- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron Pharmaceuticals (NasdaqGS:REGN) Partners With Viz.ai For AI-Powered COPD Solutions

Reviewed by Simply Wall St

Viz.ai's recent partnership with Sanofi and Regeneron Pharmaceuticals (NasdaqGS:REGN) brings AI technology to aid in the management of COPD patients, enhancing the healthcare process. Throughout the past month, Regeneron experienced a price increase of 6%, possibly boosted by this collaboration. This price move is closely aligned with broader market trends, which have seen a general uptick. Additional events, such as the clinical insights from Dupixent presentations and progress in oncology trials, may have added positive sentiment. Regeneron's share repurchase efforts and Q1 earnings also potentially supported investor confidence amidst strong market conditions.

The recent collaboration between Viz.ai and Regeneron Pharmaceuticals with Sanofi integrates AI advancements to manage COPD patients, potentially impacting Regeneron's long-term revenue by enhancing its healthcare offerings. This move, alongside recent clinical advancements, could bolster investor sentiment and positively affect revenue and earnings forecasts. Over the past month, Regeneron's share price rose by 6%, aligning with the collaboration announcement and overall market trends.

Over a longer timeframe, Regeneron's total shareholder return including dividends was approximately 4.96% over five years. This figure provides a clear indication of the company’s performance, reflecting a period of steady growth tempered by industry challenges. In comparison to the broader market, Regeneron underperformed against a 11.7% US Market return and the US Biotechs industry, which contracted 13.8% over the past year.

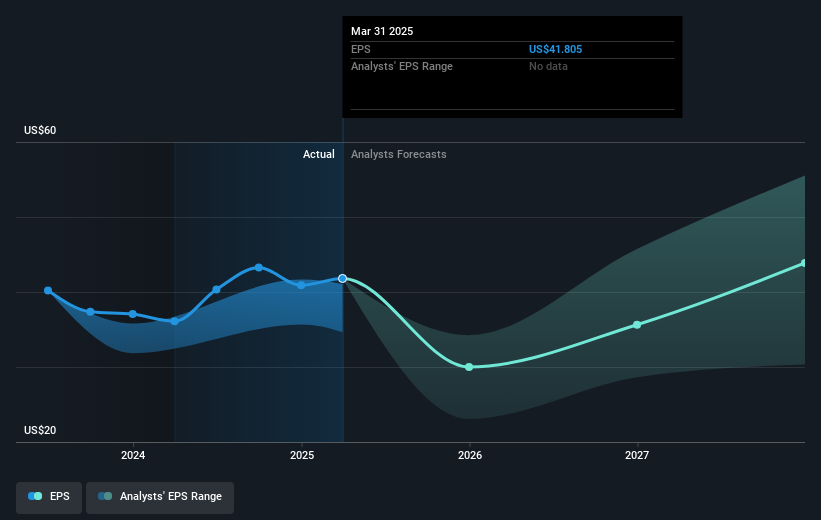

Looking forward, the alignment with Viz.ai stands to strengthen Regeneron's innovative edge in tackling chronic disease management, potentially enhancing revenue streams. Analysts have set a consensus price target of US$797.21, suggesting a share price discount exists relative to this target. This reflects varying analyst expectations about growth acceleration from emerging market ventures and regulatory favorability, which are vital for justifying future earnings growth assumptions. With the current share price at US$558.52, the potential for upward movement depends heavily on realizing projected revenues and navigating potential risks effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives