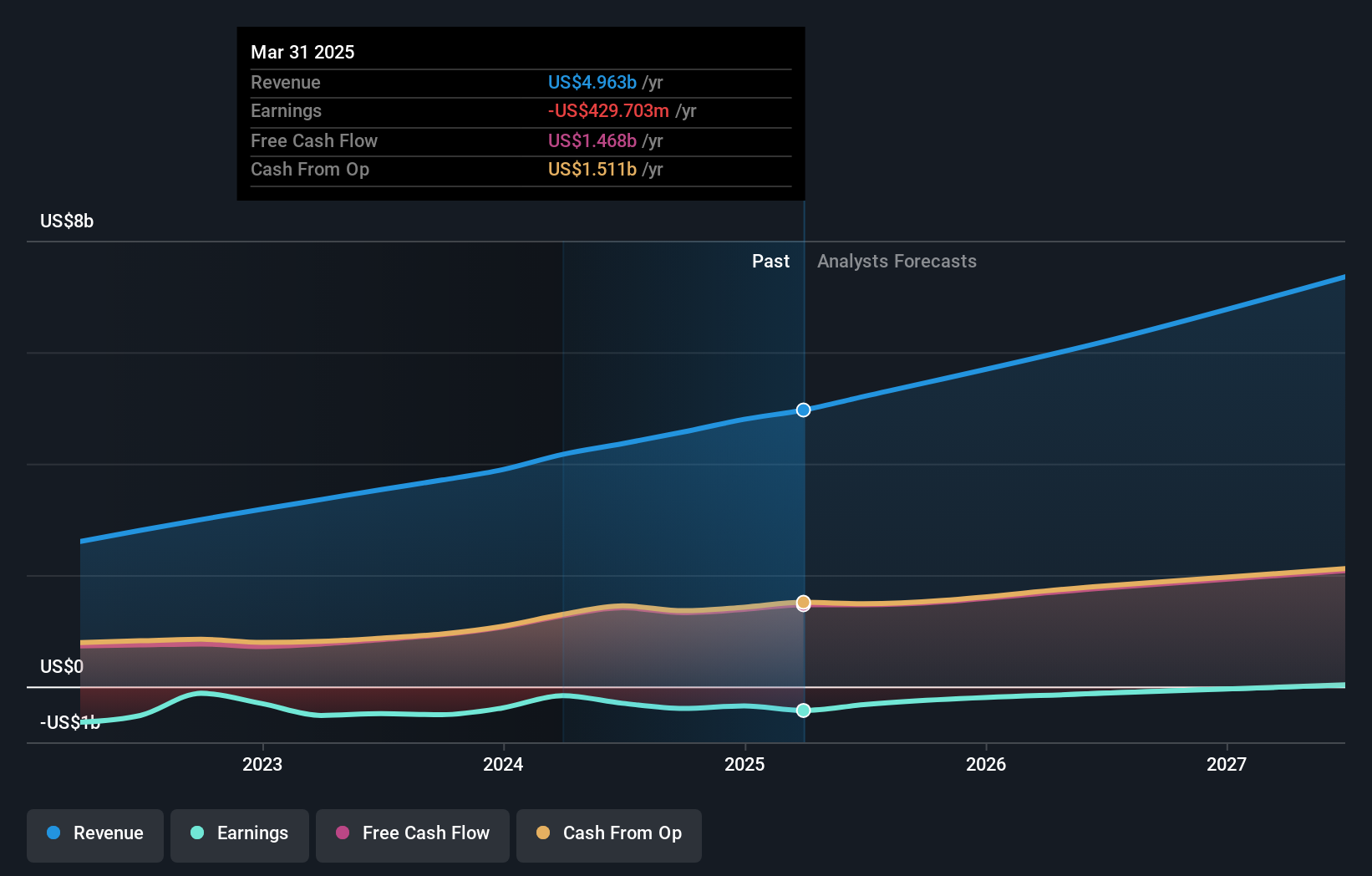

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity by connecting teams globally, with a market capitalization of $42.29 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $5.46 billion. Its business model focuses on providing collaboration tools that enhance organizational productivity on a global scale.

Atlassian's strategic maneuvers, particularly its integration into AWS Marketplace and the development of cloud apps like Jira and Confluence, underscore its commitment to enhancing enterprise software solutions globally. This collaboration not only simplifies access to Atlassian's offerings in over 150 countries but also leverages AWS's capabilities to boost performance and security features critical for large-scale digital transformations. Financially, Atlassian has shown resilience with a reported revenue increase to $1.43 billion from $1.19 billion year-over-year despite a net loss reduction from $123.77 million to $51.87 million in the latest quarter, reflecting stringent cost management and innovative product development strategies that cater to a broad customer base seeking efficient cloud-based solutions.

- Unlock comprehensive insights into our analysis of Atlassian stock in this health report.

Examine Atlassian's past performance report to understand how it has performed in the past.

Taking Advantage

- Navigate through the entire inventory of 77 US High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLS

SELLAS Life Sciences Group

A late-stage clinical biopharmaceutical company, focuses on the development of novel therapeutics for various cancer indications in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026