- United States

- /

- Pharma

- /

- NasdaqCM:SAVA

Cassava Sciences (NASDAQ:SAVA) has More Than Enough Funding to Function Until the Approval Process is Finished, but Investors may Need to be Ready for a Long Wait

Cassava Sciences, Inc.'s (NASDAQ:SAVA) a clinical stage biotechnology company, is developing a drug for Alzheimer - a neurodegenerative disease, affecting more than 35.7 million people worldwide (6 million in the US). In this article, we will review Cassava's product line and cash capacity to fund further research until FDA approval.

Cassava's products include:

- Simufilam - an oral treatment drug candidate. The intended goal of Simufilam is to reduce neurodegeneration and neuroinflammation. On the whole, the drug is supposed to treat disease symptoms. Two (final) phase 3 studies are under recruitment, with an estimated subject count of 750 and 1000 patients. If the company gains approval after publishing results, they will be able to sell the product to market. Clinical trial results are expected to come around the beginning of 2023, but the process may drag on further.

- SavaDX - an early-stage product candidate. It aims to detect Alzheimer's disease before the appearance of memory loss. It functions as a simple blood test.

The company has intellectual protections for Simufilam up to around 2033, and intends to protect the technology behind SavaDX with trade secrets.

See our latest analysis for Cassava Sciences

Cassava's Cash Runway

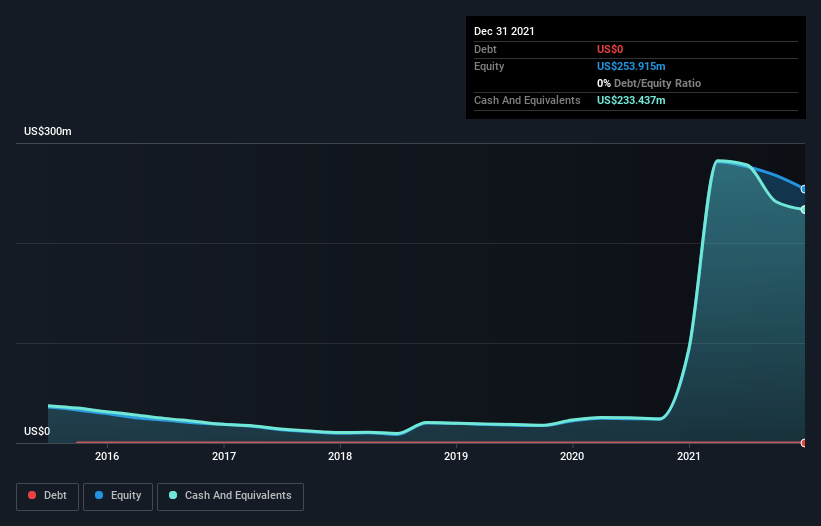

In order to finance research studies before a drug can be approved and reach market, the company must have a sufficient cash position. Currently, Cassava has a US$233.4 million cash balance, and the expected cash burn for the first half of 2022 is US$25 to $30 million.

Looking at the last year, the company burnt through US$52m. So it had a cash runway of about 4.5 years from December 2021.

A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

Cassava will need a good amount of time before approval and a shorter period to reach market. Considering that they have intellectual property rights to around 2033, and the product reaches market at 2023, they will have some 10 years to gather profits from the product before competition is allowed to jump in.

With a 6 million current potential market, Cassava may be able to reach anything from 10% to 50% of the market after the product gains traction - leaving a possible market of 1.5 million customers (assuming 25% penetration).

Conclusion

Cassava is a high-risk investment with a lot of required long-term development regarding FDA approval of phase-three studies, market rollout and customer adaptation.

While the potential of the drug is high for patients suffering from Alzheimers, an investment in SAVA may require multi-year patience before the product takes off.

Cash is not a concern for financing the current clinical studies, and the company even has excess funds if it needs to commit to additional spending.

We looked at different risks affecting the company and spotted 3 warning signs for Cassava Sciences (of which 1 is significant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqCM:SAVA

Cassava Sciences

A clinical stage biotechnology company, develops drugs for neurodegenerative diseases.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives