- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX): Assessing Valuation Following New Milestone Payment and Drug Development Progress

Reviewed by Kshitija Bhandaru

Recursion Pharmaceuticals (RXRX) just received a $12.5 million milestone payment from Rallybio, reflecting real traction in its partnered drug programs. The company also made a strategic investment to advance an innovative ENPP1 inhibitor therapy.

See our latest analysis for Recursion Pharmaceuticals.

Recursion Pharmaceuticals has had a stream of noteworthy developments lately, including its new drug partnership milestone and further investments into novel therapies. Despite this momentum, the 1-year total shareholder return is slightly negative at -0.09%, reflecting that the market remains cautious on biotechs navigating early-stage risk. While short-term share price returns have stayed relatively muted, these recent moves suggest Recursion could be building a foundation for renewed investor interest, especially as its platform evolves.

If you’re tracking advances in biotech and life sciences, exploring See the full list for free. is a great way to discover more stocks making headlines in the sector.

With shares still trading below recent analyst price targets, but the company facing ongoing early-stage risks, investors are left to consider whether Recursion is an overlooked opportunity or if the market has already factored in future growth.

Most Popular Narrative: 14.6% Undervalued

Recursion Pharmaceuticals’ consensus fair value sits comfortably above the last closing price, hinting at untapped potential if things play out as projected. Investors looking for conviction may want to understand what is powering this gap.

Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster, more cost-effective drug discovery and development. This can improve R&D efficiency and support longer-term margin expansion.

Why are analysts placing such high expectations on one tech-driven platform? The answer lies in the ambitious financial leaps, disruptive automation, and long-range targets that shape the current fair value calculation. Ready to see the numbers and ideas transforming this stock’s potential?

Result: Fair Value of $6.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on pharma partnerships and the early-stage status of Recursion’s clinical programs could quickly shift investor sentiment if progress stalls.

Find out about the key risks to this Recursion Pharmaceuticals narrative.

Another View: What About Market Comparisons?

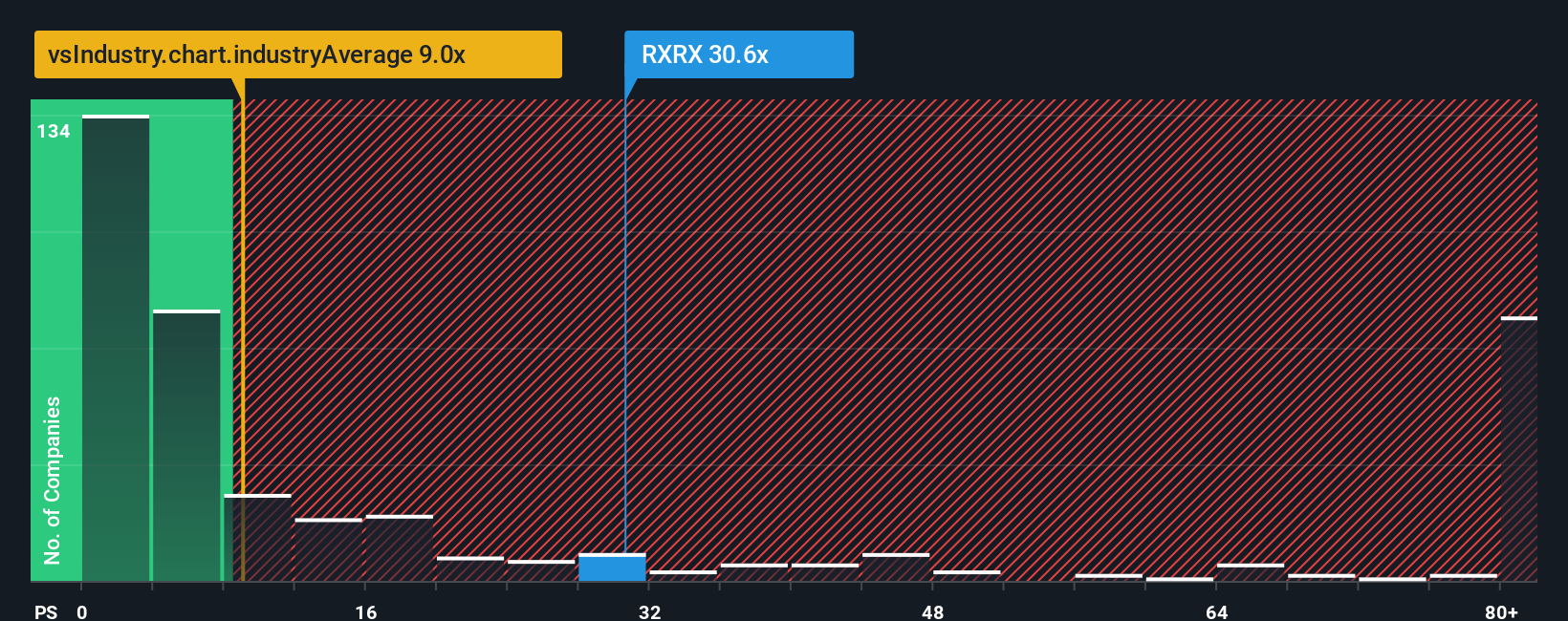

Looking at Recursion Pharmaceuticals using the price-to-sales ratio paints a very different picture. The company trades at 37.3 times sales, much higher than both industry (9.9x) and peer (14.2x) averages, and even far above our fair ratio. This gap reveals clear valuation risk. Could the market adjust if its growth does not materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recursion Pharmaceuticals Narrative

If you see things differently or want to dig into the details yourself, you can put together a personal take on Recursion’s story in just a few minutes, Do it your way.

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to a single stock. Broaden your horizons and spot tomorrow’s standouts using these unique opportunities on Simply Wall Street.

- Uncover breakthrough innovation by following these 24 AI penny stocks. These companies are making real progress in artificial intelligence, automation, and the next wave of machine learning advancements.

- Boost your passive income by targeting reliable companies with these 19 dividend stocks with yields > 3% that yield over 3%, so you can benefit from strong cash flows and consistent rewards.

- Capture potential upside with these 910 undervalued stocks based on cash flows companies offering market-beating value based on future cash flows before others catch on to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026