- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Investing in Regeneron Pharmaceuticals (NASDAQ:REGN) three years ago would have delivered you a 67% gain

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN), which is up 67%, over three years, soundly beating the market return of 50% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 17%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Regeneron Pharmaceuticals

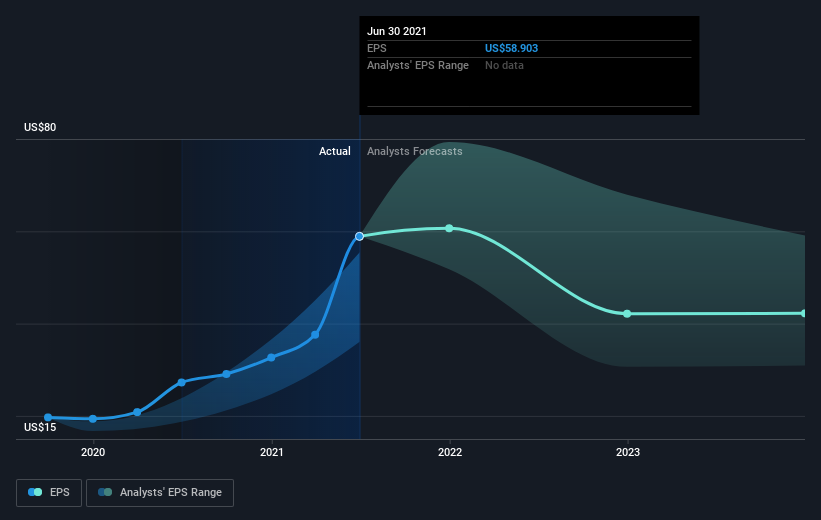

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Regeneron Pharmaceuticals was able to grow its EPS at 58% per year over three years, sending the share price higher. This EPS growth is higher than the 19% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat. This cautious sentiment is reflected in its (fairly low) P/E ratio of 10.92.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Regeneron Pharmaceuticals has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Regeneron Pharmaceuticals' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Regeneron Pharmaceuticals shareholders gained a total return of 17% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 10% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Regeneron Pharmaceuticals better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Regeneron Pharmaceuticals (of which 2 are a bit concerning!) you should know about.

We will like Regeneron Pharmaceuticals better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Regeneron Pharmaceuticals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives