- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron Pharmaceuticals (NasdaqGS:REGN) Reports Promising Results In LINKER-MM2 Trial For Linvoseltamab

Reviewed by Simply Wall St

Regeneron Pharmaceuticals (NasdaqGS:REGN) experienced a 2% increase in its share price over the past week as the company announced promising initial results from the Phase 1b LINKER-MM2 trial related to linvoseltamab for treating relapsed/refractory multiple myeloma. These results, which detailed robust efficacy rates and plans for further trials, came at a time when many major indices were experiencing declines due to renewed trade tension concerns. Thus, Regeneron's positive clinical trial outcomes likely supported its share price movement, contrasting with the broader market's downward trends, including a 0.6% drop in the Dow Jones Industrial Average.

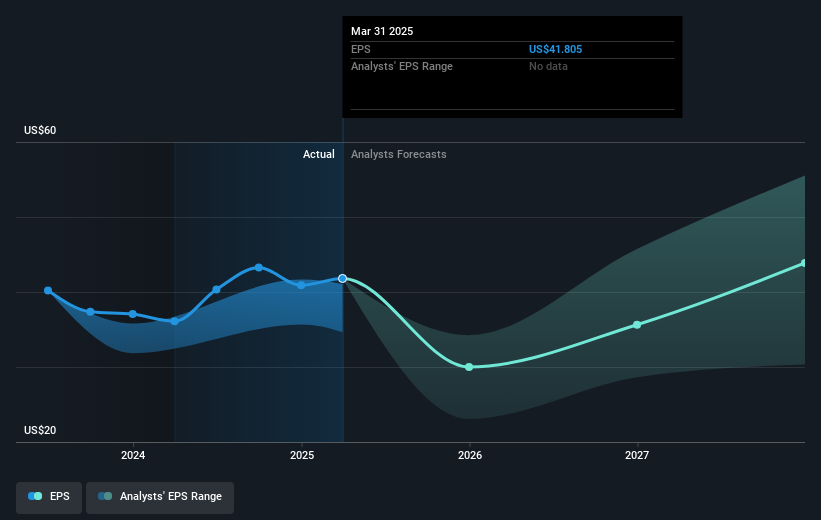

The recent announcement of promising clinical trial results for linvoseltamab has the potential to bolster Regeneron's narrative of strong pipeline innovation and expansion in core drug franchises. As the news came amid broader market declines, the positive reaction in Regeneron's share price suggests heightened investor confidence in its future prospects. Over a five-year horizon, Regeneron's total return, including both share price appreciation and dividends, was 3.51%. This long-term performance provides essential context, though it's worth noting the company underperformed compared to the US Biotech industry's 13% decline over the past year.

The ongoing advancements in treating relapsed/refractory multiple myeloma may positively impact Regeneron's revenue and earnings forecasts. With precision therapies like linvoseltamab aligning with evolving genomics trends, Regeneron is positioned to capture a growing market segment. This potential uptrend is crucial as the company faces competitive, regulatory, and pricing pressures on core products. The share price's recent movement, especially in light of the fair value price target of US$797.21, suggests room for upward trajectory, aligning with bullish analyst projections that consider potential revenue increases from novel therapies in its pipeline.

Evaluate Regeneron Pharmaceuticals' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives