- United States

- /

- Biotech

- /

- NasdaqGS:REPL

Replimune Group (NASDAQ:REPL) Is In A Strong Position To Grow Its Business

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Replimune Group (NASDAQ:REPL) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Replimune Group

Does Replimune Group Have A Long Cash Runway?

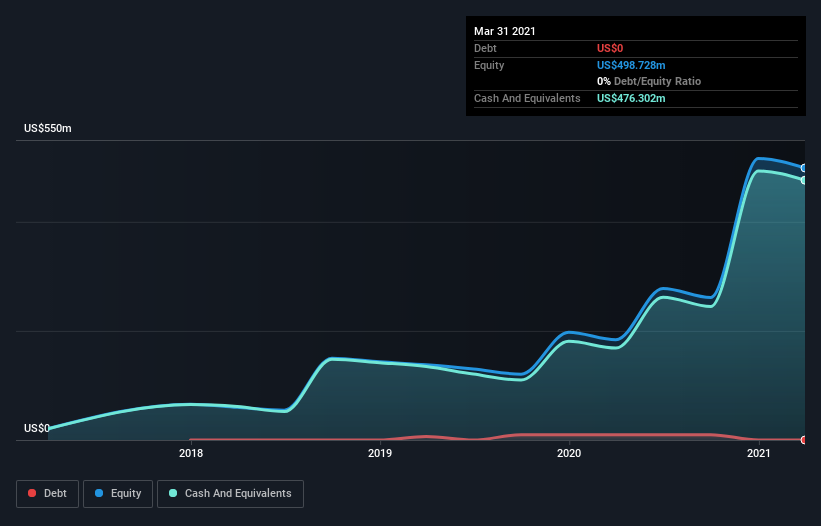

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Replimune Group last reported its balance sheet in March 2021, it had zero debt and cash worth US$476m. In the last year, its cash burn was US$64m. That means it had a cash runway of about 7.5 years as of March 2021. Importantly, though, analysts think that Replimune Group will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Is Replimune Group's Cash Burn Changing Over Time?

Because Replimune Group isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. With cash burn dropping by 4.9% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Replimune Group Raise Cash?

While Replimune Group is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Replimune Group has a market capitalisation of US$1.7b and burnt through US$64m last year, which is 3.8% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Replimune Group's Cash Burn?

As you can probably tell by now, we're not too worried about Replimune Group's cash burn. For example, we think its cash runway suggests that the company is on a good path. Its weak point is its cash burn reduction, but even that wasn't too bad! Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. An in-depth examination of risks revealed 2 warning signs for Replimune Group that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Replimune Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:REPL

Replimune Group

A clinical-stage biotechnology company, focuses on the development of oncolytic immunotherapies to treat cancer.

Excellent balance sheet moderate.