- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Did Recursion Pharmaceuticals' (RXRX) REV102 Milestone and Conference Push Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- Recursion Pharmaceuticals recently advanced its drug pipeline by making a US$12.5 million equity milestone payment to Rallybio for the development of the ENPP1 inhibitor REV102, alongside announcing participation in two major investor conferences.

- This increased activity in both drug development and investor communications highlights the company’s efforts to strengthen its scientific and financial positioning within the biotech industry.

- We'll explore how advancing REV102’s clinical development through this milestone payment could influence Recursion Pharmaceuticals’ broader investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Recursion Pharmaceuticals Investment Narrative Recap

To be a shareholder in Recursion Pharmaceuticals, an investor needs conviction in the disruptive potential of AI-driven drug discovery and faith that pipeline progress can eventually offset current cash burn and persistent losses. The recent US$12.5 million milestone payment for REV102 demonstrates continued momentum, but it does not materially shift Recursion’s biggest near-term catalyst, meaningful late-stage clinical data, or the major risk of ongoing unprofitability and reliance on future capital access.

Among recent announcements, the open-sourcing of the Boltz-2 biomolecular model stands out. This move may strengthen Recursion’s position as an innovator and help attract new research collaborations, but it does not directly change the timeline or probability of upcoming clinical or commercial milestones.

On the other hand, with funding needs still looming for the next few years, the potential for shareholder dilution is an important risk that investors should keep in mind...

Read the full narrative on Recursion Pharmaceuticals (it's free!)

Recursion Pharmaceuticals' narrative projects $220.9 million revenue and $35.5 million earnings by 2028. This requires 50.7% yearly revenue growth and a $684.6 million earnings increase from -$649.1 million.

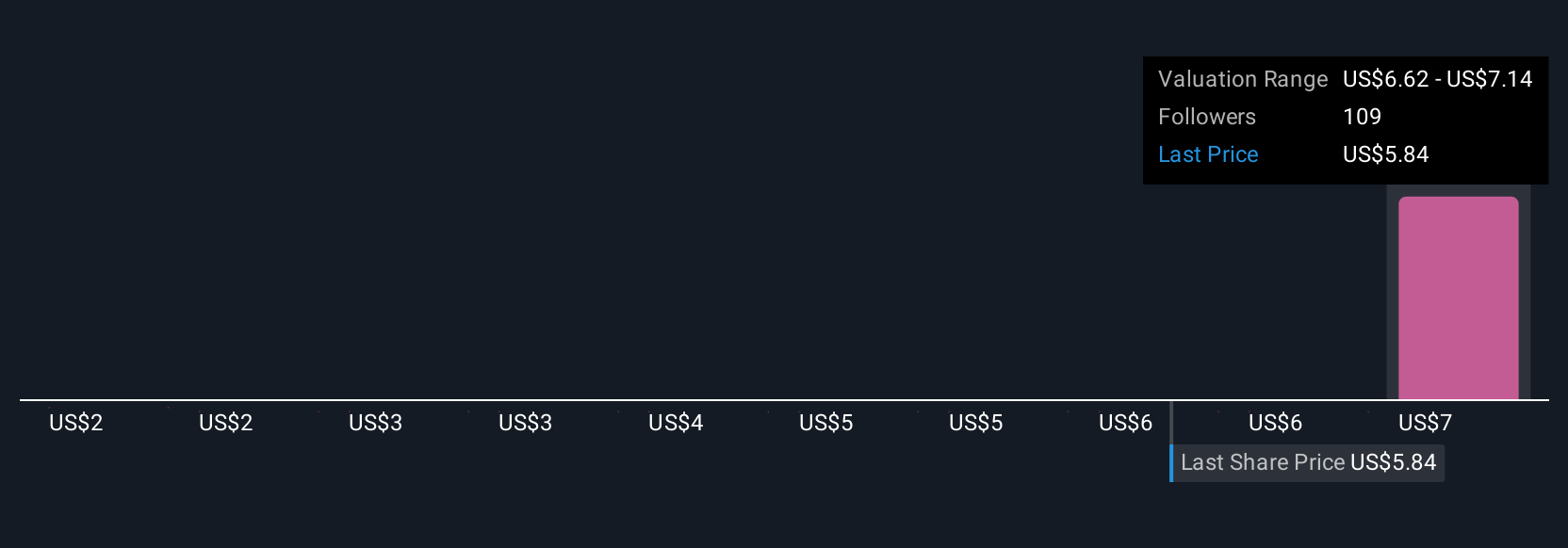

Uncover how Recursion Pharmaceuticals' forecasts yield a $6.47 fair value, a 34% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community reflected wide fair value estimates for RXRX, ranging from US$1.92 to US$6.47 across 3 analyses. While opinion varies, Recursion’s heavy cash burn and funding runway concerns remain critical watchpoints for anyone assessing long-term potential.

Explore 3 other fair value estimates on Recursion Pharmaceuticals - why the stock might be worth less than half the current price!

Build Your Own Recursion Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Recursion Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recursion Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion