- United States

- /

- Biotech

- /

- NasdaqCM:SGMO

Sangamo Therapeutics (NASDAQ:SGMO) delivers shareholders stellar 160% return over 1 year, surging 12% in the last week alone

Some Sangamo Therapeutics, Inc. (NASDAQ:SGMO) shareholders are probably rather concerned to see the share price fall 55% over the last three months. But that doesn't change the fact that the returns over the last year have been very strong. Like an eagle, the share price soared 160% in that time. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Sangamo Therapeutics

Given that Sangamo Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Sangamo Therapeutics actually shrunk its revenue over the last year, with a reduction of 74%. We're a little surprised to see the share price pop 160% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

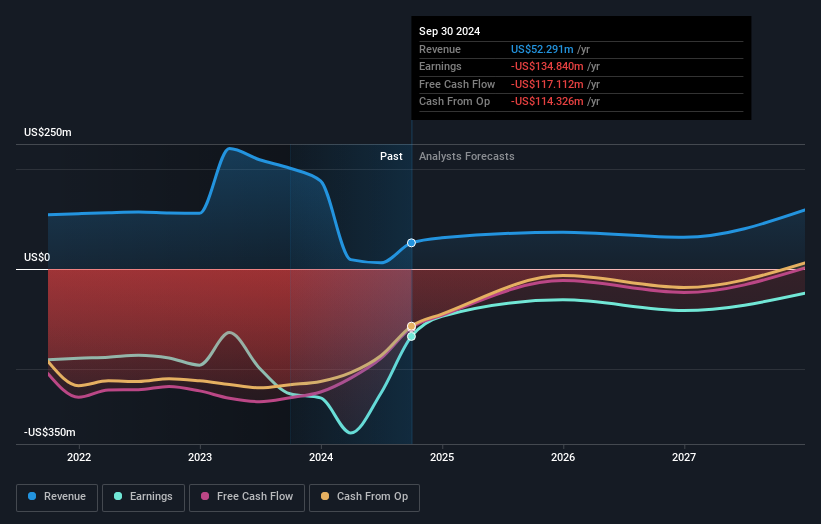

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Sangamo Therapeutics shareholders have received a total shareholder return of 160% over the last year. There's no doubt those recent returns are much better than the TSR loss of 13% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Sangamo Therapeutics better, we need to consider many other factors. Take risks, for example - Sangamo Therapeutics has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SGMO

Sangamo Therapeutics

A clinical-stage genomic medicine company, focuses on translating science into medicines that transform the lives of patients and families afflicted with serious diseases in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives