- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

Royalty Pharma (NASDAQ:RPRX) Will Pay A Larger Dividend Than Last Year At $0.21

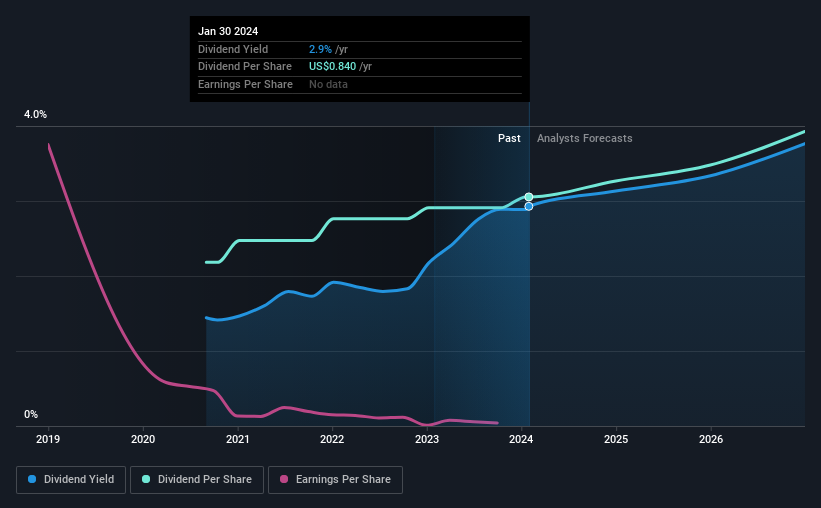

Royalty Pharma plc's (NASDAQ:RPRX) dividend will be increasing from last year's payment of the same period to $0.21 on 15th of March. Based on this payment, the dividend yield for the company will be 2.9%, which is fairly typical for the industry.

Check out our latest analysis for Royalty Pharma

Royalty Pharma's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Based on the last payment, Royalty Pharma's profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Looking forward, earnings per share is forecast to rise exponentially over the next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 25%, which is in a comfortable range for us.

Royalty Pharma Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2021, the dividend has gone from $0.60 total annually to $0.84. This means that it has been growing its distributions at 12% per annum over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Royalty Pharma's earnings per share has shrunk at 59% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Royalty Pharma's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think Royalty Pharma will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 5 warning signs for Royalty Pharma that you should be aware of before investing. Is Royalty Pharma not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States.

Undervalued with adequate balance sheet.