- United States

- /

- Biotech

- /

- NasdaqCM:PROK

Discovering Potential: IZEA Worldwide And 2 Other Top Penny Stocks

Reviewed by Simply Wall St

As U.S.-China trade tensions resurface, major stock indexes have posted significant weekly losses, highlighting the volatility in today's market. Despite this uncertainty, penny stocks—often smaller or newer companies—remain a relevant investment area for those seeking growth opportunities at lower price points. In this article, we explore three penny stocks that combine solid financial foundations with potential for impressive returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.82 | $390.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.84 | $665.46M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.72 | $273.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.895 | $55.5M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.84 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $3.99 | $524.02M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.96255 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.55 | $80.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.38 | $10.13M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 373 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

IZEA Worldwide (IZEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IZEA Worldwide, Inc. operates by offering software and professional services that link brands with content creators across North America, the Asia Pacific, and other international markets, with a market capitalization of $83.34 million.

Operations: The company generates revenue through two primary segments: SaaS Services, which contributed $0.46 million, and Managed Services, which brought in $36.47 million.

Market Cap: $83.34M

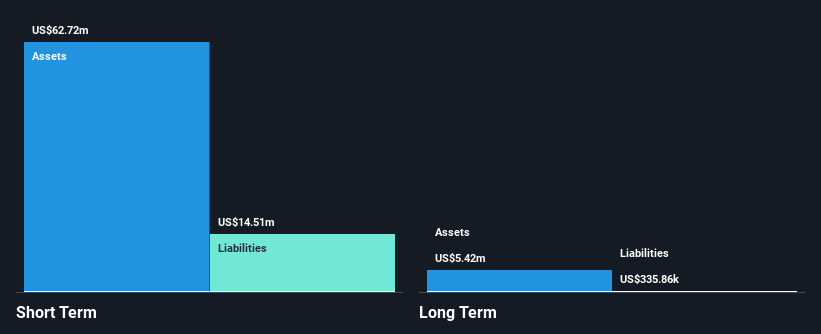

IZEA Worldwide has demonstrated a positive shift in financial performance, reporting a net income of US$1.21 million for Q2 2025, compared to a net loss the previous year. The company's short-term assets of US$57.4 million comfortably cover its short-term liabilities of US$10.3 million, and it maintains more cash than total debt, indicating financial stability despite ongoing unprofitability with negative return on equity at -24.97%. Recent strategic moves include share buybacks and the appointment of Steve Bonnell as Executive Vice President to bolster enterprise client partnerships, reflecting efforts to enhance shareholder value and operational growth in the evolving Creator Economy.

- Dive into the specifics of IZEA Worldwide here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into IZEA Worldwide's future.

ProKidney (PROK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ProKidney Corp. is a clinical-stage biotechnology company focused on developing a cell therapy platform for treating multiple chronic kidney diseases in the United States, with a market cap of $888.73 million.

Operations: ProKidney has not reported any revenue segments.

Market Cap: $888.73M

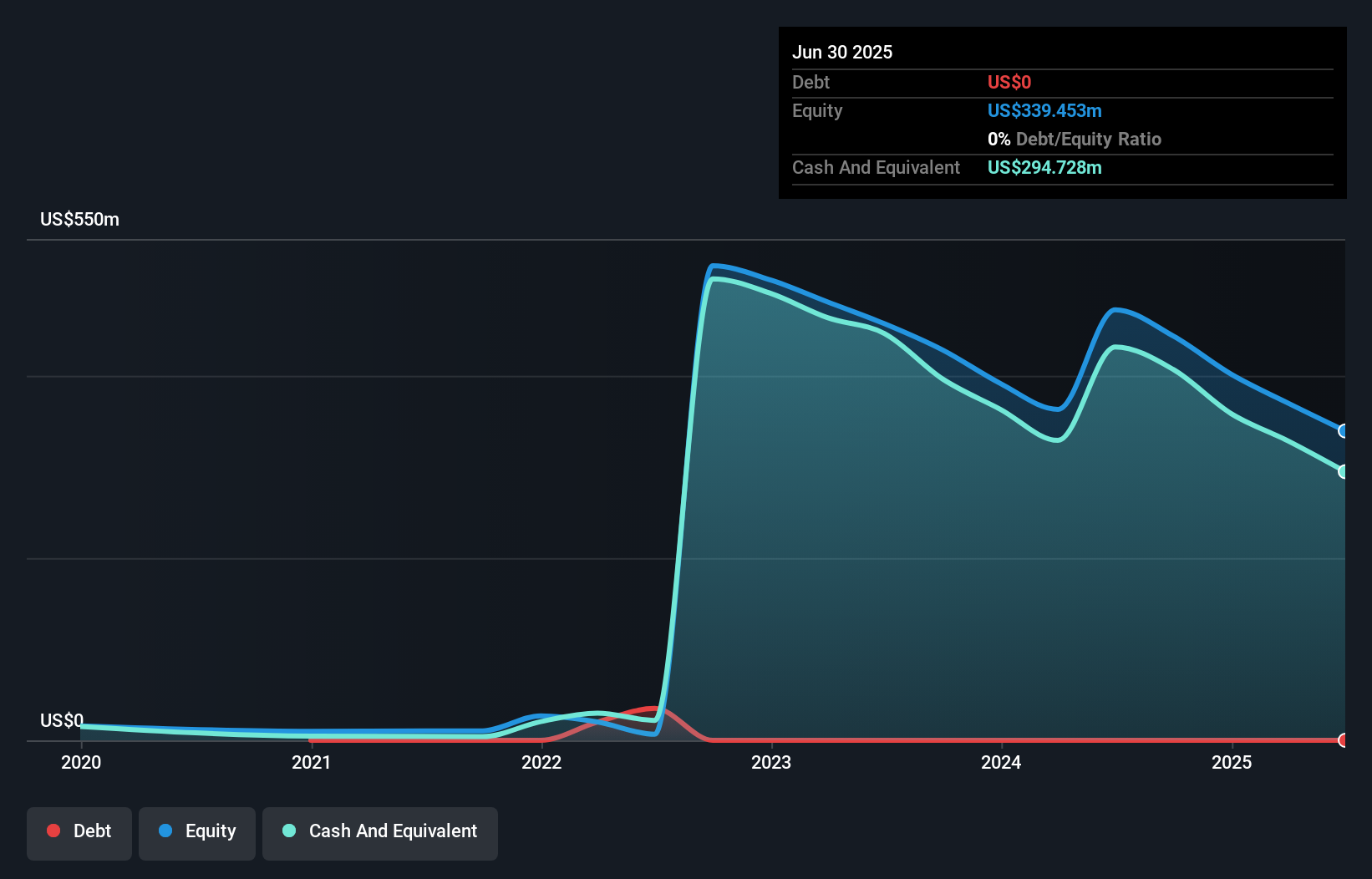

ProKidney is a clinical-stage biotechnology company with a market cap of US$888.73 million, focusing on cell therapy for chronic kidney diseases. It remains pre-revenue with sales under US$1 million and reported a net loss of US$33.29 million for the first half of 2025. Despite high volatility and an unprofitable status, ProKidney's cash runway extends over a year, supported by recent equity offerings totaling US$300 million. The FDA has aligned with its accelerated approval pathway for rilparencel, boosting prospects in its ongoing Phase 3 trial. However, challenges include regulatory hurdles and maintaining operational growth amidst industry competition.

- Click here to discover the nuances of ProKidney with our detailed analytical financial health report.

- Understand ProKidney's earnings outlook by examining our growth report.

Erasca (ERAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erasca, Inc. is a clinical-stage precision oncology company dedicated to discovering, developing, and commercializing therapies for RAS/MAPK pathway-driven cancers, with a market cap of approximately $683.65 million.

Operations: Erasca, Inc. has not reported any revenue segments.

Market Cap: $683.65M

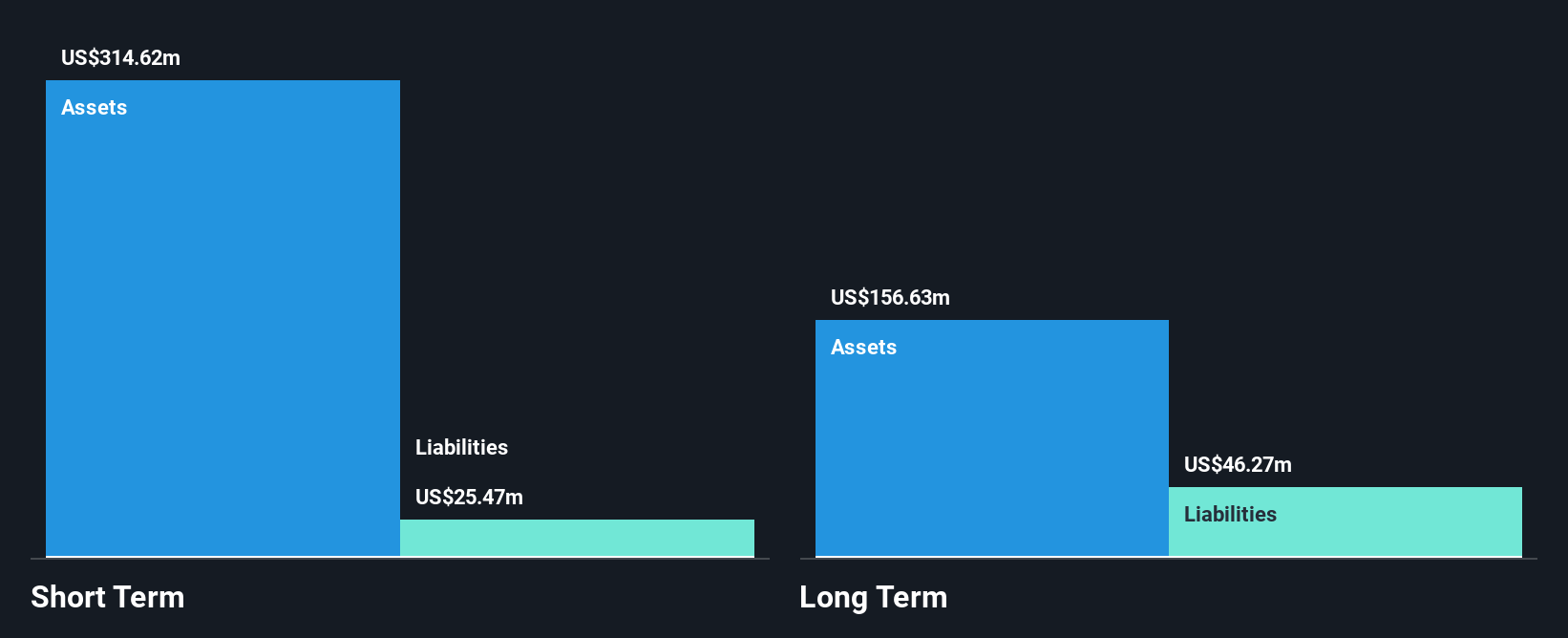

Erasca, Inc., with a market cap of approximately US$683.65 million, is a clinical-stage precision oncology company that remains pre-revenue. Recent earnings reported a net loss of US$33.88 million for Q2 2025, an improvement from the previous year's loss. The company has filed a shelf registration for US$500 million to potentially raise capital through various securities offerings. Despite high share price volatility and unprofitability, Erasca benefits from having no debt and sufficient short-term assets to cover liabilities. Its cash runway extends over two years if current cash flow trends persist, though earnings are forecasted to decline slightly over the next three years.

- Take a closer look at Erasca's potential here in our financial health report.

- Learn about Erasca's future growth trajectory here.

Taking Advantage

- Unlock more gems! Our US Penny Stocks screener has unearthed 370 more companies for you to explore.Click here to unveil our expertly curated list of 373 US Penny Stocks.

- Looking For Alternative Opportunities? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PROK

ProKidney

A clinical-stage biotechnology company, develops a cell therapy platform for the treatment of multiple chronic kidney diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success