- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Rhythm Pharmaceuticals (RYTM): Assessing Valuation Following New Partnerships and IMCIVREE Phase 3 Progress

Reviewed by Kshitija Bhandaru

Rhythm Pharmaceuticals (RYTM) is drawing fresh attention after advancing its lead drug IMCIVREE in rare neuroendocrine diseases. The company is building on new strategic partnerships and ongoing Phase 3 clinical trials.

See our latest analysis for Rhythm Pharmaceuticals.

Rhythm Pharmaceuticals has outpaced much of the sector this year, with a 75% year-to-date share price return. This reflects rising optimism fueled by clinical milestones and new partnerships. Looking at a longer period, the stock’s 1-year total shareholder return is 109%, while three- and five-year total shareholder returns are over 340% and 370% respectively. These figures suggest growing conviction among investors and momentum that remains hard to ignore.

If the latest clinical wins have prompted you to look beyond Rhythm, this could be the perfect time to discover See the full list for free.

With shares soaring and analysts projecting further upside, investors now face a pivotal question: is Rhythm Pharmaceuticals still undervalued with room to run, or is all the future growth already priced in?

Most Popular Narrative: 11.1% Undervalued

Rhythm Pharmaceuticals’ most widely followed narrative assigns a fair value that is roughly 11% above the recent closing price, signaling further upside according to analysts. As shares push higher, all eyes turn to what is fueling such ambitious valuation targets.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader-Willi syndrome, along with expansion into younger age groups, are expected to materially grow Rhythm's commercial opportunity and topline over the next several years.

Want to know what bold expectations justify this price target? The narrative projects a rare blend of sky-high revenue growth and future profit margins many biopharmas can only dream of. Wonder which pivotal numbers and assumptions underpin such a bullish outlook? Dive in to uncover the surprising forecasts that drive this elevated valuation.

Result: Fair Value of $118.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering questions about Rhythm's sustained profitability and its deep reliance on setmelanotide could quickly challenge this optimistic outlook.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

Another View: What Do Market Multiples Say?

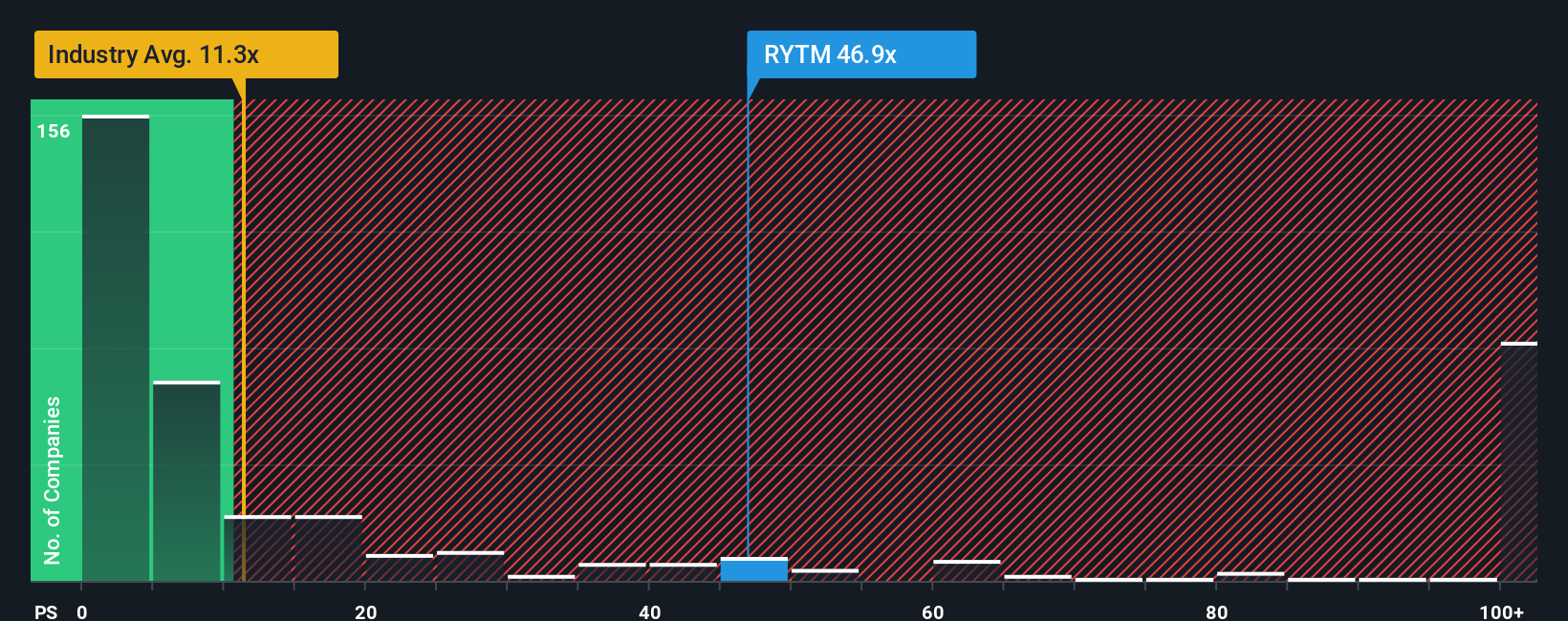

Looking through the lens of market ratios, Rhythm Pharmaceuticals trades at a price-to-sales ratio of 44.7. This stands well above both its peer average of 12.5 and the estimated fair ratio of 21.6. Such a hefty premium reflects lofty investor expectations, but it also signals a greater risk if future performance does not deliver. Could the market re-rate Rhythm closer to these lower benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you think the story plays out differently, or want to investigate the numbers for yourself, you can build your own in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Looking for more investment ideas?

Stay ahead of the curve by tapping into unique investing angles you might not have considered. The right idea now could transform your returns for years to come.

- Tap into future market trends and power your portfolio with these 25 AI penny stocks, a selection designed to capture the significant rise of artificial intelligence innovation.

- Uncover reliable cash flow and growth potential by checking out these 878 undervalued stocks based on cash flows, which are currently trading beneath their intrinsic value and may provide a strong starting point for your portfolio.

- Lock in steady income by exploring these 18 dividend stocks with yields > 3% that offer yields above 3%, helping your investments work harder for you each month.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives