- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX) Is Up 10.6% After Expanding AI Partnerships and Acquiring Exscientia

Reviewed by Simply Wall St

- Recursion Pharmaceuticals has recently expanded its AI-powered drug discovery capabilities through high-profile collaborations and the acquisition of Exscientia, adding over 20 new programs and increasing milestone opportunities to over US$20 billion.

- These alliances with major technology and pharmaceutical partners, including NVIDIA and Google Cloud, highlight an accelerating pace of innovation and operational scale in data-driven drug development.

- We'll look at how Recursion's partnership-driven expansion of its AI drug discovery platform shapes its future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Recursion Pharmaceuticals Investment Narrative Recap

To be a shareholder in Recursion Pharmaceuticals, you have to believe in the long-term promise of AI-driven drug discovery and the company’s ability to translate early scientific success into commercial outcomes. While the recent news about analyst sentiment and earnings anticipation hasn’t shifted the fundamental near-term catalyst, progress in advancing key clinical programs, these updates reinforce that Recursion’s biggest short-term risk remains the unpredictability of milestone payments and revenue as it scales new partnerships and trial results.

The June 2025 release of Boltz-2, an open-source biomolecular modeling tool built with NVIDIA’s supercomputing power, stands out as especially relevant. By making drug discovery tools more accessible and dramatically faster, this move could accelerate the pipeline and potentially improve Recursion’s timeline for milestone achievement, which remains a critical variable for investors watching the company’s operational progress.

However, investors should be mindful that, despite accelerating partnerships, major risks still exist if...

Read the full narrative on Recursion Pharmaceuticals (it's free!)

Recursion Pharmaceuticals' outlook anticipates $188.8 million in revenue and $19.9 million in earnings by 2028. This projection is based on an assumed 46.7% annual revenue growth rate and an earnings increase of $594.7 million from current earnings of $-574.8 million.

Exploring Other Perspectives

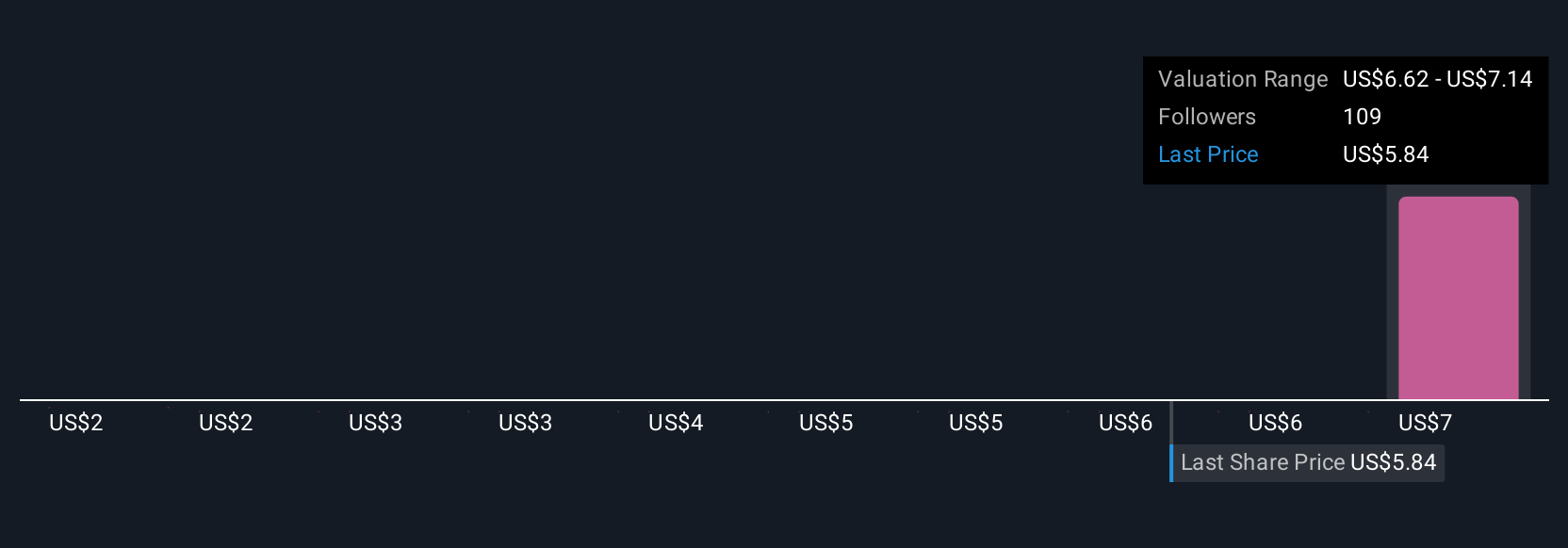

Simply Wall St Community members provided three different fair value estimates for Recursion Pharmaceuticals, ranging from US$1.89 to US$7.14 per share. While partnership expansion is a catalyst for optimism, milestone unpredictability means opinions on future business performance frequently diverge, take time to explore all viewpoints.

Build Your Own Recursion Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Recursion Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recursion Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives