- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

Undiscovered Gems in the US Market for May 2025

Reviewed by Simply Wall St

As the U.S. market experiences a notable rally with the S&P 500 and Nasdaq Composite showing gains, investors are keenly observing the impact of eased U.S.-China tariffs and a dip in inflation rates to a four-year low. Amidst this backdrop, identifying promising small-cap stocks becomes crucial as these companies often thrive in environments where economic indicators favor growth and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

SIGA Technologies (NasdaqGM:SIGA)

Simply Wall St Value Rating: ★★★★★★

Overview: SIGA Technologies, Inc. is a commercial-stage pharmaceutical company that specializes in the health security market within the United States, with a market cap of $424.36 million.

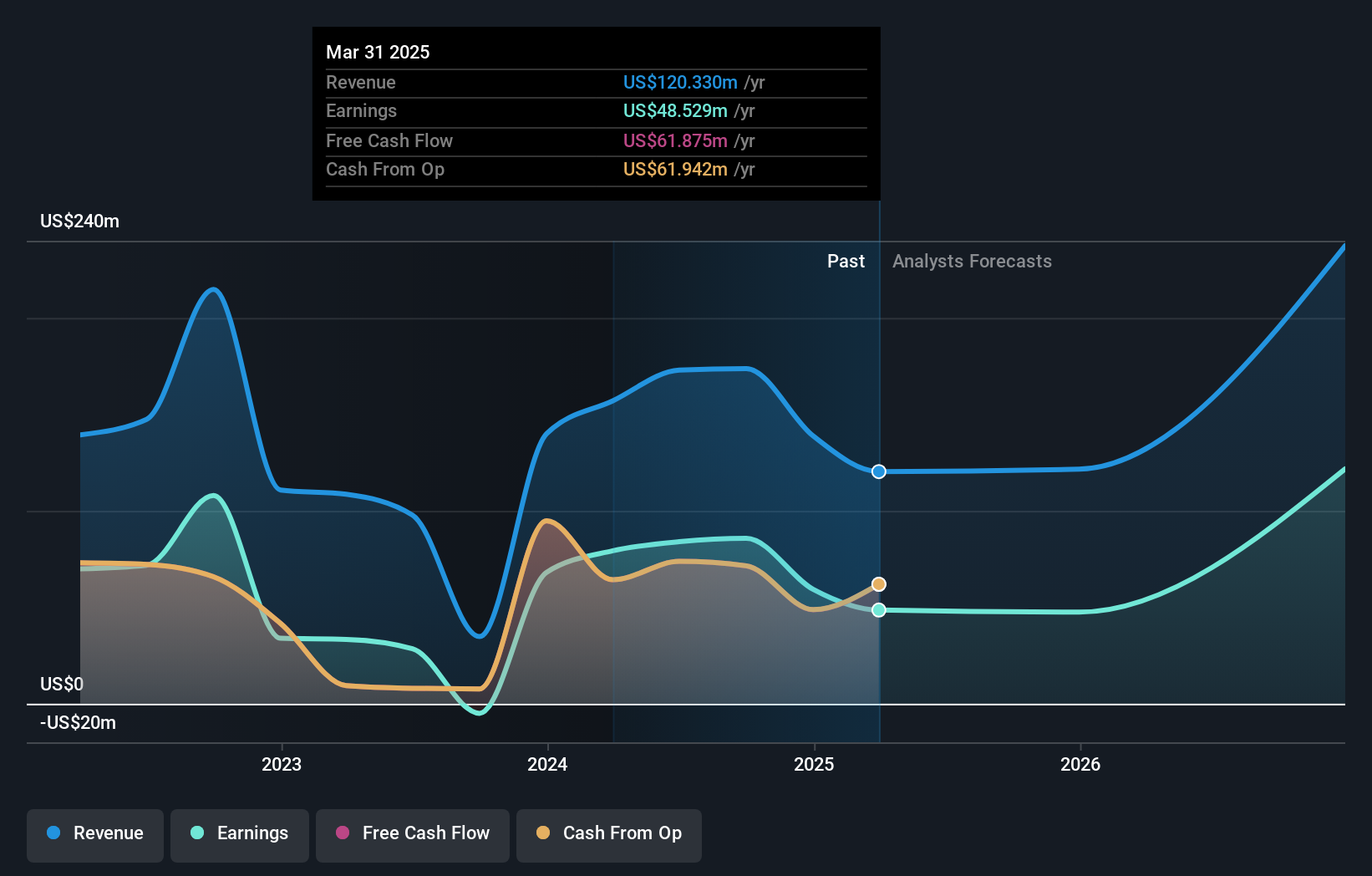

Operations: SIGA Technologies generates revenue primarily from its pharmaceuticals segment, amounting to $120.33 million.

SIGA Technologies, a nimble player in the pharmaceutical sector, shows intriguing potential despite recent challenges. The company is debt-free and trades at 73.8% below its estimated fair value, suggesting an appealing entry point for investors seeking undervalued opportunities. While it reported a net loss of US$0.41 million for Q1 2025 compared to a net income of US$10.28 million the previous year, SIGA remains profitable with positive free cash flow and high-quality earnings history. Although last year's earnings growth was negative at -38.8%, forecasts predict robust annual growth of nearly 60%, highlighting its resilience amidst industry fluctuations.

Andersons (NasdaqGS:ANDE)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Andersons, Inc. is a diversified company engaged in trade, renewables, and nutrient and industrial sectors across various countries including the United States, Canada, Mexico, Egypt, and Switzerland with a market cap of approximately $1.22 billion.

Operations: Andersons generates revenue from its renewables segment, contributing $2.81 billion.

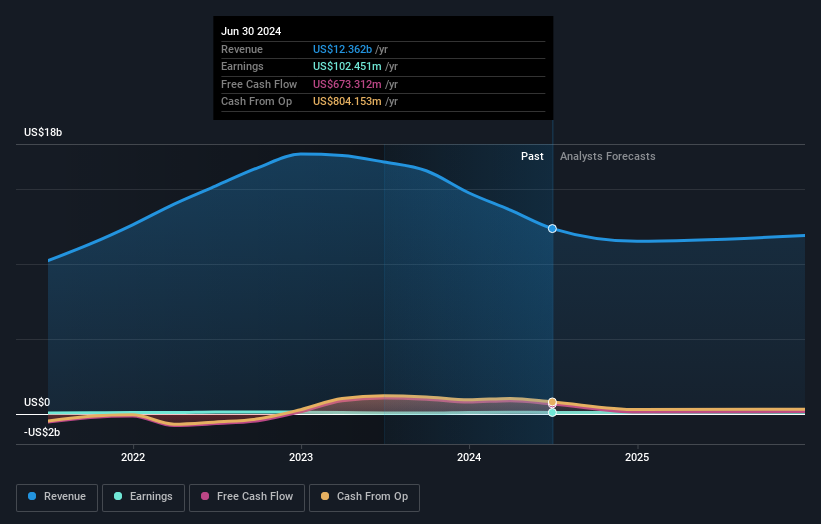

Andersons, a notable player in the agricultural sector, is making strategic moves to bolster its North American footprint through an expansion with Skyland Grain. This initiative aims to enhance grain origination and merchandising, potentially driving revenue growth. Despite a high net debt to equity ratio of 40.7%, Andersons maintains strong interest coverage at 9.6x EBIT and trades at a favorable price-to-earnings ratio of 11.4x compared to the US market average of 17.9x. However, challenges such as fluctuating grain prices and regulatory hurdles persist, impacting earnings which recently saw net income drop from $5.58 million to $0.284 million year-over-year in Q1 2025.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Banco Latinoamericano de Comercio Exterior S.A. (NYSE: BLX) is a financial institution focused on promoting foreign trade and economic integration in Latin America, with a market cap of approximately $1.50 billion.

Operations: BLX generates revenue primarily through its Commercial segment, contributing $260.93 million, and its Treasury segment, which adds $28.58 million. The company's net profit margin displays a notable trend at 34%.

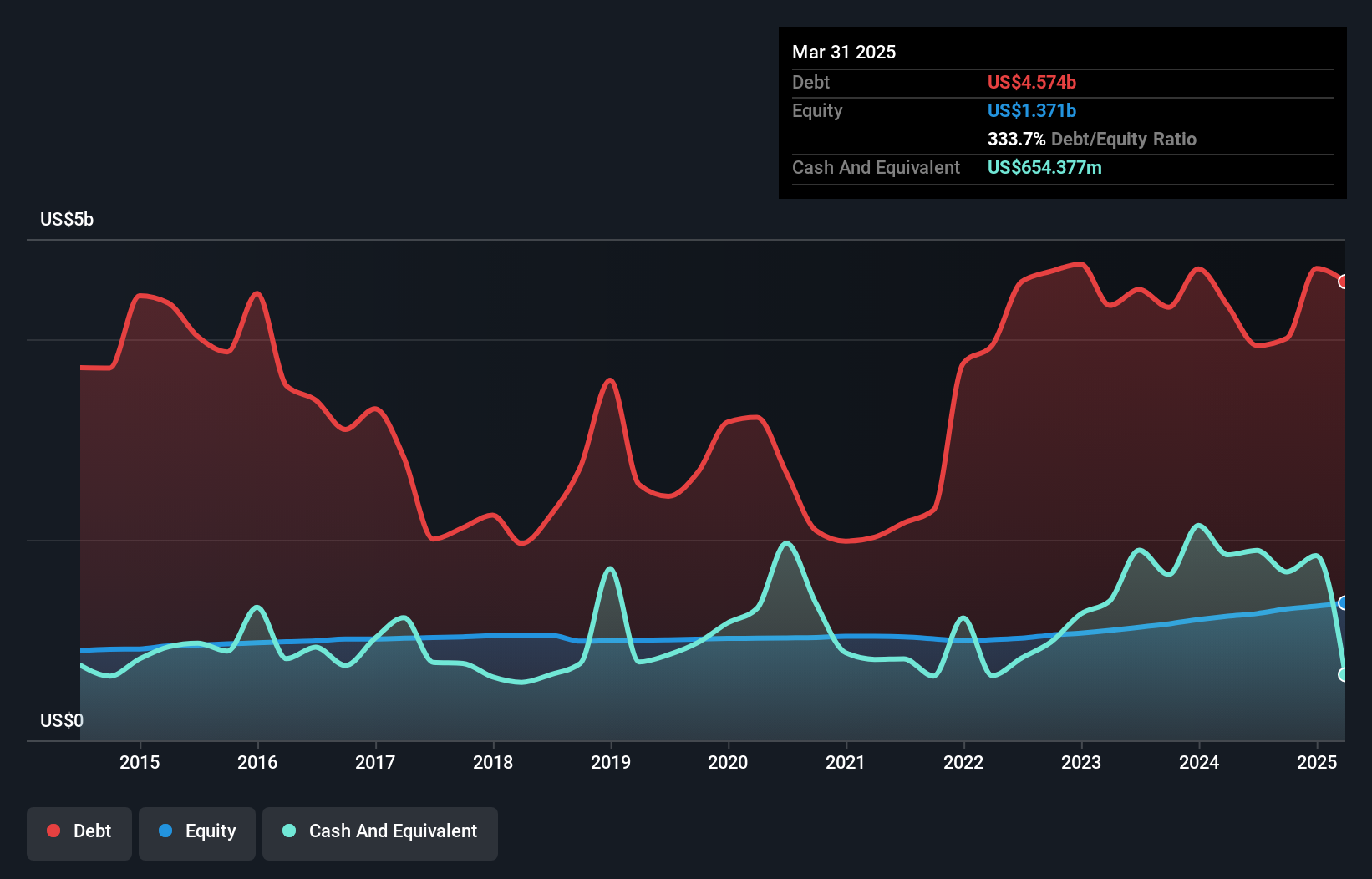

Bladex, with assets totaling $12.4 billion and equity of $1.4 billion, is making strides in Latin America through strategic expansion into new trade platforms, boosting client numbers and operational efficiency. The bank's bad loans are at a low 0.2%, supported by a robust allowance of 453%. Deposits stand at $5.9 billion against loans of $8.6 billion, with 53% of liabilities funded by low-risk customer deposits. Despite challenges like geopolitical risks and tighter lending spreads, Bladex remains well-positioned for growth with its earnings rising 14% last year and trading below estimated fair value by about 4%.

Where To Now?

- Access the full spectrum of 281 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SIGA Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives