- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

The Bull Case For SIGA Technologies (SIGA) Could Change Following Projected Surge in Global Monkeypox Treatment Demand

Reviewed by Sasha Jovanovic

- Recent market research forecasts that the global monkeypox treatment market will grow to approximately US$258.6 million by 2032, with SIGA Technologies identified as one of the leading companies positioned to benefit from rising demand as monkeypox cases increase worldwide.

- This projection highlights the growing recognition of SIGA Technologies’ role in providing critical health solutions for emerging infectious disease threats.

- We’ll explore how SIGA’s inclusion as a market leader in expanding monkeypox treatment drives its investment narrative amid changing healthcare demand.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is SIGA Technologies' Investment Narrative?

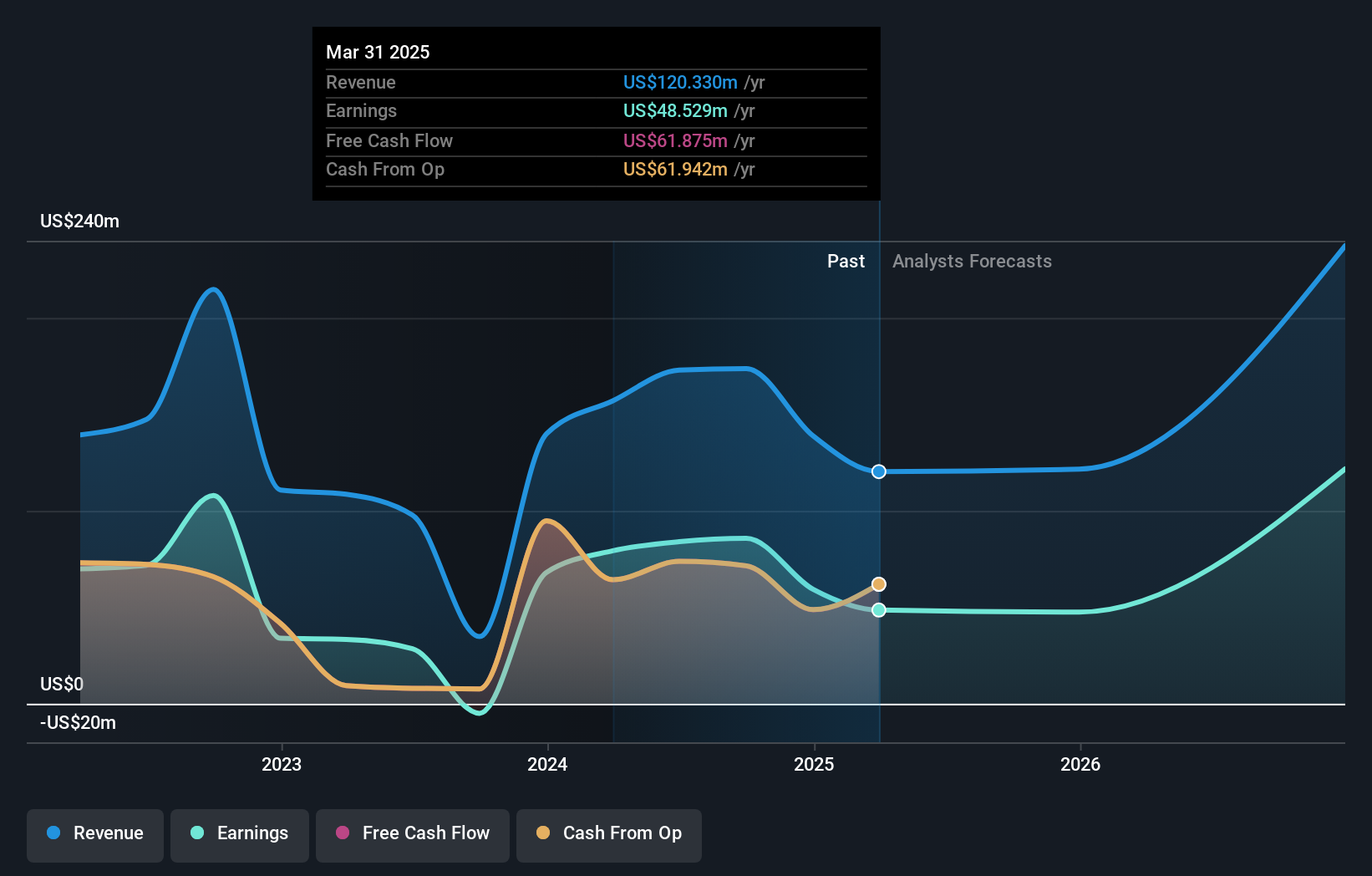

Shareholders in SIGA Technologies are essentially betting on continued demand for infectious disease treatments, especially as global health threats like monkeypox gain attention. The latest market research projecting the monkeypox treatment market at US$258.6 million by 2032 could strengthen SIGA’s investment narrative, since it positions the company in a rising segment where it’s already viewed as a market leader. This news aligns well with SIGA’s robust earnings growth and recent contracts but could shift near-term expectations, with potential for greater investor focus on sales tied to monkeypox outbreaks. The biggest risk, though, is that current optimism might be priced in, and any slowing in global case growth or increased competition could put pressure on future revenue momentum. So, while the recent announcement fits the company’s story, investors shouldn’t lose sight of market volatility and execution hurdles.

But earnings momentum faces another test should the monkeypox outbreak wane or competition intensify.

Exploring Other Perspectives

Explore 14 other fair value estimates on SIGA Technologies - why the stock might be a potential multi-bagger!

Build Your Own SIGA Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SIGA Technologies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SIGA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SIGA Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)