- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (NasdaqGS:RXRX) Jumps 12% Following US$500M Equity Offering

Reviewed by Simply Wall St

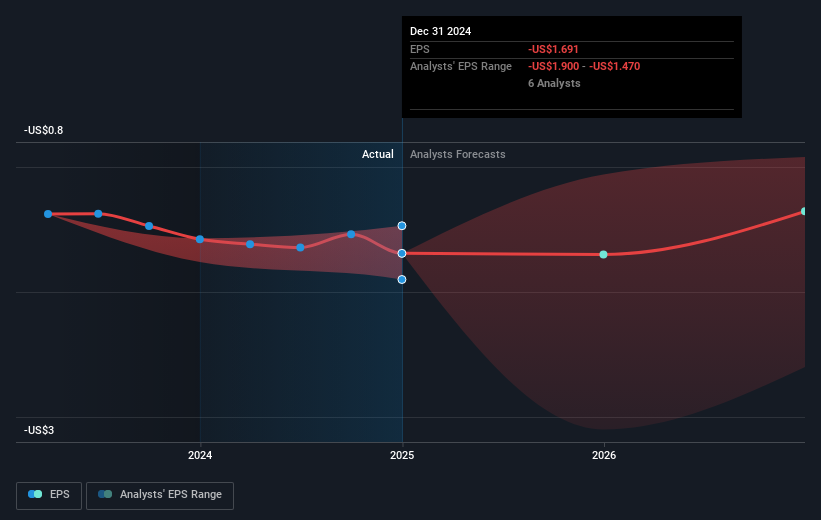

Recursion Pharmaceuticals (NasdaqGS:RXRX) saw its stock price increase by 12% over the past week. This movement could be associated with several recent developments. The company announced a significant follow-on equity offering of $500 million, which may have attracted investor attention. Additionally, Recursion’s reported earnings for FY 2024 showed growth in sales and revenue despite a widening net loss, providing mixed signals to the market. These strategic maneuvers coincided with broader market trends where major indices such as the Nasdaq have faced volatile trading conditions, partly due to uncertainty in the tech sector and general market fluctuations. Against this backdrop, Recursion's market activity appeared resilient, perhaps benefiting from its forward-looking positioning compared to broader concerns around tariffs and economic growth that pressured many tech and pharmaceutical shares. Overall market indices were generally negative, with major tech companies experiencing losses, while Recursion maintained upward momentum likely driven by these internal updates.

Recursion Pharmaceuticals has experienced a modest total shareholder return of 3.32% over the past three years, reflecting both internal developments and sector-wide challenges. Despite achieving a US$58.84 million rise in revenue for fiscal year 2024, the company continues to grapple with widening net losses, affecting investor sentiment. Recent regulatory milestones like the FDA approval for the Phase 1/2 trial of REC-4539 in January 2025 underscore potential growth avenues but have not yet translated into profitability.

The past year has seen Recursion underperforming compared to the broader US biotech and market benchmarks. However, clinical progress such as positive Phase 2 study data for REC-994, and strategic executive appointments following its business combination with Exscientia in November 2024, have offered glimpses of future potential. The equity offerings, including the recent US$500 million, have also positioned Recursion for sustained operational initiatives, though share dilution remains a consideration for long-term shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Flawless balance sheet slight.