- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Is Regeneron at a Turning Point After 43% Drop and FDA Eye Drug Approval News?

Reviewed by Bailey Pemberton

Thinking about making a move on Regeneron Pharmaceuticals? You are not alone. This stock has been on a lot of investors’ radars, especially after a series of headline-making swings. Regeneron closed most recently at $569.90, which, if you have been following along, means it has come down about 43% over the past year and is clocking a 20.3% decline year to date. That is tough, but context is key here. Just a month ago, Regeneron had clawed back a gain of 2.4%, and despite a recent 5% dip over the past week, many are wondering if the risk profile is shifting or if the market is simply being impatient following broader biotech volatility.

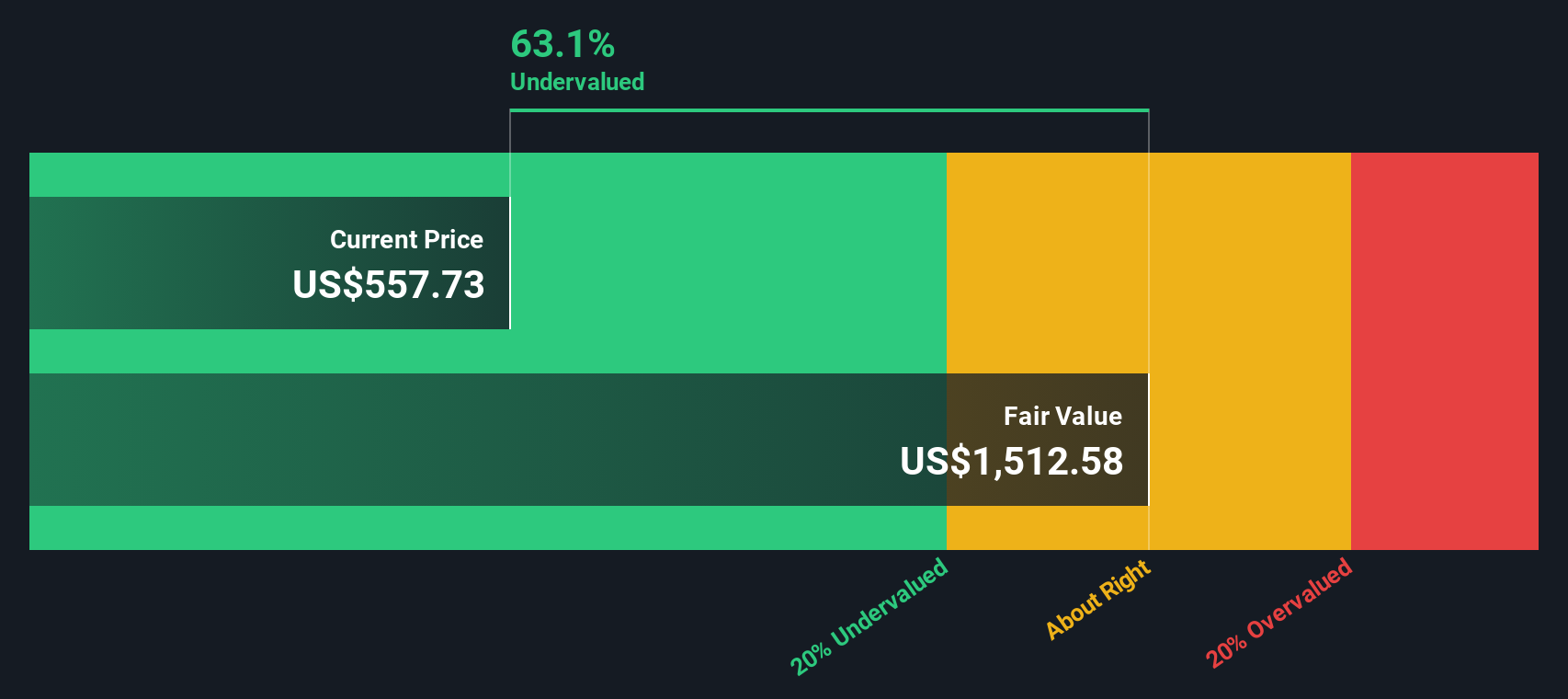

Stepping back, the big question is whether the current price reflects fair value or if Regeneron is sitting here as a bargain waiting to be noticed. If you go strictly by the numbers, this company scores an impressive 6 out of 6 on a key value assessment. That means Regeneron comes up undervalued on every major check, which is rare and suggests the market might be missing something in the rush of short-term sentiment and sector-wide moves.

So, how do we break down what is “undervalued” and what truly matters for long-term returns? Let’s walk through the different approaches used to value Regeneron, and keep an eye out, because there is an even better way to make sense of what all these numbers really mean, which we will get to at the end.

Why Regeneron Pharmaceuticals is lagging behind its peers

Approach 1: Regeneron Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting those amounts back to today's dollars. It is widely used to assess whether a stock is undervalued or overvalued based on its anticipated ability to generate cash over time.

For Regeneron Pharmaceuticals, the latest reported Free Cash Flow stands at $3.4 Billion. Analyst estimates expect this figure to grow, with projected Free Cash Flow reaching $6.0 Billion by 2029. The ten-year forecast, which extrapolates beyond what analysts have directly projected, continues this upward trend and incorporates both analyst insights and longer-term models.

According to this DCF approach, the model arrives at an intrinsic value of $1,514.94 per share for Regeneron. In comparison, Regeneron's recent trading price is $569.90. This suggests that Regeneron is trading at a 62.4% discount to its estimated intrinsic value and points to significant potential upside if these cash flow projections prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Regeneron Pharmaceuticals is undervalued by 62.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Regeneron Pharmaceuticals Price vs Earnings

For profitable companies like Regeneron Pharmaceuticals, the price-to-earnings (PE) ratio is a widely trusted method of valuation. This metric helps investors quickly see how much the market is currently paying for each dollar of the company’s earnings. Because it directly reflects profitability, the PE ratio provides meaningful insight, especially when earnings are stable and growing, as is generally the case for established biotech firms.

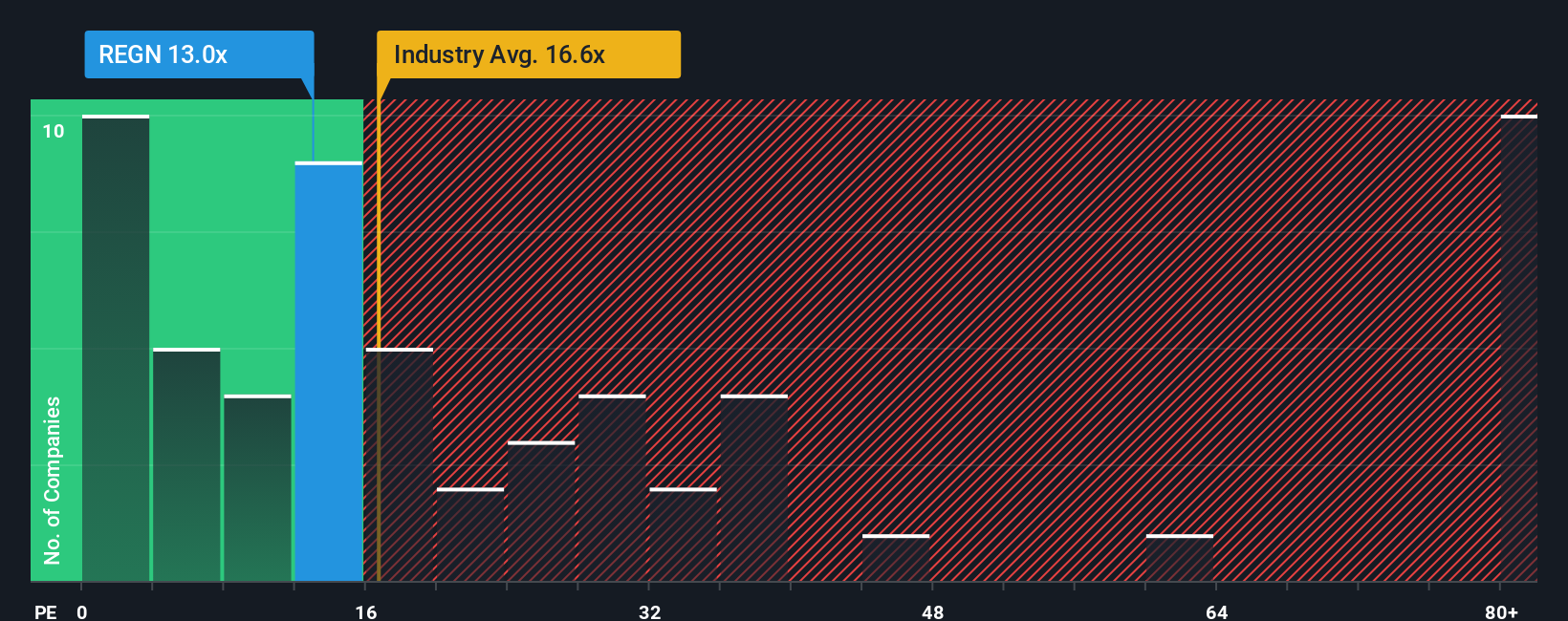

But what is a normal or fair PE ratio? The answer depends on factors such as earnings growth potential and perceived risk. Fast-growing or lower-risk companies tend to command higher PE multiples, while slower growth or high-risk names usually trade at a discount. With Regeneron's current PE ratio at 13.3x, it stands below both the industry average of 17.0x and the peer average of 22.6x. This suggests the stock is priced conservatively relative to its sector.

This is where Simply Wall St’s Fair Ratio comes into play. The Fair Ratio for Regeneron is 24.3x. This proprietary metric blends together the company’s growth outlook, industry dynamics, profit margins, risk profile, and market cap, aiming to deliver a valuation that is more tailored than a simple peer or industry comparison. By accounting for what genuinely makes Regeneron unique, the Fair Ratio offers a higher-confidence benchmark for fair value.

Comparing these numbers, Regeneron’s actual PE ratio sits significantly below the Fair Ratio of 24.3x. This points to a stock that the market may be undervaluing, given its growth and earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Regeneron Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, approachable way for you to lay out your own story about Regeneron Pharmaceuticals by connecting your view of its future sales, earnings, and margins to a fair value that makes sense to you.

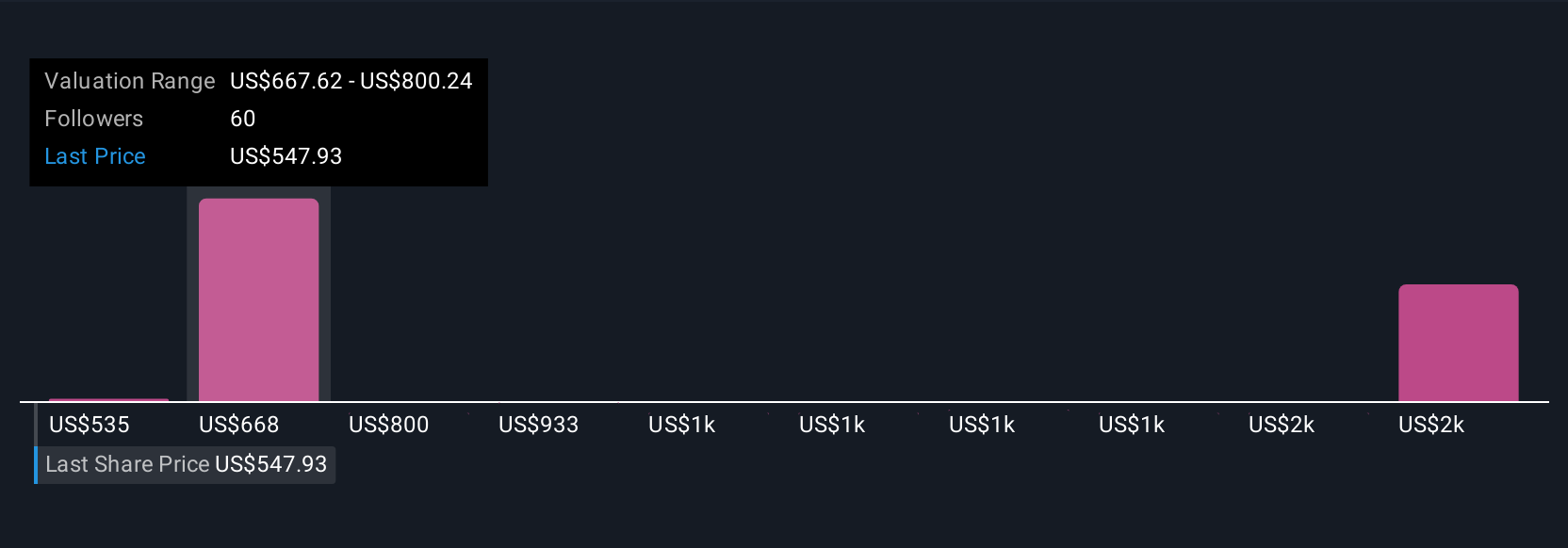

Unlike traditional valuation tools, Narratives bring together the facts, forecasts, and your perspective about the business, making your investment decision both personal and purposeful. Through Simply Wall St’s Community page, millions of investors now use Narratives to transparently map their assumptions about Regeneron's future, see the fair value those assumptions imply, and instantly compare that to today's price to decide whether the stock is a buy, hold, or sell for them.

The best part: Narratives update dynamically as fresh news or earnings come in, so your story and your investment thesis can evolve in real time with the company. For Regeneron Pharmaceuticals, some investors see the potential for a fair value as high as $890.00 based on bullish pipeline and revenue scenarios, while others are more cautious, seeing fair value near $543.00 if risk factors play out. Narratives let you see where you fit on that spectrum.

Do you think there's more to the story for Regeneron Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives