- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Ultragenyx Pharmaceutical (RARE): Valuation in Focus After Launching FDA Submission for DTX401 Gene Therapy

Reviewed by Simply Wall St

Most Popular Narrative: 65.4% Undervalued

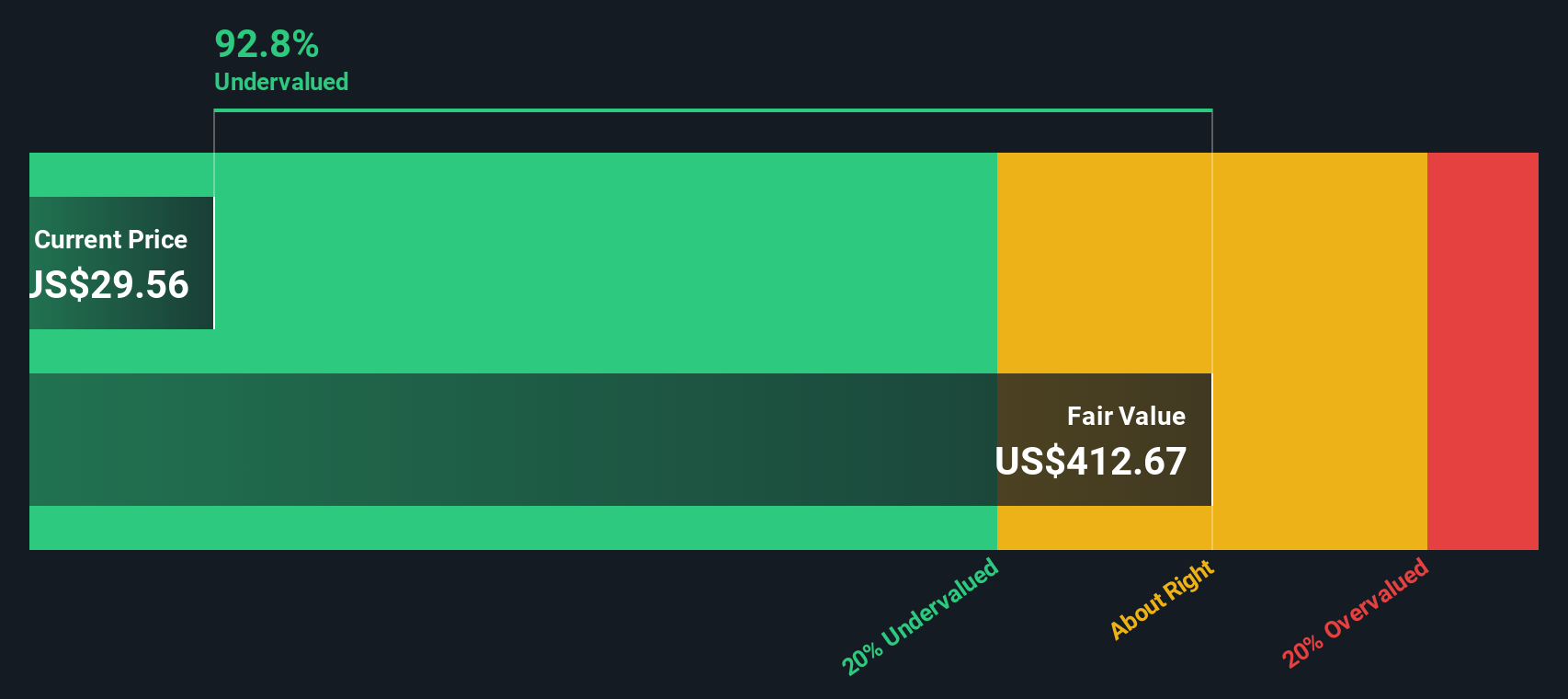

According to community narrative, Ultragenyx Pharmaceutical is considered highly undervalued, with a calculated fair value much higher than the current market price. This view is driven by aggressive expectations for both earnings and revenue growth in the coming years.

The accelerating global identification and diagnosis of rare diseases, supported by advancements in genomics and genetic testing, are expanding the addressable patient pool for Ultragenyx's existing and future therapies. This trend is expected to drive sustained long-term revenue growth. Healthcare payers and regulatory agencies are increasingly recognizing the value of orphan drugs, as seen with faster development timelines (such as the FDA Breakthrough Therapy designation for GTX-102) and ongoing pricing and reimbursement wins in regions like Latin America and EMEA. These factors support robust revenue streams and pricing power over the next several years.

Can Ultragenyx live up to the numbers? The sharp projected gains all hinge on a few critical financial assumptions. Curious about what is fueling one of the largest valuation gaps in biotech? The main driver of this fair value is a bold path to profitability that could shift the entire investment case. See why this narrative stands out from the consensus.

Result: Fair Value of $86.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent losses or regulatory setbacks could still derail Ultragenyx’s path to profitability and challenge the optimistic outlook that is currently driving sentiment.

Find out about the key risks to this Ultragenyx Pharmaceutical narrative.Another View: What Does the SWS DCF Model Say?

Taking a different approach, our DCF model looks beyond earnings multiples and focuses on future cash flows. This method also suggests Ultragenyx is trading well below its fair value. Will the market eventually catch up?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ultragenyx Pharmaceutical Narrative

If you see things differently or enjoy digging into the details yourself, it is easy to review the data and shape your own story in just a few minutes. Give it a try and do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ultragenyx Pharmaceutical.

Looking for more investment ideas?

Do not let your next opportunity pass you by. The right screener can quickly identify stocks that fit your strategy and open doors to powerful trends. Explore these specially curated selections to spot growth potential and strengthen your investment approach:

- Explore companies that are shaping the future of healthcare by using healthcare AI stocks to take advantage of the growth in AI-powered innovation transforming patient care and diagnostics.

- Find value opportunities with undervalued stocks based on cash flows, where stocks trading below their intrinsic worth may provide your next investment advantage.

- Enhance your income portfolio and pursue reliable returns by seeking out dividend stocks with yields > 3% with attractive yields and consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives