- United States

- /

- Biotech

- /

- NasdaqCM:RCEL

The Market Doesn't Like What It Sees From AVITA Medical, Inc.'s (NASDAQ:RCEL) Revenues Yet As Shares Tumble 32%

To the annoyance of some shareholders, AVITA Medical, Inc. (NASDAQ:RCEL) shares are down a considerable 32% in the last month, which continues a horrid run for the company. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 114% in the last twelve months.

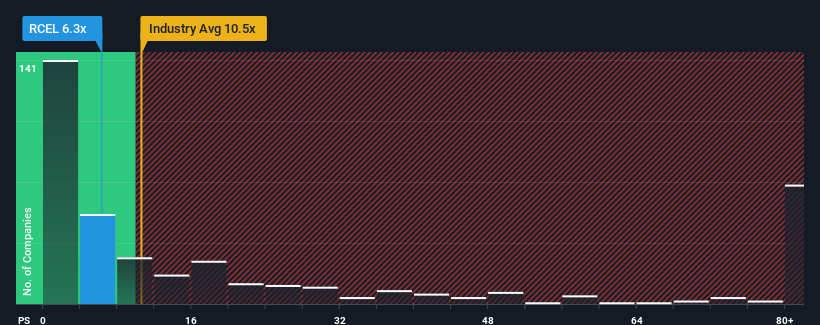

After such a large drop in price, AVITA Medical's price-to-sales (or "P/S") ratio of 6.3x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.5x and even P/S above 42x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for AVITA Medical

How AVITA Medical Has Been Performing

AVITA Medical certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on AVITA Medical will help you uncover what's on the horizon.How Is AVITA Medical's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as AVITA Medical's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The latest three year period has also seen an excellent 186% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 39% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 103% per year, which is noticeably more attractive.

In light of this, it's understandable that AVITA Medical's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does AVITA Medical's P/S Mean For Investors?

AVITA Medical's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of AVITA Medical's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for AVITA Medical you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RCEL

AVITA Medical

Operates as a therapeutic acute wound care company in the United States, Japan, the European Union, Australia, and the United Kingdom.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives