- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Assessing Recursion Pharmaceuticals After Shares Surge 19% Amid AI-Driven Market Optimism

Reviewed by Bailey Pemberton

If you’re watching Recursion Pharmaceuticals after its latest run-up, you’re not alone. In just the past week, shares have shot up 19.4%, and they’re up 31.8% over the past month. But before you jump in or count your gains, it’s worth pausing to ask whether these moves hint at new growth potential or if the market is simply repricing risk.

Long-term holders have had a rockier ride, with the stock down 15.5% for the year so far and nearly flat compared to a year ago. Over the past three years, the picture is even bumpier, showing a 44% decline. Clearly, it’s been anything but a straight path, and recent enthusiasm has to be considered in light of that backstory. Part of the latest optimism seems linked to renewed excitement in digital biology and pharmacological AI platforms, areas where Recursion Pharmaceuticals is aiming to make its mark. Some investors may also see the recent price surge as the market trying to find a fairer value after a long stretch of underperformance.

On paper, though, Recursion Pharmaceuticals currently has a valuation score of 0, meaning it doesn’t appear undervalued by any of the six major checks analysts use. That’s not necessarily a reason to walk away, but it’s a fact worth noting as you consider the next move. Let’s walk through what goes into those valuation methods and, more importantly, how you might look past them to see the stock’s real potential.

Recursion Pharmaceuticals scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Recursion Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth based on its ability to generate cash in the future, projecting these cash flows and then discounting them back to today's dollars. This method seeks to identify the intrinsic value of a company's share by balancing both near-term forecasts with longer-term expectations.

For Recursion Pharmaceuticals, the starting point is a current Free Cash Flow of -$404 million, highlighting that the company is still burning cash. Over the next decade, projections show that Free Cash Flow is expected to turn positive and reach $139 million by the end of 2029, according to analyst estimates and broader extrapolations. The DCF model used here blends five years of analyst input with five years of calculated extensions to account for longer-term growth trends and uncertainties.

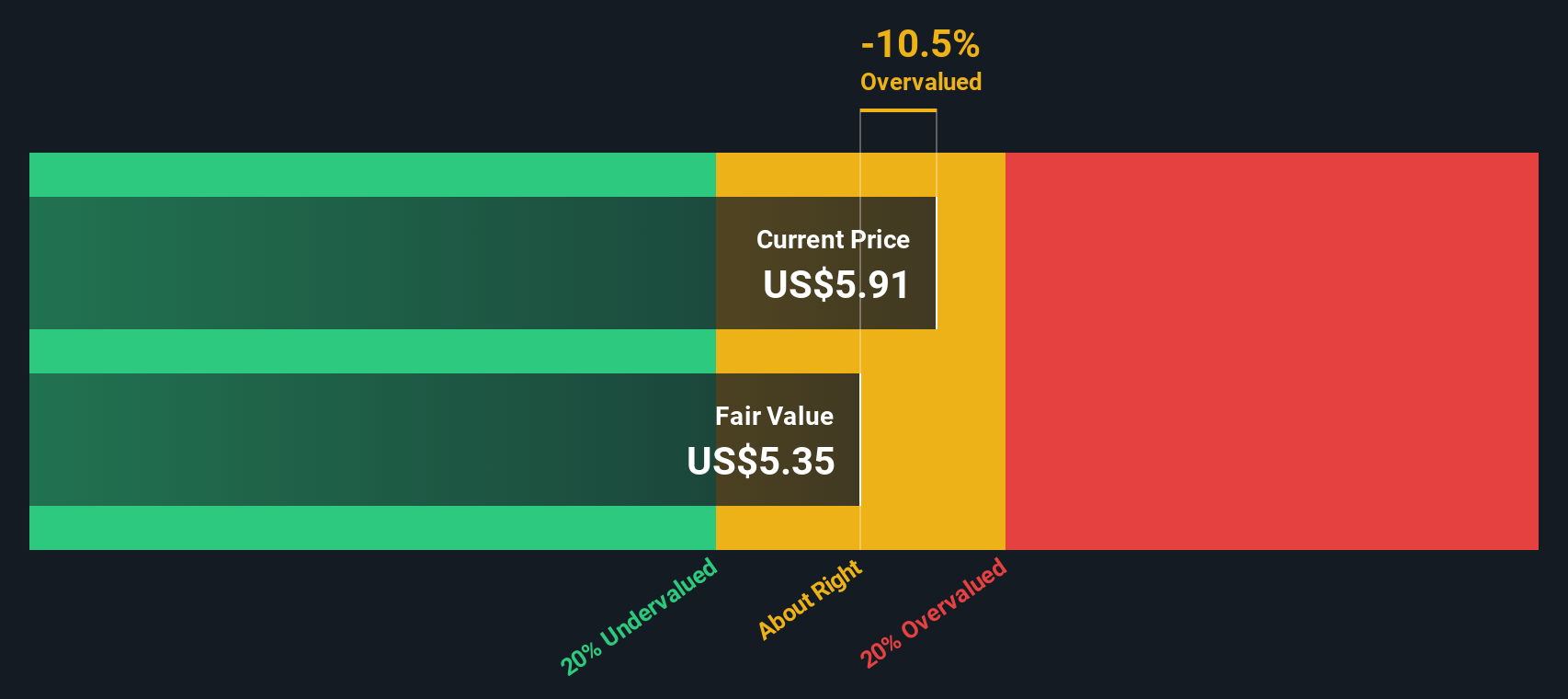

Based on these inputs, the DCF model assigns Recursion Pharmaceuticals an intrinsic value of $5.36 per share. When compared to the current share price, this suggests the stock is about 13.7% overvalued using this method, pointing toward an elevated valuation relative to its discounted future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Recursion Pharmaceuticals may be overvalued by 13.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Recursion Pharmaceuticals Price vs Sales

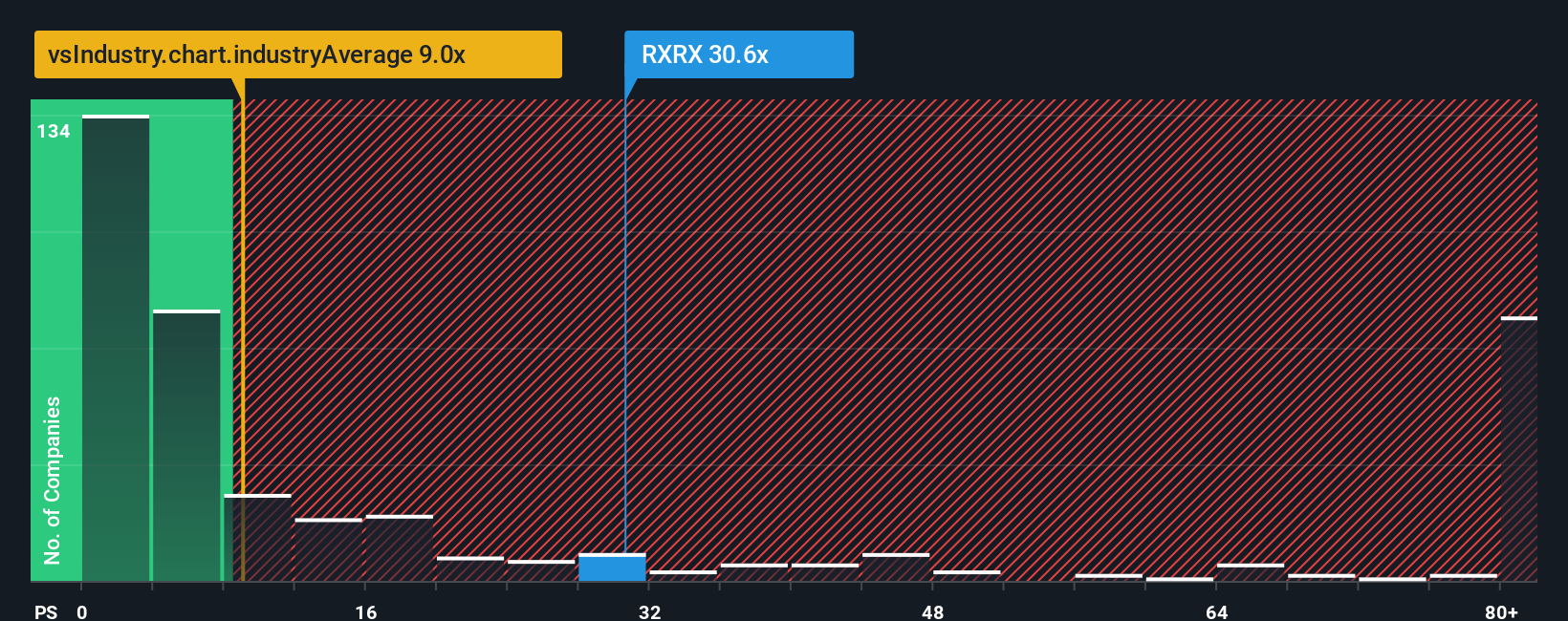

The Price-to-Sales (P/S) ratio is commonly used to value early-stage or unprofitable companies, like Recursion Pharmaceuticals, that are not yet generating positive earnings. Since profits are currently negative, the P/S ratio gives investors a window into how much they are paying for each dollar of sales the business produces, making it a relevant tool for evaluating biotech firms still in ramp-up mode.

While higher growth expectations or lower business risk can sometimes justify paying a larger multiple, a “normal” or “fair” P/S ratio typically falls in line with peers or industry averages unless a company stands out for its superior outlook or stability. At the moment, Recursion Pharmaceuticals trades at a P/S ratio of 41.2x, which stands well above the biotech industry average of 10.5x and also tops its peer average of 15x. This implies a significant premium is being placed on its future potential.

Simply Wall St’s proprietary "Fair Ratio" metric is designed to cut through headline comparisons by layering in factors specific to Recursion Pharmaceuticals, such as its topline growth, margins, market risks, and company size, to estimate what would be a reasonable P/S multiple based on its actual profile. In this case, Recursion’s Fair Ratio computes to just 0.0008x, a stark contrast to its current multiple. Since the difference is much greater than 0.10, this suggests the stock is significantly overvalued by the P/S measure, especially after considering growth prospects and sector dynamics in context.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Recursion Pharmaceuticals Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story behind the numbers. It is a perspective you build about a company by combining what you believe about its future revenue, earnings, and margins, and then connecting that story to a financial forecast and a fair value estimate. Narratives work because they help investors link the "why" to the "what" by clearly outlining the reasons behind their fair value, making tough buy or sell decisions more concrete.

On Simply Wall St’s platform, Narratives are quick and accessible tools used by millions of investors within the Community page. They help you compare your calculated Fair Value to Recursion Pharmaceuticals’ current price, so you can spot opportunities or potential risks using your own logic, not just someone else’s model. Additionally, Narratives stay up to date by dynamically adjusting when new information, such as breaking news or earnings, is released.

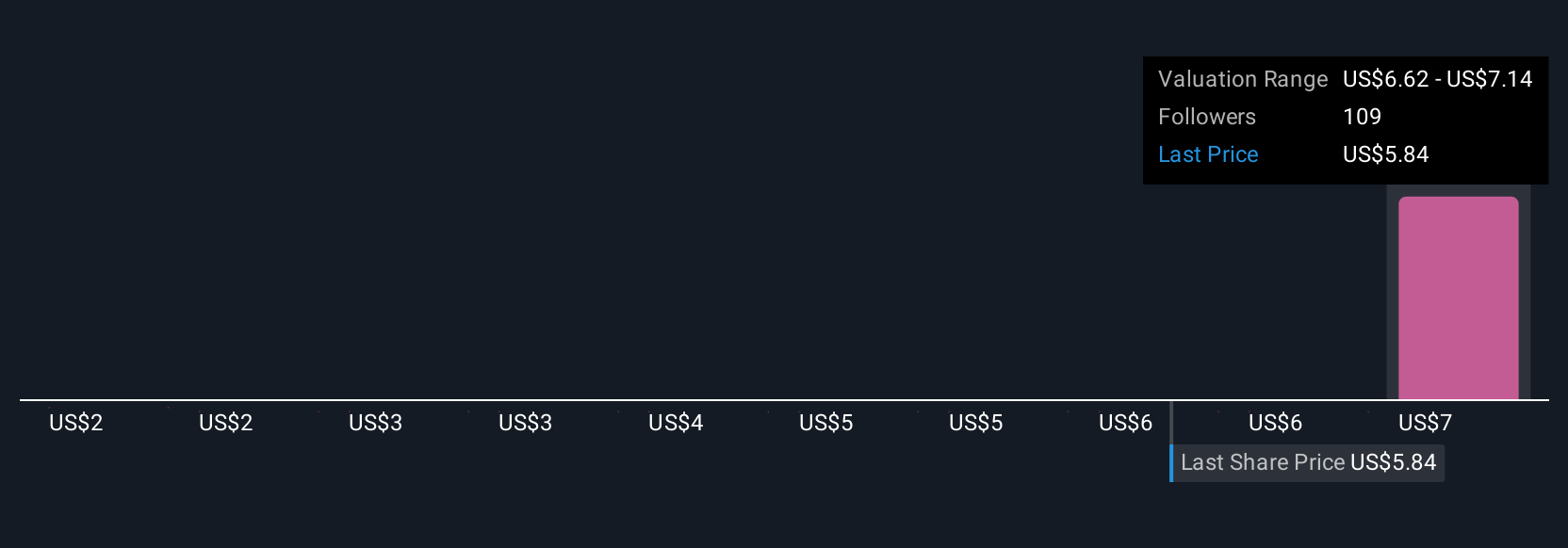

For example, on the Community page, one investor’s Narrative might expect transformative AI to accelerate drug development and set Recursion Pharmaceuticals’ fair value as high as $10 per share. In contrast, a more cautious Narrative, focusing on regulatory hurdles and funding risks, estimates fair value at just $3. Whatever your perspective, Narratives put the power of investment decisions back in your hands.

Do you think there's more to the story for Recursion Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives